- Hong Kong

- /

- Consumer Services

- /

- SEHK:8483

Shareholders Will Probably Not Have Any Issues With Max Sight Group Holdings Limited's (HKG:8483) CEO Compensation

Key Insights

- Max Sight Group Holdings will host its Annual General Meeting on 14th of June

- CEO Timmy Chan's total compensation includes salary of HK$216.0k

- The overall pay is 30% below the industry average

- Max Sight Group Holdings' three-year loss to shareholders was 0.5% while its EPS grew by 35% over the past three years

The performance at Max Sight Group Holdings Limited (HKG:8483) has been rather lacklustre of late and shareholders may be wondering what CEO Timmy Chan is planning to do about this. At the next AGM coming up on 14th of June, they can influence managerial decision making through voting on resolutions, including executive remuneration. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. We think CEO compensation looks appropriate given the data we have put together.

View our latest analysis for Max Sight Group Holdings

How Does Total Compensation For Timmy Chan Compare With Other Companies In The Industry?

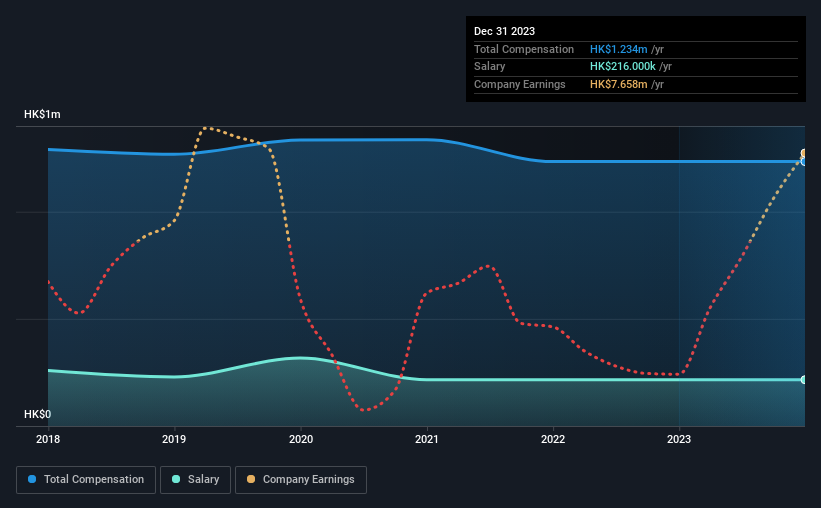

According to our data, Max Sight Group Holdings Limited has a market capitalization of HK$72m, and paid its CEO total annual compensation worth HK$1.2m over the year to December 2023. There was no change in the compensation compared to last year. We think total compensation is more important but our data shows that the CEO salary is lower, at HK$216k.

For comparison, other companies in the Hong Kong Consumer Services industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$1.8m. That is to say, Timmy Chan is paid under the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$216k | HK$216k | 18% |

| Other | HK$1.0m | HK$1.0m | 82% |

| Total Compensation | HK$1.2m | HK$1.2m | 100% |

On an industry level, roughly 85% of total compensation represents salary and 15% is other remuneration. Max Sight Group Holdings sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Max Sight Group Holdings Limited's Growth Numbers

Max Sight Group Holdings Limited's earnings per share (EPS) grew 35% per year over the last three years. Its revenue is up 157% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Max Sight Group Holdings Limited Been A Good Investment?

With a three year total loss of 0.5% for the shareholders, Max Sight Group Holdings Limited would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

The uninspiring share price returns contrasts with the strong EPS growth, suggesting that there may be other factors at play causing it to diverge from fundamentals. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Max Sight Group Holdings (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8483

Max Sight Group Holdings

An investment holding company, provides photography services through automatic identity documentation (ID) photo booths primarily in Hong Kong and Mainland China.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion