- Hong Kong

- /

- Diversified Financial

- /

- SEHK:3848

If You Had Bought Wealthy Way Group Stock A Year Ago, You Could Pocket A 26% Gain Today

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. For example, the Wealthy Way Group Limited (HKG:3848) share price is up 26% in the last year, clearly besting than the market return of around -7.3% (not including dividends). So that should have shareholders smiling. Note that businesses generally develop over the long term, so it the returns over the last year might not reflect a long term trend.

View our latest analysis for Wealthy Way Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year, Wealthy Way Group actually saw its earnings per share drop 36%. Given the share price gain, we doubt the market is measuring progress with EPS. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Unfortunately Wealthy Way Group's fell 14% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

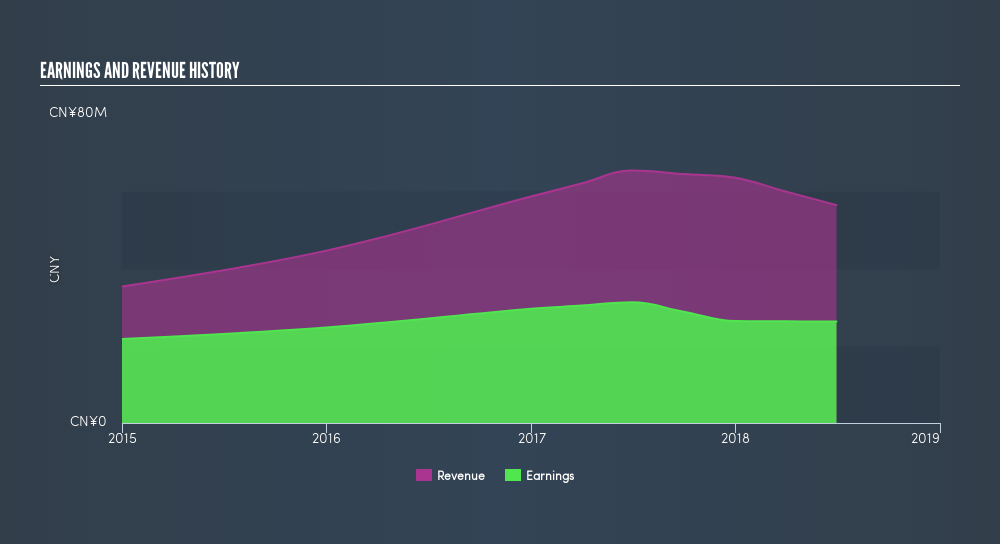

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our freereport on Wealthy Way Group's earnings, revenue and cash flow.

A Different Perspective

Wealthy Way Group shareholders should be happy with the total gain of 26% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 33% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. Before forming an opinion on Wealthy Way Group you might want to consider these 3 valuation metrics.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:3848

Haosen Fintech Group

An investment holding company, provides financial leasing, factoring, and financial advisory services in the People's Republic of China and Hong Kong.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives