- Hong Kong

- /

- Diversified Financial

- /

- SEHK:3877

CSSC (Hong Kong) Shipping (SEHK:3877): Valuation Check After Auditor Resignation and Baker Tilly Appointment

Reviewed by Simply Wall St

CSSC (Hong Kong) Shipping (SEHK:3877) just saw its long standing auditor Grant Thornton resign over a fee dispute, with Baker Tilly stepping in. This presents a governance twist that investors will now weigh against recent share gains.

See our latest analysis for CSSC (Hong Kong) Shipping.

At HK$2.06, the share price has cooled slightly in the past month but still shows solid momentum, with a 90 day share price return of 7.85 percent and a three year total shareholder return of 133.53 percent. This suggests investors see the auditor change as a manageable governance wrinkle rather than a thesis breaker.

If this governance shake up has you rethinking where growth and conviction overlap, it may be worth scanning fast growing stocks with high insider ownership for other ideas with aligned insiders.

With earnings still growing, a modest discount to analyst targets and a meaningful intrinsic value gap, the market is sending mixed signals. So is CSSC (Hong Kong) Shipping still a buy or already pricing in its future growth?

Price-to-Earnings of 6.8x: Is it justified?

CSSC (Hong Kong) Shipping looks undervalued at the last close of HK$2.06, with the stock trading on a notably low earnings multiple versus peers.

The preferred metric here is the price-to-earnings ratio, which compares the company’s share price to its earnings per share, a common yardstick for diversified financials.

At 6.8x earnings, investors are paying far less for each dollar of profit than both similar companies and the wider Asian Diversified Financials industry. This suggests the market may be underpricing its earnings power. Relative to an estimated fair price-to-earnings ratio of 8.7x, there appears to be room for the valuation to move higher if sentiment normalises.

Against the Asian Diversified Financials industry average of 15.8x, CSSC (Hong Kong) Shipping’s 6.8x multiple looks deeply discounted. This reinforces the view that the market is assigning a steep valuation gap.

Explore the SWS fair ratio for CSSC (Hong Kong) Shipping

Result: Price-to-Earnings of 6.8x (UNDERVALUED)

However, lingering auditor uncertainty and any slowdown in leasing growth across key shipping markets could quickly compress that apparent valuation discount.

Find out about the key risks to this CSSC (Hong Kong) Shipping narrative.

Another View: What Our DCF Suggests

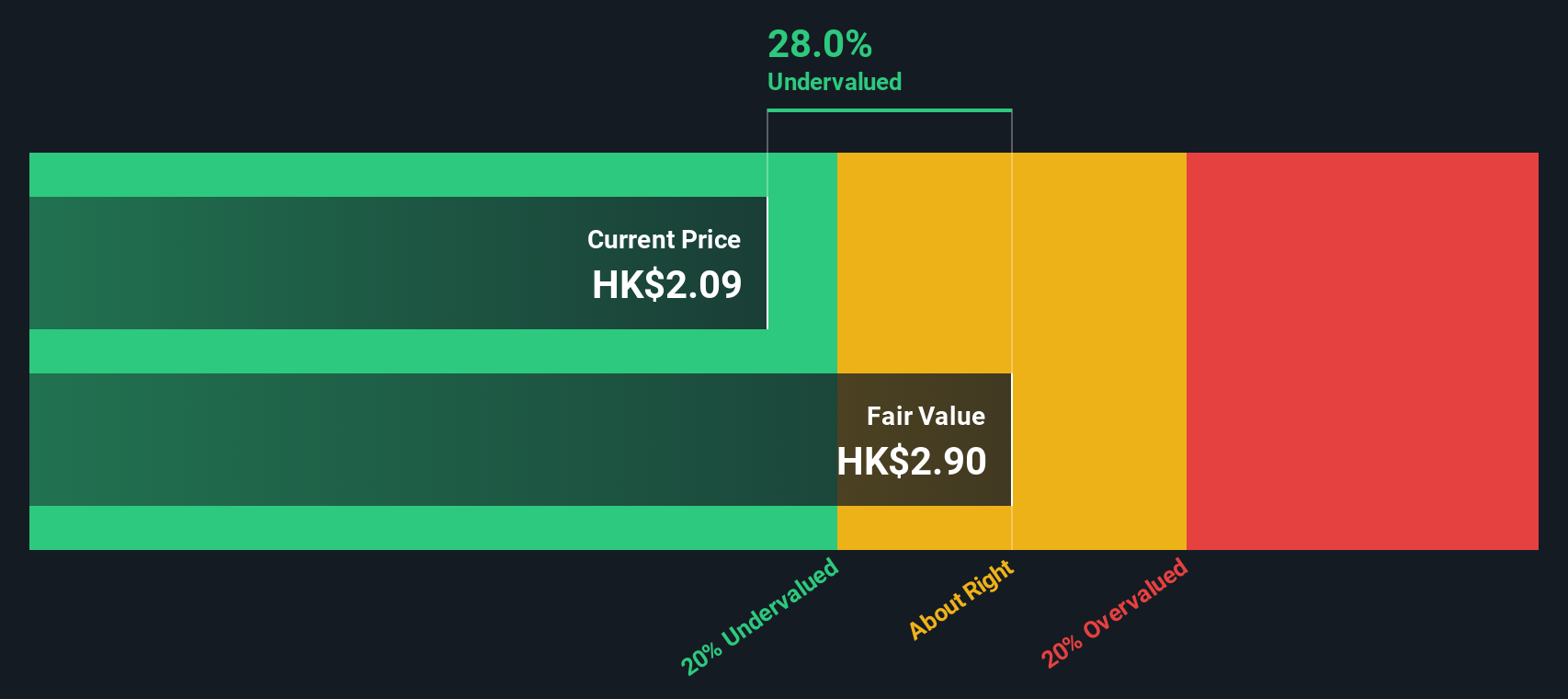

Our DCF model also points to upside, with CSSC (Hong Kong) Shipping trading about 28 percent below an estimated fair value of roughly HK$2.87 per share. If both earnings multiples and cash flows flag a discount, the key risk may now relate more to governance than to valuation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CSSC (Hong Kong) Shipping for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CSSC (Hong Kong) Shipping Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your CSSC (Hong Kong) Shipping research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh stocks that match your style before the market catches on.

- Capture potential growth at attractive prices by scanning these 900 undervalued stocks based on cash flows that may be trading below their intrinsic worth.

- Capitalize on groundbreaking innovation by reviewing these 26 AI penny stocks shaping the future of automation, data intelligence, and machine learning.

- Strengthen your income stream by targeting these 15 dividend stocks with yields > 3% that offer cash returns alongside solid business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3877

CSSC (Hong Kong) Shipping

Operates as a shipyard-affiliated leasing company in People Republic of China, Asia, the United States, and Europe.

Undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026