- Hong Kong

- /

- Industrials

- /

- SEHK:8095

Why Beijing Beida Jade Bird Universal Sci-Tech's (HKG:8095) Earnings Are Weaker Than They Seem

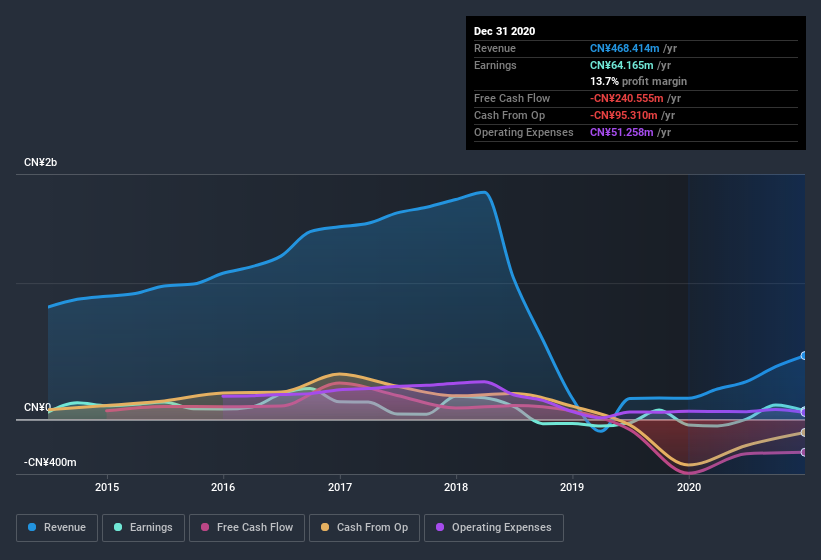

Beijing Beida Jade Bird Universal Sci-Tech Company Limited (HKG:8095) recently released a strong earnings report, and the market responded by raising the share price. Despite the strong profit numbers, we believe that there are some deeper issues which investors should look into.

View our latest analysis for Beijing Beida Jade Bird Universal Sci-Tech

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Beijing Beida Jade Bird Universal Sci-Tech issued 9.8% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Beijing Beida Jade Bird Universal Sci-Tech's EPS by clicking here.

How Is Dilution Impacting Beijing Beida Jade Bird Universal Sci-Tech's Earnings Per Share? (EPS)

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. And even focusing only on the last twelve months, we don't have a meaningful growth rate because it made a loss a year ago, too. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. And so, you can see quite clearly that dilution is influencing shareholder earnings.

If Beijing Beida Jade Bird Universal Sci-Tech's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Beijing Beida Jade Bird Universal Sci-Tech.

How Do Unusual Items Influence Profit?

Finally, we should also consider the fact that unusual items boosted Beijing Beida Jade Bird Universal Sci-Tech's net profit by CN¥69m over the last year. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Beijing Beida Jade Bird Universal Sci-Tech had a rather significant contribution from unusual items relative to its profit to December 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Beijing Beida Jade Bird Universal Sci-Tech's Profit Performance

To sum it all up, Beijing Beida Jade Bird Universal Sci-Tech got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. Considering all this we'd argue Beijing Beida Jade Bird Universal Sci-Tech's profits probably give an overly generous impression of its sustainable level of profitability. So while earnings quality is important, it's equally important to consider the risks facing Beijing Beida Jade Bird Universal Sci-Tech at this point in time. When we did our research, we found 3 warning signs for Beijing Beida Jade Bird Universal Sci-Tech (1 is a bit concerning!) that we believe deserve your full attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade Beijing Beida Jade Bird Universal Sci-Tech, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Beijing Beida Jade Bird Universal Sci-Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8095

Beijing Beida Jade Bird Universal Sci-Tech

An investment holding company, engages in the trading of metallic products and tourism development in the People’s Republic of China, Hong Kong, and the United States.

Mediocre balance sheet with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026