- Hong Kong

- /

- Capital Markets

- /

- SEHK:1911

China Renaissance Holdings Limited (HKG:1911) Analysts Just Trimmed Their Revenue Forecasts By 24%

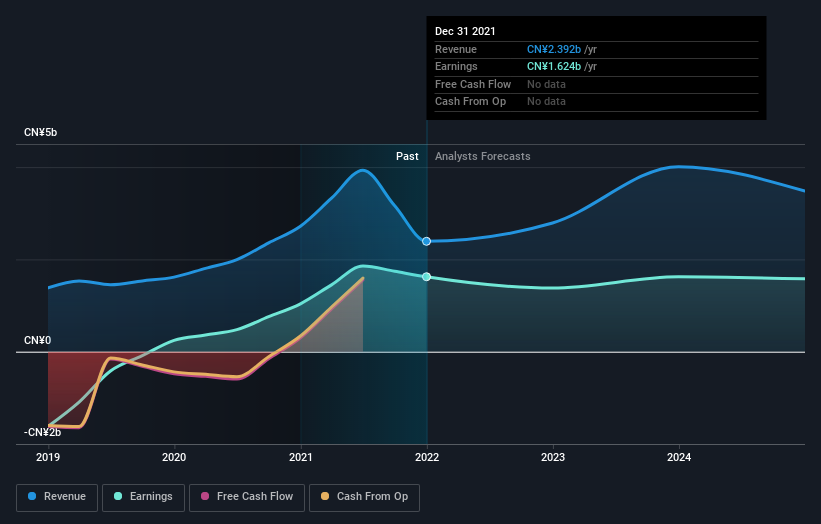

One thing we could say about the analysts on China Renaissance Holdings Limited (HKG:1911) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

Following the downgrade, the current consensus from China Renaissance Holdings' four analysts is for revenues of CN¥2.8b in 2022 which - if met - would reflect a meaningful 17% increase on its sales over the past 12 months. Before the latest update, the analysts were foreseeing CN¥3.7b of revenue in 2022. The consensus view seems to have become more pessimistic on China Renaissance Holdings, noting the pretty serious reduction to revenue estimates in this update.

View our latest analysis for China Renaissance Holdings

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that China Renaissance Holdings' revenue growth is expected to slow, with the forecast 17% annualised growth rate until the end of 2022 being well below the historical 29% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 12% annually. So it's pretty clear that, while China Renaissance Holdings' revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for China Renaissance Holdings this year. Analysts also expect revenues to grow faster than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on China Renaissance Holdings after today.

Want to learn more? We have estimates for China Renaissance Holdings from its four analysts out until 2024, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1911

China Renaissance Holdings

Provides investment banking and investment management services in Mainland China, Hong Kong, and the United States.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives