- Hong Kong

- /

- Capital Markets

- /

- SEHK:1359

China Cinda Asset Management Co., Ltd.'s (HKG:1359) Shares Leap 28% Yet They're Still Not Telling The Full Story

China Cinda Asset Management Co., Ltd. (HKG:1359) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 12% over that time.

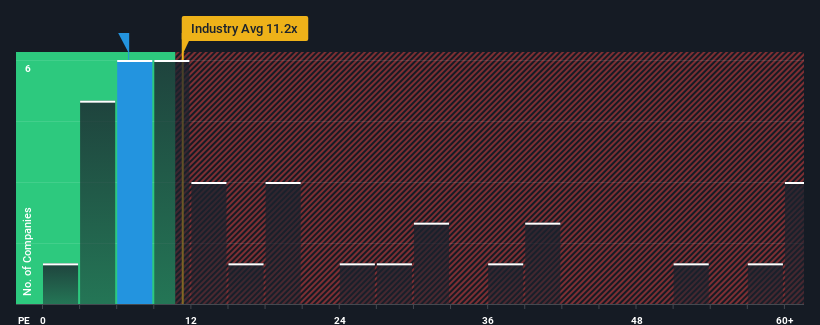

In spite of the firm bounce in price, China Cinda Asset Management's price-to-earnings (or "P/E") ratio of 6.9x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 20x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

China Cinda Asset Management could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for China Cinda Asset Management

How Is China Cinda Asset Management's Growth Trending?

In order to justify its P/E ratio, China Cinda Asset Management would need to produce sluggish growth that's trailing the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. As a result, earnings from three years ago have also fallen 49% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 26% per annum as estimated by the two analysts watching the company. With the market only predicted to deliver 16% per year, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that China Cinda Asset Management's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift China Cinda Asset Management's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that China Cinda Asset Management currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for China Cinda Asset Management (1 is concerning!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1359

China Cinda Asset Management

Acquires, manages, invests in, and disposes financial and non-financial institution distressed assets in the People’s Republic of China and Hong Kong.

Slight with moderate growth potential.