- Hong Kong

- /

- Diversified Financial

- /

- SEHK:3848

Investors Don't See Light At End Of Haosen Fintech Group Limited's (HKG:3848) Tunnel And Push Stock Down 91%

The Haosen Fintech Group Limited (HKG:3848) share price has fared very poorly over the last month, falling by a substantial 91%. For any long-term shareholders, the last month ends a year to forget by locking in a 91% share price decline.

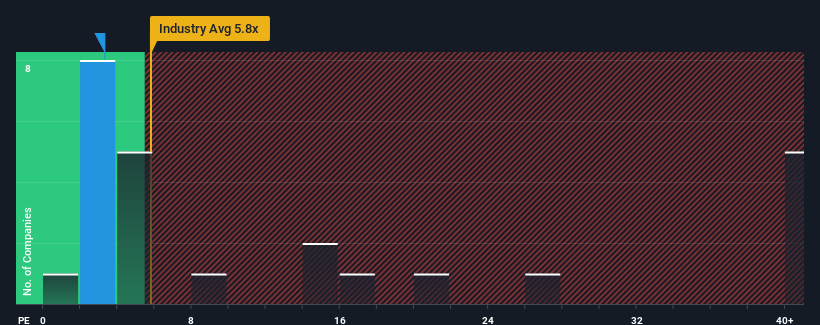

Even after such a large drop in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may still consider Haosen Fintech Group as a highly attractive investment with its 3.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For instance, Haosen Fintech Group's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Haosen Fintech Group

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Haosen Fintech Group's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 3.9%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 20% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Haosen Fintech Group is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Final Word

Shares in Haosen Fintech Group have plummeted and its P/E is now low enough to touch the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Haosen Fintech Group revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Haosen Fintech Group (1 is significant!) that you should be aware of before investing here.

If you're unsure about the strength of Haosen Fintech Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Haosen Fintech Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3848

Haosen Fintech Group

An investment holding company, provides financial leasing, factoring, and financial advisory services in the People's Republic of China and Hong Kong.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives