- Hong Kong

- /

- Capital Markets

- /

- SEHK:863

Here's What Analysts Are Forecasting For BC Technology Group Limited (HKG:863) After Its Yearly Results

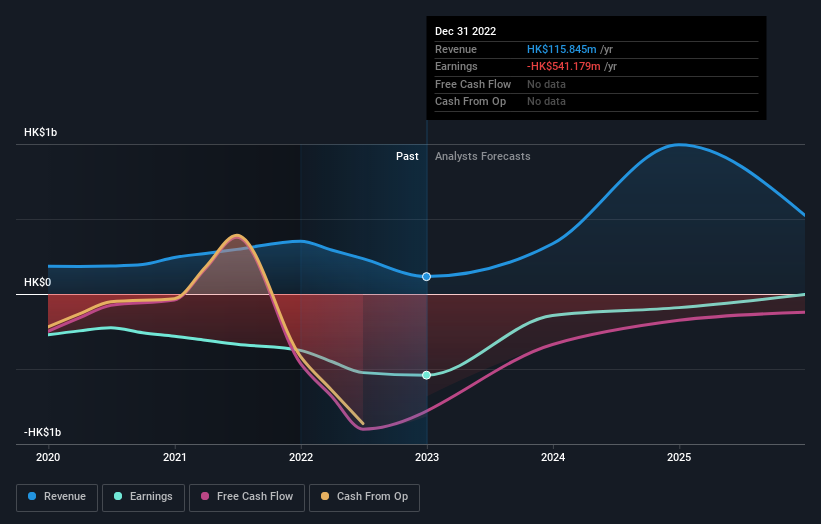

As you might know, BC Technology Group Limited (HKG:863) last week released its latest full-year, and things did not turn out so great for shareholders. Statutory earnings fell substantially short of expectations, with revenues of HK$116m missing forecasts by 74%. Losses exploded, with a per-share loss of HK$1.27 some 32% below prior forecasts. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

View our latest analysis for BC Technology Group

Taking into account the latest results, the consensus forecast from BC Technology Group's dual analysts is for revenues of HK$335.0m in 2023, which would reflect a huge 189% improvement in sales compared to the last 12 months. Losses are predicted to fall substantially, shrinking 73% to HK$0.34. Yet prior to the latest earnings, the analysts had been forecasting revenues of HK$725.3m and losses of HK$0.48 per share in 2023. So there's been quite a change-up of views after the recent consensus updates, withthe analysts making a serious cut to their revenue forecasts while also reducing the estimated losses the business will incur.

There was no major change to the HK$8.59average price target, suggesting that the adjustments to revenue and earnings are not expected to have a long-term impact on the business.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the BC Technology Group's past performance and to peers in the same industry. It's clear from the latest estimates that BC Technology Group's rate of growth is expected to accelerate meaningfully, with the forecast 189% annualised revenue growth to the end of 2023 noticeably faster than its historical growth of 8.2% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 16% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect BC Technology Group to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts reconfirmed their loss per share estimates for next year. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. Still, earnings per share are more important to value creation for shareholders. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for BC Technology Group going out as far as 2025, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with BC Technology Group , and understanding these should be part of your investment process.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:863

OSL Group

An investment holding company, engages in digital assets and blockchain platform business in Hong Kong, Australia, Japan, Singapore, and Mainland China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.