- Hong Kong

- /

- Capital Markets

- /

- SEHK:1911

China Renaissance Holdings (HKG:1911 shareholders incur further losses as stock declines 11% this week, taking five-year losses to 67%

Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high. For example, after five long years the China Renaissance Holdings Limited (HKG:1911) share price is a whole 69% lower. That's an unpleasant experience for long term holders. Shareholders have had an even rougher run lately, with the share price down 36% in the last 90 days.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

We know that China Renaissance Holdings has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move.

It could be that the revenue decline of 31% per year is viewed as evidence that China Renaissance Holdings is shrinking. That could explain the weak share price.

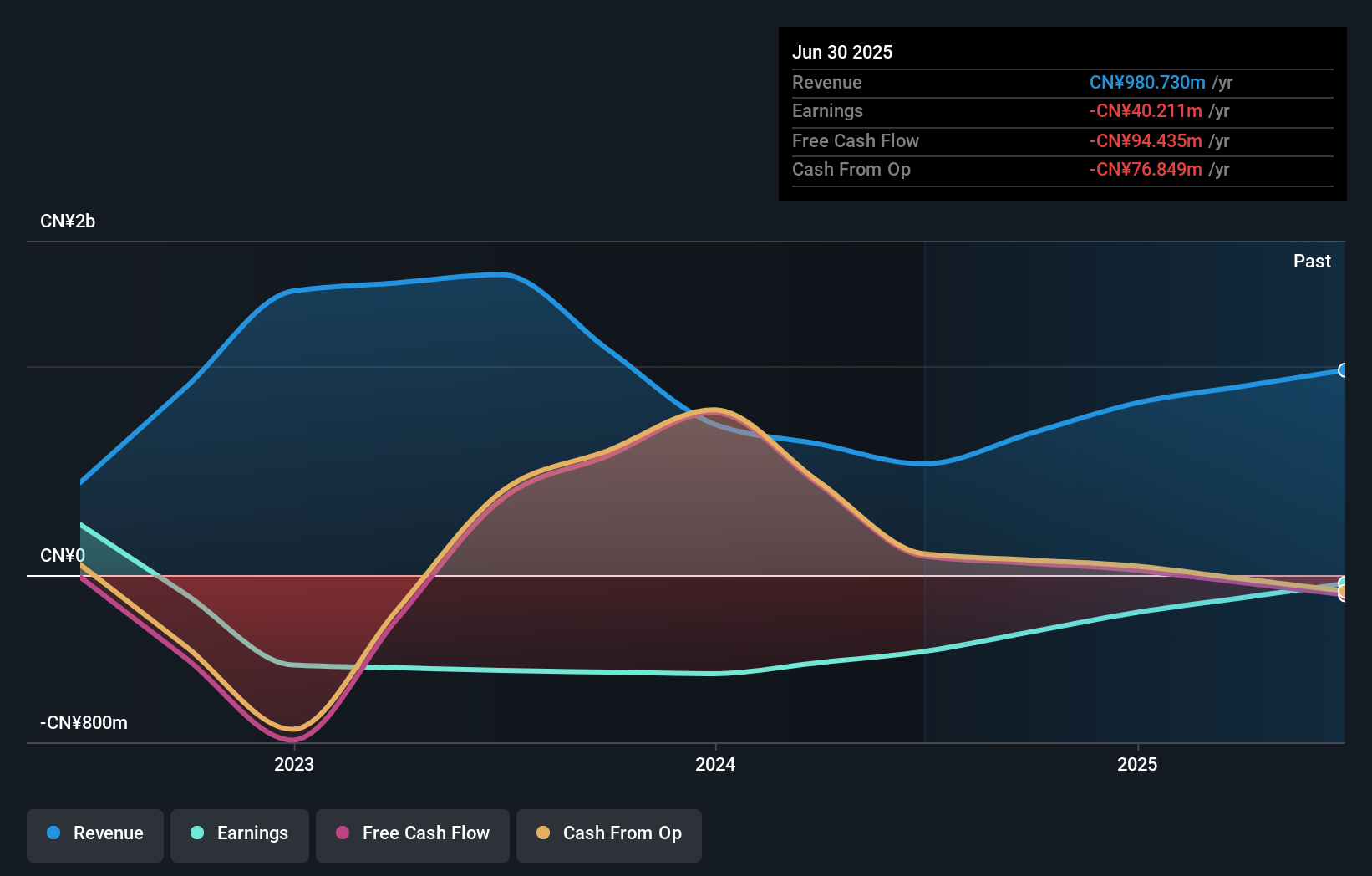

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling China Renaissance Holdings stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between China Renaissance Holdings' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that China Renaissance Holdings' TSR, which was a 67% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

We're pleased to report that China Renaissance Holdings shareholders have received a total shareholder return of 45% over one year. Notably the five-year annualised TSR loss of 11% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with China Renaissance Holdings , and understanding them should be part of your investment process.

But note: China Renaissance Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1911

China Renaissance Holdings

Provides investment banking and investment management services in Mainland China, Hong Kong, and the United States.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026