- Hong Kong

- /

- Diversified Financial

- /

- SEHK:8525

This Is Why We Think Baiying Holdings Group Limited's (HKG:8525) CEO Might Get A Pay Rise Approved By Shareholders

Key Insights

- Baiying Holdings Group's Annual General Meeting to take place on 19th of June

- Salary of CN¥481.6k is part of CEO Dake Huang's total remuneration

- Total compensation is 54% below industry average

- Baiying Holdings Group's EPS declined by 10.0% over the past three years while total shareholder return over the past three years was 67%

The decent performance at Baiying Holdings Group Limited (HKG:8525) recently will please most shareholders as they go into the AGM coming up on 19th of June. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

View our latest analysis for Baiying Holdings Group

Comparing Baiying Holdings Group Limited's CEO Compensation With The Industry

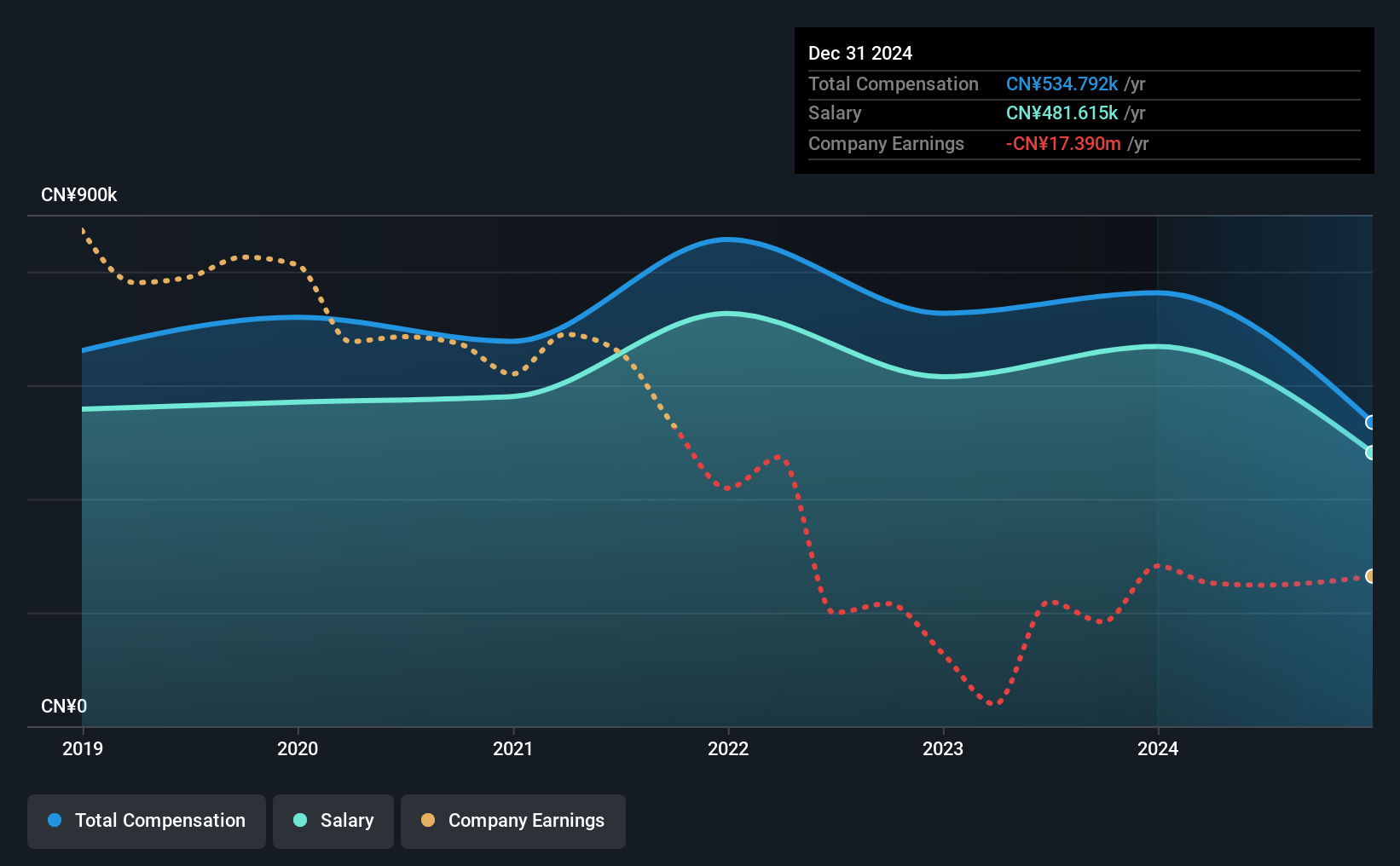

According to our data, Baiying Holdings Group Limited has a market capitalization of HK$230m, and paid its CEO total annual compensation worth CN¥535k over the year to December 2024. We note that's a decrease of 30% compared to last year. Notably, the salary which is CN¥481.6k, represents most of the total compensation being paid.

On comparing similar-sized companies in the Hong Kong Diversified Financial industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was CN¥1.2m. This suggests that Dake Huang is paid below the industry median. What's more, Dake Huang holds HK$11m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥482k | CN¥668k | 90% |

| Other | CN¥53k | CN¥95k | 10% |

| Total Compensation | CN¥535k | CN¥763k | 100% |

On an industry level, roughly 70% of total compensation represents salary and 30% is other remuneration. It's interesting to note that Baiying Holdings Group pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Baiying Holdings Group Limited's Growth Numbers

Over the last three years, Baiying Holdings Group Limited has shrunk its earnings per share by 10.0% per year. It achieved revenue growth of 31% over the last year.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Baiying Holdings Group Limited Been A Good Investment?

Most shareholders would probably be pleased with Baiying Holdings Group Limited for providing a total return of 67% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

The company's overall performance, while not bad, could be better. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for Baiying Holdings Group (2 are a bit concerning!) that you should be aware of before investing here.

Important note: Baiying Holdings Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Baiying Holdings Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8525

Baiying Holdings Group

An investment holding company, engages in the provision of equipment-based financing solutions to small and medium-sized enterprises, individual entrepreneurs, and large enterprises in the People’s Republic of China.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.