- Hong Kong

- /

- Consumer Services

- /

- SEHK:8363

Take Care Before Jumping Onto SDM Education Group Holdings Limited (HKG:8363) Even Though It's 53% Cheaper

SDM Education Group Holdings Limited (HKG:8363) shareholders that were waiting for something to happen have been dealt a blow with a 53% share price drop in the last month. Still, a bad month hasn't completely ruined the past year with the stock gaining 77%, which is great even in a bull market.

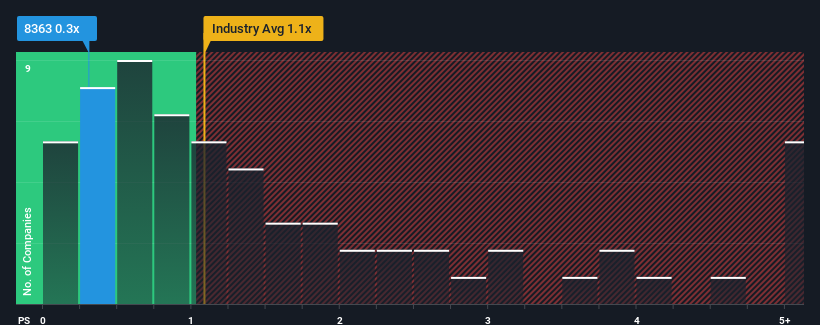

Since its price has dipped substantially, given about half the companies operating in Hong Kong's Consumer Services industry have price-to-sales ratios (or "P/S") above 1.1x, you may consider SDM Education Group Holdings as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for SDM Education Group Holdings

How SDM Education Group Holdings Has Been Performing

The revenue growth achieved at SDM Education Group Holdings over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on SDM Education Group Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on SDM Education Group Holdings' earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, SDM Education Group Holdings would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 22% last year. Pleasingly, revenue has also lifted 79% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 19%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that SDM Education Group Holdings' P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

SDM Education Group Holdings' P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of SDM Education Group Holdings revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Before you take the next step, you should know about the 4 warning signs for SDM Education Group Holdings (2 shouldn't be ignored!) that we have uncovered.

If you're unsure about the strength of SDM Education Group Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8363

SDM Education Group Holdings

An investment holding company, operates dance institutions for children in Hong Kong and Singapore.

Moderate and good value.

Market Insights

Community Narratives