- Hong Kong

- /

- Diversified Financial

- /

- SEHK:3360

The total return for Far East Horizon (HKG:3360) investors has risen faster than earnings growth over the last five years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Far East Horizon Limited (HKG:3360), since the last five years saw the share price fall 28%.

If the past week is anything to go by, investor sentiment for Far East Horizon isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Far East Horizon

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate half decade during which the share price slipped, Far East Horizon actually saw its earnings per share (EPS) improve by 2.2% per year. So it doesn't seem like EPS is a great guide to understanding how the market is valuing the stock. Alternatively, growth expectations may have been unreasonable in the past.

Based on these numbers, we'd venture that the market may have been over-optimistic about forecast growth, half a decade ago. Looking to other metrics might better explain the share price change.

The steady dividend doesn't really explain why the share price is down. While it's not completely obvious why the share price is down, a closer look at the company's history might help explain it.

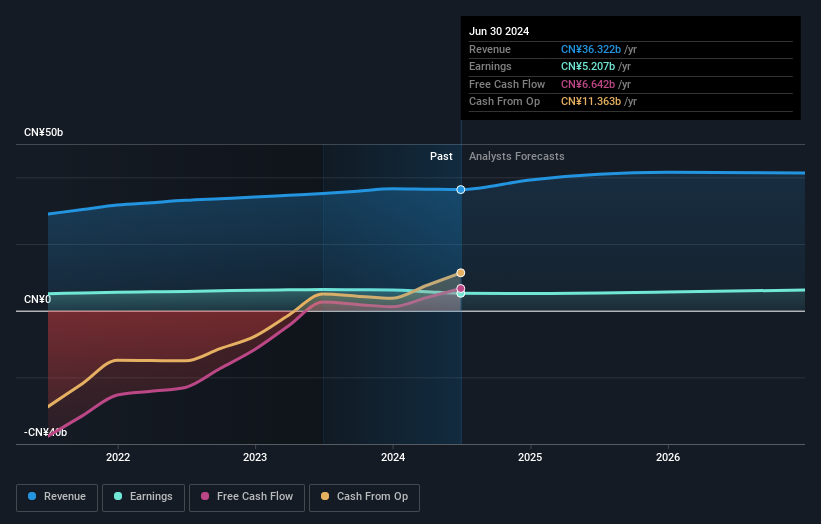

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Far East Horizon's TSR for the last 5 years was 13%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Far East Horizon shareholders gained a total return of 7.6% during the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 2% per year over five year. This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand Far East Horizon better, we need to consider many other factors. Even so, be aware that Far East Horizon is showing 1 warning sign in our investment analysis , you should know about...

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3360

Far East Horizon

Provides various financial services in Mainland China, Hong Kong, and internationally.

Undervalued established dividend payer.

Market Insights

Community Narratives