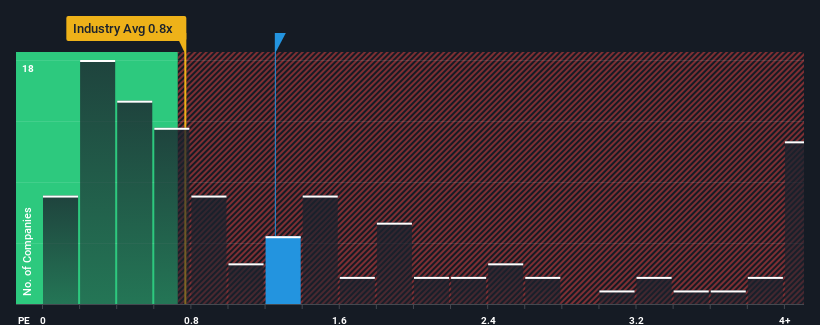

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Hospitality industry in Hong Kong, you could be forgiven for feeling indifferent about Shangri-La Asia Limited's (HKG:69) P/S ratio of 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Shangri-La Asia

How Shangri-La Asia Has Been Performing

Shangri-La Asia could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shangri-La Asia.How Is Shangri-La Asia's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Shangri-La Asia's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 39%. As a result, it also grew revenue by 8.9% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 24% over the next year. With the industry predicted to deliver 24% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that Shangri-La Asia's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Shangri-La Asia's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Shangri-La Asia's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Hospitality industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Shangri-La Asia (1 is a bit unpleasant!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:69

Shangri-La Asia

An investment holding company, develops, owns/leases, operates, and manages hotels and associated properties worldwide.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives