- Hong Kong

- /

- Oil and Gas

- /

- SEHK:1277

Three Undiscovered Gems In Hong Kong To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

As global markets continue to navigate economic uncertainties and shifts in monetary policy, the Hong Kong market has shown resilience with its small-cap stocks offering unique opportunities for investors. In light of recent market dynamics, identifying undervalued stocks with strong growth potential can be a strategic move to enhance your investment portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Pizu Group Holdings | 48.34% | -4.53% | -19.78% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited, with a market cap of HK$10.79 billion, is an investment holding company involved in the extraction and sale of coal products in the People’s Republic of China.

Operations: Kinetic Development Group Limited derives its revenue primarily from the extraction and sale of coal products in China. The company reported CN¥6.73 billion in revenue for the most recent period. Net profit margin stands at 15%.

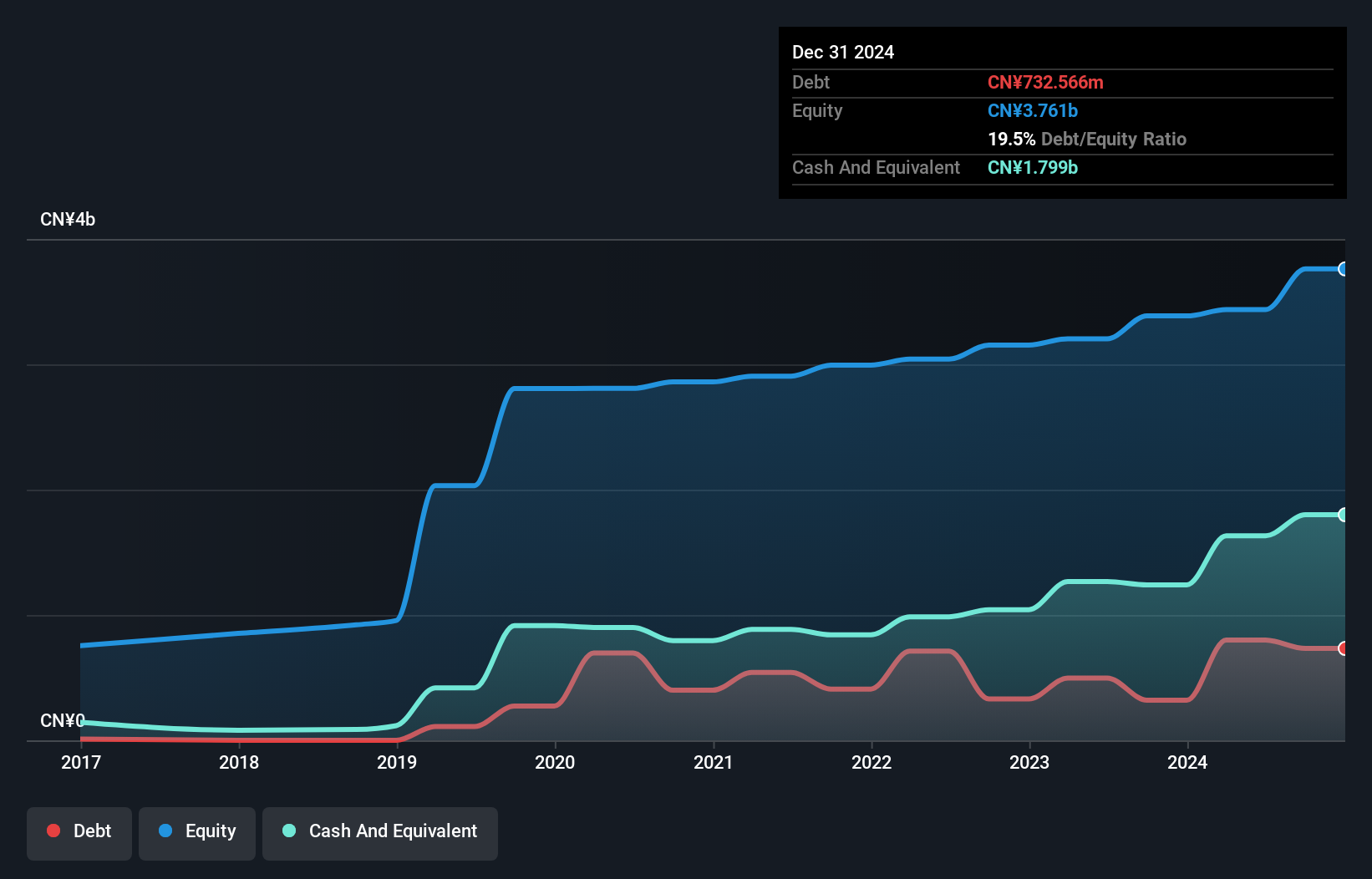

Kinetic Development Group has reported impressive earnings growth of 39.2% over the past year, far outpacing the Oil and Gas industry's 4.6%. Trading at 66.5% below its estimated fair value, it offers significant upside potential. The company's debt to equity ratio improved from 28.4% to 12.5% over five years, and its interest payments are well covered by EBIT (163x). Recent announcements include a special dividend of HKD 0.04 per share and interim results showing net income of CNY1 billion for H1-2024 compared to CNY570 million a year ago.

IVD Medical Holding (SEHK:1931)

Simply Wall St Value Rating: ★★★★★☆

Overview: IVD Medical Holding Limited, with a market cap of HK$2.73 billion, is an investment holding company that distributes in vitro diagnostic (IVD) products in Mainland China and internationally.

Operations: IVD Medical Holding generates revenue primarily from its distribution business (CN¥2.86 billion), followed by after-sales services (CN¥196.47 million) and self-branded products (CN¥9.05 million). The company has a market cap of HK$2.73 billion.

IVD Medical Holding, a smaller player in the healthcare sector, reported half-year sales of CNY 1.35 billion, slightly down from CNY 1.38 billion last year. However, net income rose to CNY 125.29 million from CNY 103.01 million previously, with basic earnings per share increasing to CNY 0.0927 from CNY 0.0762 last year. The company repurchased shares recently and has more cash than total debt despite a rising debt-to-equity ratio over five years (5.4% to 23%).

- Navigate through the intricacies of IVD Medical Holding with our comprehensive health report here.

Understand IVD Medical Holding's track record by examining our Past report.

AGTech Holdings (SEHK:8279)

Simply Wall St Value Rating: ★★★★★★

Overview: AGTech Holdings Limited operates as an integrated technology and services company in the People’s Republic of China and Macau with a market cap of HK$2.45 billion.

Operations: AGTech Holdings generates revenue primarily from Lottery Operations (HK$248.76 million) and Electronic Payment and Related Services (HK$364.50 million).

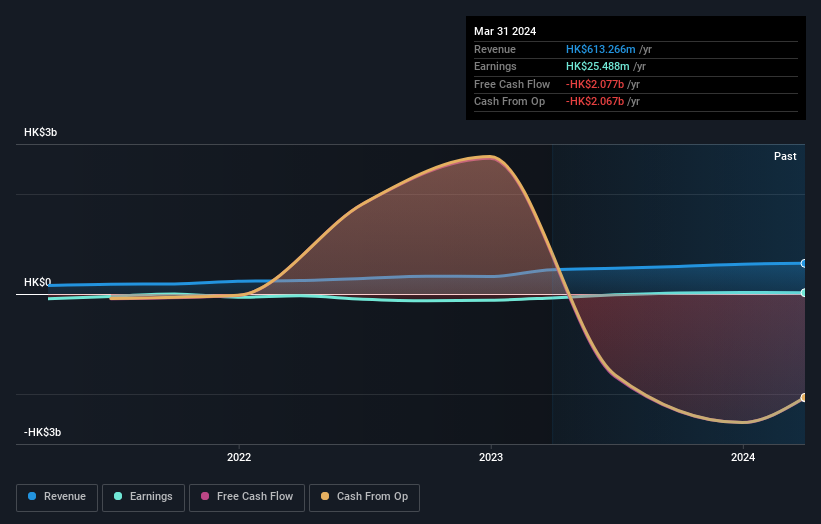

AGTech Holdings, a small cap stock in Hong Kong, has recently become profitable, making it challenging to compare its earnings growth to the Diversified Financial industry. The company reported net income of HK$31.86 million for the fifteen months ended March 31, 2024. Additionally, AGTech is debt-free now compared to five years ago when its debt-to-equity ratio was 13.8%. Recent board changes include Mr. Zou Liang retiring as a non-executive director due to other business commitments.

- Click here to discover the nuances of AGTech Holdings with our detailed analytical health report.

Gain insights into AGTech Holdings' past trends and performance with our Past report.

Next Steps

- Click through to start exploring the rest of the 167 SEHK Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinetic Development Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1277

Kinetic Development Group

An investment holding company, engages in the extraction and sale of coal products in the People’s Republic of China.

Outstanding track record with excellent balance sheet and pays a dividend.