- Hong Kong

- /

- Hospitality

- /

- SEHK:520

Lacklustre Performance Is Driving Xiabuxiabu Catering Management (China) Holdings Co., Ltd.'s (HKG:520) 32% Price Drop

The Xiabuxiabu Catering Management (China) Holdings Co., Ltd. (HKG:520) share price has fared very poorly over the last month, falling by a substantial 32%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

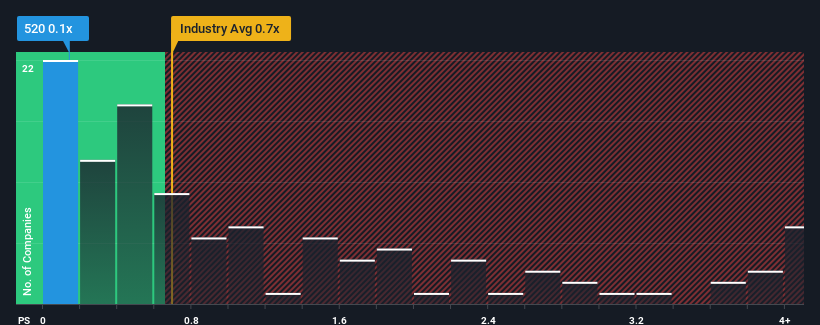

Following the heavy fall in price, Xiabuxiabu Catering Management (China) Holdings may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Hospitality industry in Hong Kong have P/S ratios greater than 0.7x and even P/S higher than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Xiabuxiabu Catering Management (China) Holdings

How Xiabuxiabu Catering Management (China) Holdings Has Been Performing

Xiabuxiabu Catering Management (China) Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Xiabuxiabu Catering Management (China) Holdings .Is There Any Revenue Growth Forecasted For Xiabuxiabu Catering Management (China) Holdings?

The only time you'd be truly comfortable seeing a P/S as low as Xiabuxiabu Catering Management (China) Holdings' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. The last three years don't look nice either as the company has shrunk revenue by 23% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 1.3% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 14% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Xiabuxiabu Catering Management (China) Holdings' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Xiabuxiabu Catering Management (China) Holdings' P/S

The southerly movements of Xiabuxiabu Catering Management (China) Holdings' shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Xiabuxiabu Catering Management (China) Holdings' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 2 warning signs we've spotted with Xiabuxiabu Catering Management (China) Holdings .

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:520

Xiabuxiabu Catering Management (China) Holdings

An investment holding company, operates Chinese hotpot restaurants in the People’s Republic of China.

Undervalued with moderate growth potential.

Market Insights

Community Narratives