- Hong Kong

- /

- Hospitality

- /

- SEHK:780

Tongcheng Travel Holdings (SEHK:780) Eyes Growth with Tencent Alliance Amid Earnings Surge and Shareholder Meeting

Reviewed by Simply Wall St

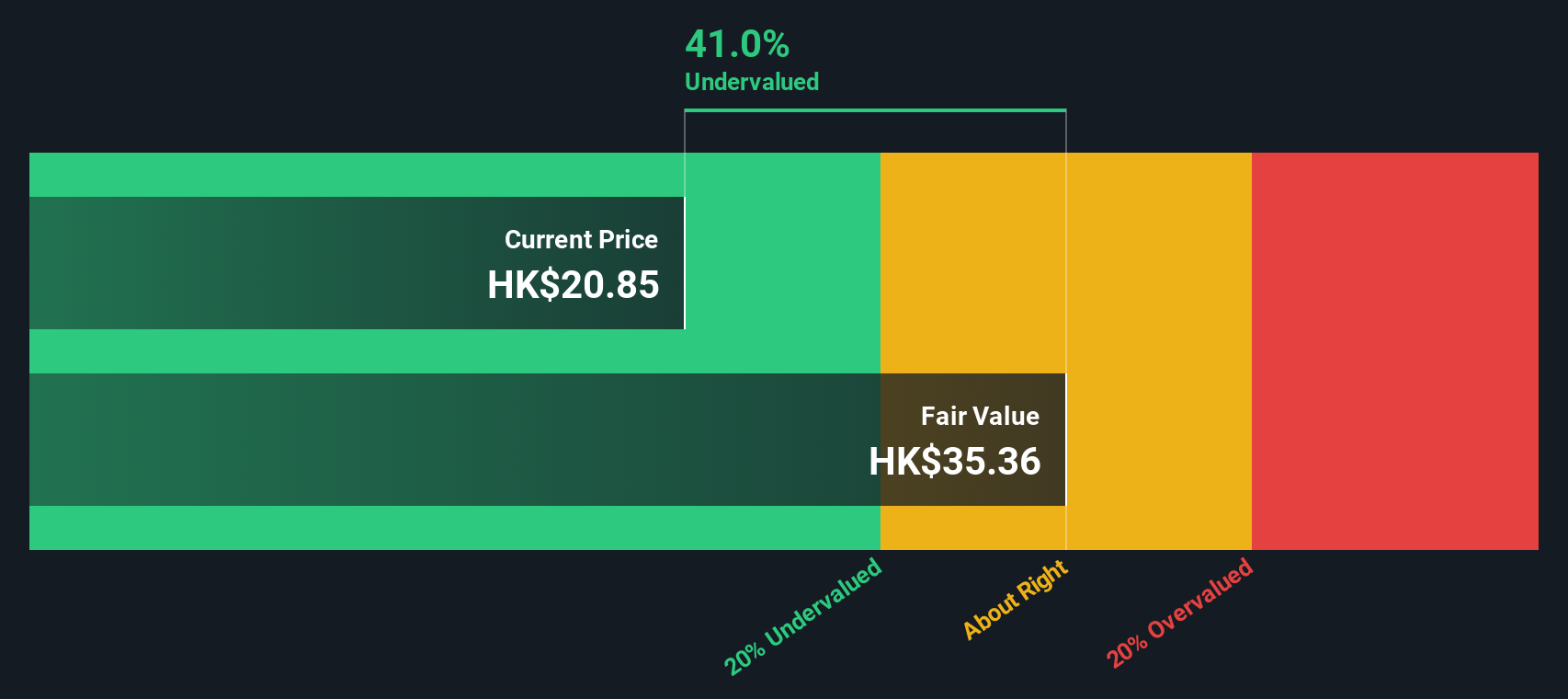

Tongcheng Travel Holdings (SEHK:780) continues to capture investor attention with its impressive 166.7% earnings growth over the past year, driven by strategic market penetration and operational efficiencies. As the company gears up for its Special Shareholder Meeting on September 30, 2024, to discuss the pivotal Tencent Strategic Cooperation Agreement, stakeholders should anticipate discussions on leveraging this partnership for enhanced market reach and service offerings. Challenges like a low Return on Equity and rising operating expenses are present, but Tongcheng's solid financial health and trading below its fair value present a promising investment opportunity.

See the full analysis report here for a deeper understanding of Tongcheng Travel Holdings.

Competitive Advantages That Elevate Tongcheng Travel Holdings

With a forecast of 18.5% annual earnings growth, Tongcheng Travel Holdings is outpacing the Hong Kong market average. This is complemented by a remarkable 166.7% earnings surge over the past year, demonstrating effective strategies and market penetration. The company's focus on operational efficiency is evident in its improved gross margins, rising to 38% as highlighted in the latest earnings call. Additionally, the introduction of innovative products has been well-received, enhancing competitive positioning. The financial health is solid, with more cash than debt, ensuring stability and flexibility for future investments. Trading significantly below its estimated fair value of HK$47.19, the company presents a compelling opportunity for investors.

Critical Issues Affecting the Performance of Tongcheng Travel Holdings and Areas for Growth

The company faces challenges such as a low Return on Equity of 8.5%, which is below the industry threshold. The revenue growth forecast of 14.2% per year, although positive, lags behind its earnings growth, indicating potential inefficiencies. Operating expenses have increased, putting pressure on net income, as noted by CEO Lei Fan. Additionally, the company offers a modest dividend yield of 0.78%, which may deter income-focused investors. Trading at a Price-To-Earnings Ratio of 23.9x, it is considered expensive relative to the industry average, highlighting a potential area for strategic cost management and revenue enhancement.

Emerging Markets Or Trends for Tongcheng Travel Holdings

The company's strategic alliances, such as the Tencent Strategic Cooperation, offer significant growth potential. These partnerships are crucial for expanding market reach and enhancing service offerings. The upcoming shareholder meeting to discuss this agreement underscores its strategic importance. Trading below its estimated fair value suggests room for price appreciation, aligning with its forecasted earnings growth. Such opportunities can bolster market position and drive long-term value creation.

Competitive Pressures and Market Risks Facing Tongcheng Travel Holdings

Economic headwinds, including rising interest rates and inflation, pose risks to consumer spending and revenue growth. The competitive environment is intensifying, with new entrants and aggressive pricing strategies challenging market share. Supply chain disruptions further complicate operations, necessitating robust risk management strategies. Substantial insider selling in recent months raises concerns about internal confidence, highlighting the need for transparent communication and strategic clarity to reassure stakeholders.

Conclusion

Tongcheng Travel Holdings showcases a promising growth trajectory with an 18.5% annual earnings growth forecast, significantly outperforming the Hong Kong market average. Despite trading below its estimated fair value of HK$47.19, its Price-To-Earnings Ratio of 23.9x suggests it is priced higher than industry peers, indicating potential for strategic cost management to align valuation with intrinsic value. The company's strategic partnerships, such as the Tencent cooperation, are pivotal for market expansion and service enhancement, which could drive future earnings and support price appreciation. However, challenges such as low Return on Equity, increased operating expenses, and economic headwinds require focused management to sustain growth and reassure stakeholders of its long-term potential.

Where To Now?

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Tongcheng Travel Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:780

Tongcheng Travel Holdings

An investment holding company, provides travel related services in the People’s Republic of China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives