- Hong Kong

- /

- Real Estate

- /

- SEHK:2156

February 2025's Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape of rising inflation and shifting trade policies, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge. For investors looking to explore beyond the well-trodden paths of large-cap equities, penny stocks—despite their somewhat antiquated name—remain a compelling area for potential investment. These smaller or newer companies can offer affordability and growth potential when backed by strong financials, making them worth considering in today's market climate.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.52 | MYR2.59B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$44.77B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.95 | £327.19M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.96 | £150.13M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.855 | £469.93M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.09 | £305.33M | ★★★★☆☆ |

Click here to see the full list of 5,687 stocks from our Penny Stocks screener.

Let's uncover some gems from our specialized screener.

3D Medicines (SEHK:1244)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 3D Medicines Inc. is a biopharmaceutical company focused on researching, developing, and commercializing oncology products for cancer treatment in Mainland China, with a market cap of approximately HK$786.58 million.

Operations: The company's revenue is primarily derived from its biopharmaceutical research and development segment, totaling CN¥488.82 million.

Market Cap: HK$786.58M

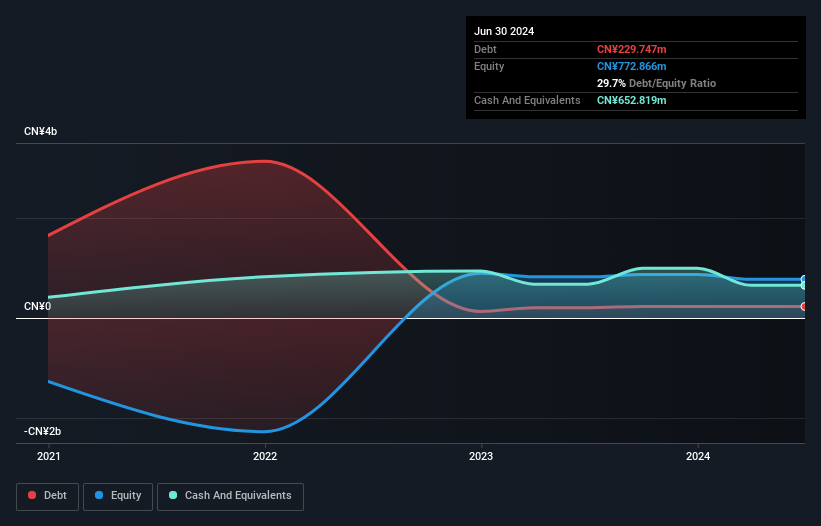

3D Medicines Inc., with a market cap of HK$786.58 million, is focused on oncology products in Mainland China. Despite being unprofitable, it has reduced losses by 18.2% annually over five years and maintains a strong cash position exceeding its debt, providing a runway of over three years based on current free cash flow. Recent executive changes include appointing Mr. Ding Gan as chief commercial officer to enhance commercialization efforts, leveraging his extensive industry experience. However, legal challenges have arisen with asset freezes ordered by the Qingdao court amid ongoing litigation that the company is contesting for reconsideration.

- Click here and access our complete financial health analysis report to understand the dynamics of 3D Medicines.

- Understand 3D Medicines' track record by examining our performance history report.

C&D Property Management Group (SEHK:2156)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: C&D Property Management Group Co. Limited is an investment holding company offering property management services for residential and non-residential properties in the People's Republic of China, with a market cap of HK$3.48 billion.

Operations: The company's revenue primarily comes from the provision of property management services and value-added services, totaling CN¥3.80 billion.

Market Cap: HK$3.48B

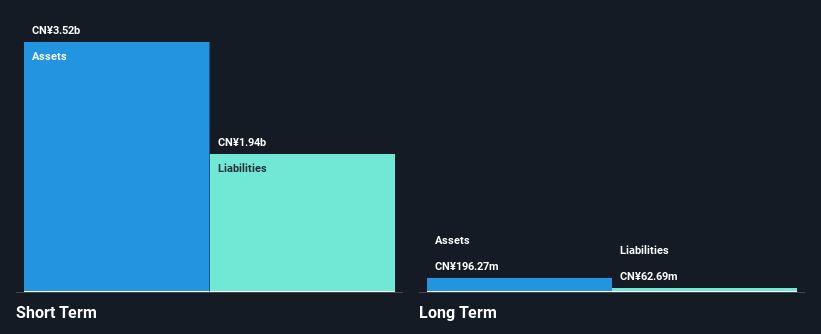

C&D Property Management Group Co. Limited, with a market cap of HK$3.48 billion, primarily generates revenue from property management services in China, totaling CN¥3.80 billion. The company demonstrates strong financial health with cash exceeding total debt and short-term assets covering both short and long-term liabilities comfortably. Earnings have grown significantly, surpassing industry averages, and profit margins have improved to 12.8%. Despite a dividend yield of 6.25%, it isn't well covered by free cash flows; however, operating cash flow robustly covers debt obligations at 328.4%. The management team is experienced with no recent shareholder dilution observed.

- Dive into the specifics of C&D Property Management Group here with our thorough balance sheet health report.

- Gain insights into C&D Property Management Group's historical outcomes by reviewing our past performance report.

Hanhua Financial Holding (SEHK:3903)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hanhua Financial Holding Co., Ltd., along with its subsidiaries, offers financial services in the People’s Republic of China and has a market capitalization of HK$855.60 million.

Operations: The company generates revenue from three main segments: Digital Finance (CN¥109.79 million), Digital Services (CN¥137.55 million), and Capital Investment and Management (CN¥36.49 million).

Market Cap: HK$855.6M

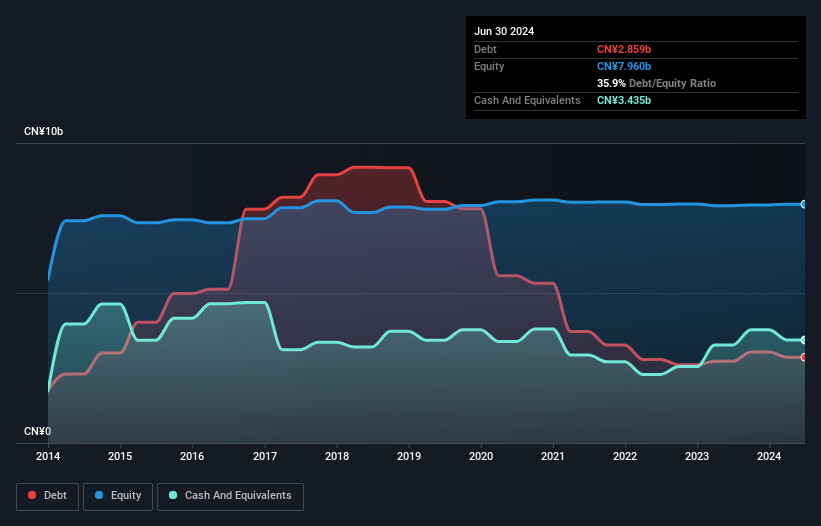

Hanhua Financial Holding Co., Ltd., with a market cap of HK$855.60 million, shows mixed financial signals. The company generates revenue from Digital Finance (CN¥109.79 million), Digital Services (CN¥137.55 million), and Capital Investment and Management (CN¥36.49 million). While earnings grew by a very large margin over the past year, they have declined significantly over five years, indicating volatility in performance. Short-term assets comfortably cover both short- and long-term liabilities, yet negative operating cash flow raises concerns about debt coverage. Recent auditor changes may also warrant attention for potential implications on financial transparency.

- Jump into the full analysis health report here for a deeper understanding of Hanhua Financial Holding.

- Learn about Hanhua Financial Holding's historical performance here.

Turning Ideas Into Actions

- Investigate our full lineup of 5,687 Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2156

C&D Property Management Group

An investment holding company, provides property management services for residential and non-residential properties in the People’s Republic of China.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives