- Hong Kong

- /

- Hospitality

- /

- SEHK:9658

Do Super Hi International Holding's (HKG:9658) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Super Hi International Holding (HKG:9658), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Super Hi International Holding's Improving Profits

Super Hi International Holding has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Super Hi International Holding's EPS grew from US$0.029 to US$0.059, over the previous 12 months. It's not often a company can achieve year-on-year growth of 99%.

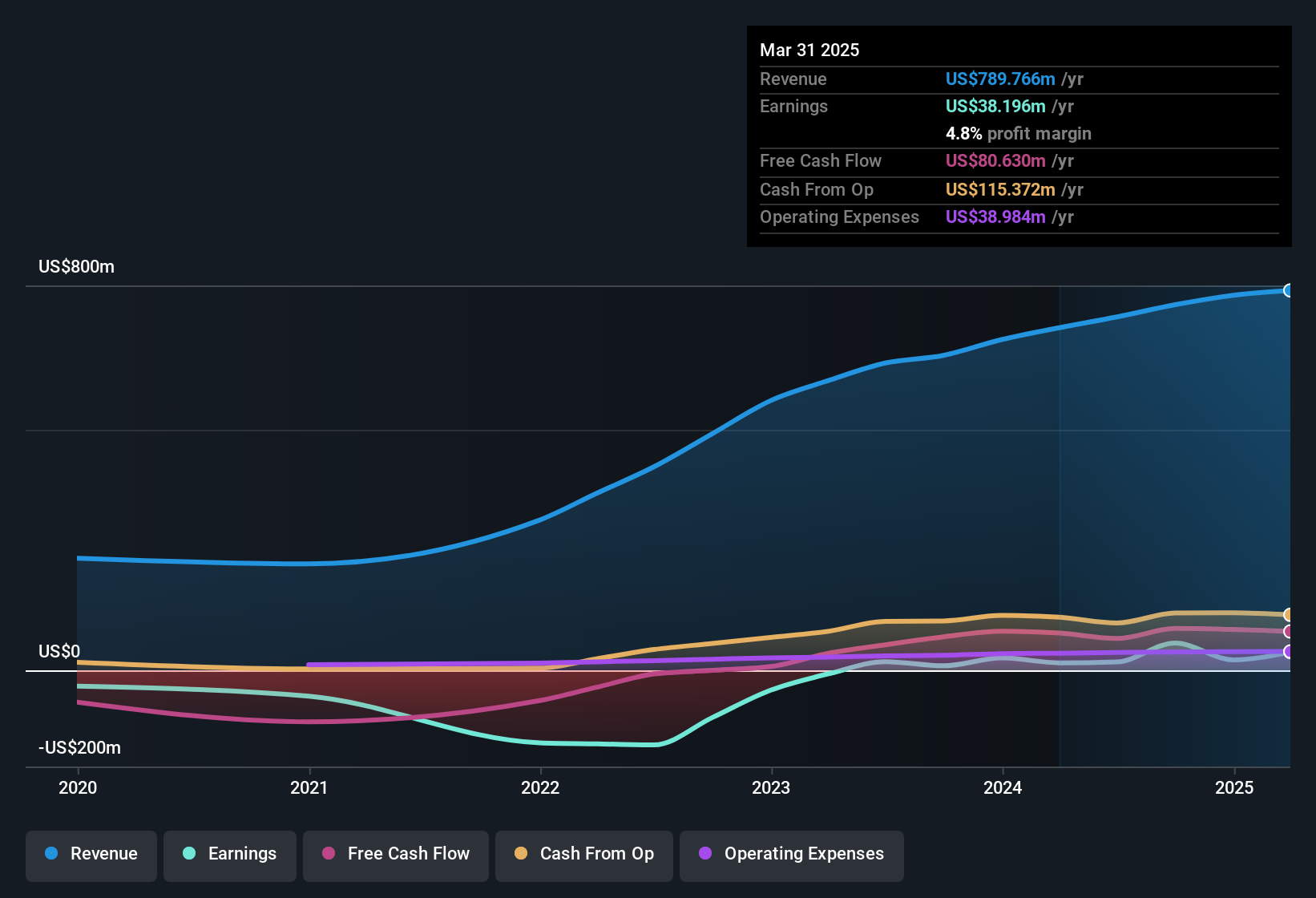

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Super Hi International Holding maintained stable EBIT margins over the last year, all while growing revenue 11% to US$790m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Check out our latest analysis for Super Hi International Holding

Fortunately, we've got access to analyst forecasts of Super Hi International Holding's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Super Hi International Holding Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First and foremost; there we saw no insiders sell Super Hi International Holding shares in the last year. Even better, though, is that the CEO & Executive Director, Lijuan Yang, bought a whopping US$3.0m worth of shares, paying about US$13.99 per share, on average. Big buys like that may signal an opportunity; actions speak louder than words.

The good news, alongside the insider buying, for Super Hi International Holding bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$285m worth of its stock. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 2.7%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does Super Hi International Holding Deserve A Spot On Your Watchlist?

Super Hi International Holding's earnings have taken off in quite an impressive fashion. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Super Hi International Holding deserves timely attention. If you think Super Hi International Holding might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Keen growth investors love to see insider activity. Thankfully, Super Hi International Holding isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9658

Super Hi International Holding

An investment holding company, engages in the restaurant operation, delivery business, and others in Asia, North America, Europe, Oceania, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives