- Hong Kong

- /

- Hospitality

- /

- SEHK:520

Bearish: Analysts Just Cut Their Xiabuxiabu Catering Management (China) Holdings Co., Ltd. (HKG:520) Revenue and EPS estimates

Today is shaping up negative for Xiabuxiabu Catering Management (China) Holdings Co., Ltd. (HKG:520) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon.

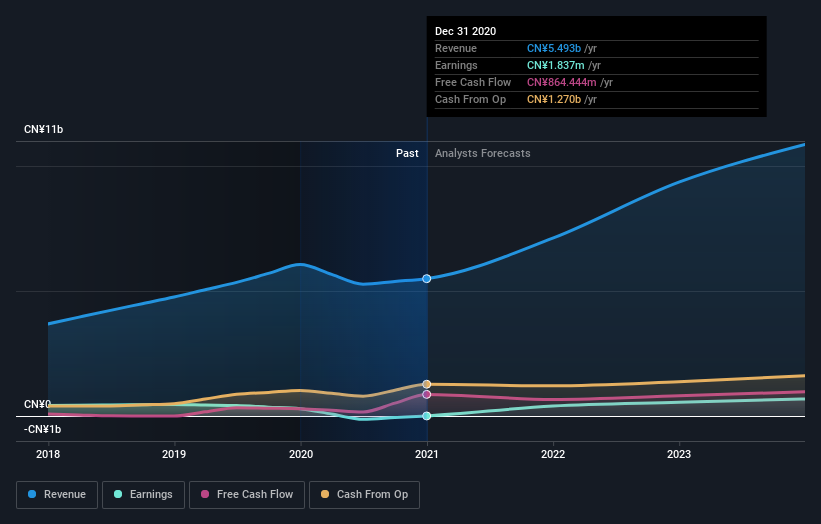

Following the downgrade, the current consensus from Xiabuxiabu Catering Management (China) Holdings' 15 analysts is for revenues of CN¥7.1b in 2021 which - if met - would reflect a substantial 30% increase on its sales over the past 12 months. Statutory earnings per share are presumed to leap 19,367% to CN¥0.33. Previously, the analysts had been modelling revenues of CN¥7.9b and earnings per share (EPS) of CN¥0.42 in 2021. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a pretty serious decline to earnings per share numbers as well.

See our latest analysis for Xiabuxiabu Catering Management (China) Holdings

It'll come as no surprise then, to learn that the analysts have cut their price target 16% to CN¥8.50. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. There are some variant perceptions on Xiabuxiabu Catering Management (China) Holdings, with the most bullish analyst valuing it at CN¥13.91 and the most bearish at CN¥7.69 per share. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The analysts are definitely expecting Xiabuxiabu Catering Management (China) Holdings' growth to accelerate, with the forecast 30% annualised growth to the end of 2021 ranking favourably alongside historical growth of 19% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 29% annually. Xiabuxiabu Catering Management (China) Holdings is expected to grow at about the same rate as its industry, so it's not clear that we can draw any conclusions from its growth relative to competitors.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Xiabuxiabu Catering Management (China) Holdings. There was also a drop in their revenue estimates, although as we saw earlier, forecast growth is only expected to be about the same as the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Xiabuxiabu Catering Management (China) Holdings analysts - going out to 2023, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Xiabuxiabu Catering Management (China) Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:520

Xiabuxiabu Catering Management (China) Holdings

An investment holding company, operates Chinese hotpot restaurants in the People’s Republic of China and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives