- Hong Kong

- /

- Hospitality

- /

- SEHK:520

Xiabuxiabu Catering Management (China) Holdings Co., Ltd.'s (HKG:520) 29% Dip In Price Shows Sentiment Is Matching Revenues

The Xiabuxiabu Catering Management (China) Holdings Co., Ltd. (HKG:520) share price has fared very poorly over the last month, falling by a substantial 29%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 62% loss during that time.

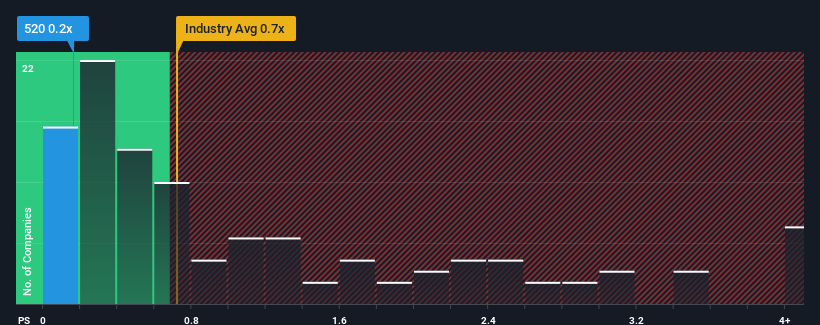

After such a large drop in price, it would be understandable if you think Xiabuxiabu Catering Management (China) Holdings is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Hong Kong's Hospitality industry have P/S ratios above 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Xiabuxiabu Catering Management (China) Holdings

How Has Xiabuxiabu Catering Management (China) Holdings Performed Recently?

With revenue growth that's inferior to most other companies of late, Xiabuxiabu Catering Management (China) Holdings has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Xiabuxiabu Catering Management (China) Holdings.How Is Xiabuxiabu Catering Management (China) Holdings' Revenue Growth Trending?

Xiabuxiabu Catering Management (China) Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 17% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 8.8% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 14% per year, which is noticeably more attractive.

With this in consideration, its clear as to why Xiabuxiabu Catering Management (China) Holdings' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Xiabuxiabu Catering Management (China) Holdings' P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Xiabuxiabu Catering Management (China) Holdings' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Xiabuxiabu Catering Management (China) Holdings is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Xiabuxiabu Catering Management (China) Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:520

Xiabuxiabu Catering Management (China) Holdings

An investment holding company, operates Chinese hotpot restaurants in the People’s Republic of China.

Undervalued with moderate growth potential.

Market Insights

Community Narratives