- Hong Kong

- /

- Hospitality

- /

- SEHK:3918

Trade Alert: The Founder Of NagaCorp Ltd. (HKG:3918), Lip Keong Chen, Has Just Spent US$10.0m Buying A Few More Shares

NagaCorp Ltd. (HKG:3918) shareholders (or potential shareholders) will be happy to see that the Founder, Lip Keong Chen, recently bought a whopping HK$10.0m worth of stock, at a price of HK$9.23. There's no denying a buy of that magnitude suggests conviction in a brighter future, although we do note that proportionally it only increased their holding by 0.04%.

View our latest analysis for NagaCorp

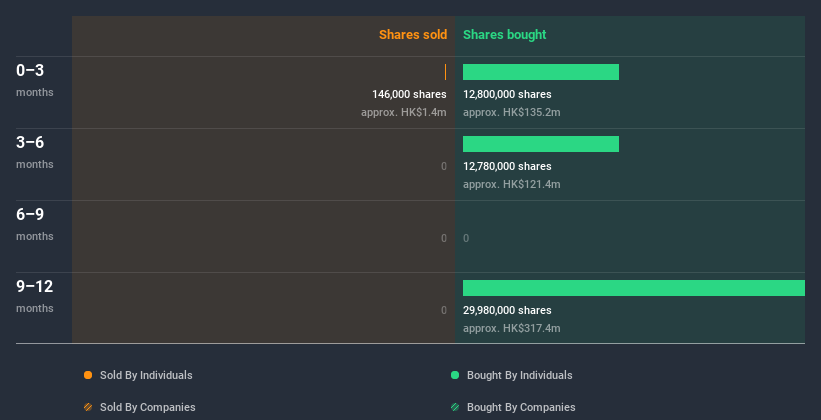

The Last 12 Months Of Insider Transactions At NagaCorp

Notably, that recent purchase by Founder Lip Keong Chen was not the only time they bought NagaCorp shares this year. They previously made an even bigger purchase of HK$39m worth of shares at a price of HK$11.25 per share. That means that even when the share price was higher than HK$9.63 (the recent price), an insider wanted to purchase shares. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. We always take careful note of the price insiders pay when purchasing shares. Generally speaking, it catches our eye when an insider has purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price. Lip Keong Chen was the only individual insider to buy shares in the last twelve months. Notably Lip Keong Chen was also the biggest seller.

Lip Keong Chen bought a total of 55.56m shares over the year at an average price of HK$10.29. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

NagaCorp is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. It's great to see that NagaCorp insiders own 64% of the company, worth about HK$27b. I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

What Might The Insider Transactions At NagaCorp Tell Us?

It is good to see the recent insider purchase. And the longer term insider transactions also give us confidence. Once you factor in the high insider ownership, it certainly seems like insiders are positive about NagaCorp. One for the watchlist, at least! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing NagaCorp. You'd be interested to know, that we found 1 warning sign for NagaCorp and we suggest you have a look.

But note: NagaCorp may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading NagaCorp or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NagaCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3918

NagaCorp

An investment holding company, manages and operates a hotel and casino complex in the Kingdom of Cambodia.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives