Have Insiders Been Buying First Pacific Company Limited (HKG:142) Shares?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So we'll take a look at whether insiders have been buying or selling shares in First Pacific Company Limited (HKG:142).

What Is Insider Selling?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, such insiders must disclose their trading activities, and not trade on inside information.

We would never suggest that investors should base their decisions solely on what the directors of a company have been doing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise'.

Check out our latest analysis for First Pacific

The Last 12 Months Of Insider Transactions At First Pacific

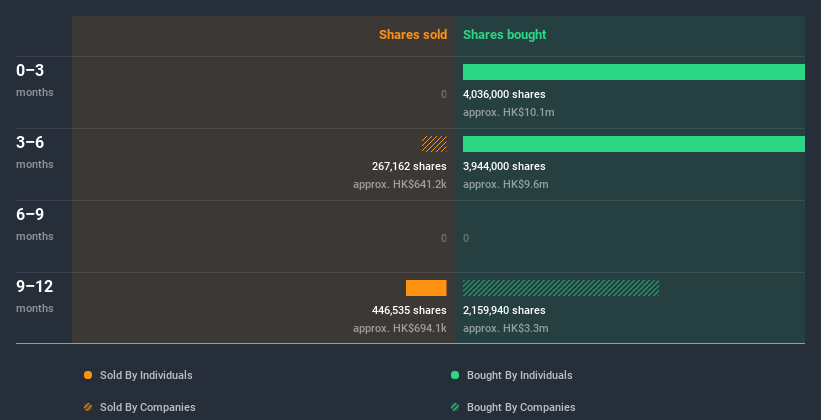

Over the last year, we can see that the biggest insider purchase was by Independent Non-Executive Director Yan Hok Fan for HK$1.4m worth of shares, at about HK$2.41 per share. So it's clear an insider wanted to buy, even at a higher price than the current share price (being HK$2.29). While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. To us, it's very important to consider the price insiders pay for shares. Generally speaking, it catches our eye when an insider has purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price. Yan Hok Fan was the only individual insider to buy shares in the last twelve months.

Yan Hok Fan purchased 7.98m shares over the year. The average price per share was HK$2.46. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

First Pacific is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Does First Pacific Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. First Pacific insiders own 28% of the company, currently worth about HK$2.9b based on the recent share price. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Do The First Pacific Insider Transactions Indicate?

It is good to see the recent insider purchase. We also take confidence from the longer term picture of insider transactions. But we don't feel the same about the fact the company is making losses. Once you factor in the high insider ownership, it certainly seems like insiders are positive about First Pacific. Looks promising! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing First Pacific. For instance, we've identified 3 warning signs for First Pacific (1 shouldn't be ignored) you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade First Pacific, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:142

First Pacific

An investment holding company, engages in the consumer food products, telecommunications, infrastructure, and natural resources businesses in the Philippines, Indonesia, Singapore, the Middle East, Africa, and internationally.

Undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives