- Hong Kong

- /

- Hospitality

- /

- SEHK:341

Café de Coral Holdings' (HKG:341) Upcoming Dividend Will Be Larger Than Last Year's

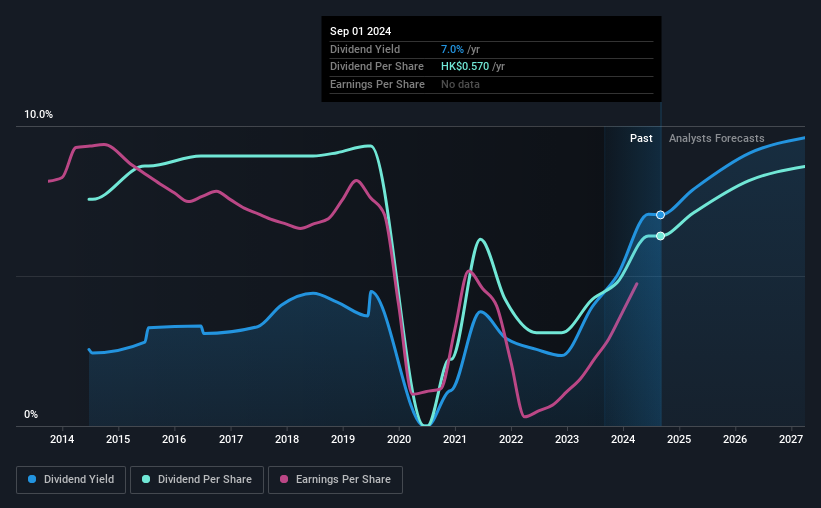

Café de Coral Holdings Limited's (HKG:341) dividend will be increasing from last year's payment of the same period to HK$0.42 on 24th of September. This will take the annual payment to 7.0% of the stock price, which is above what most companies in the industry pay.

View our latest analysis for Café de Coral Holdings

Café de Coral Holdings' Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, the company was paying out 100% of what it was earning, however the dividend was quite comfortably covered by free cash flows at a cash payout ratio of only 24%. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Looking forward, earnings per share is forecast to rise by 47.6% over the next year. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 62% which brings it into quite a comfortable range.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2014, the annual payment back then was HK$0.68, compared to the most recent full-year payment of HK$0.57. The dividend has shrunk at around 1.7% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Over the past five years, it looks as though Café de Coral Holdings' EPS has declined at around 10% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

Café de Coral Holdings' Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Café de Coral Holdings' payments are rock solid. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 1 warning sign for Café de Coral Holdings that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:341

Café de Coral Holdings

An investment holding company, engages in the operation of quick service restaurants and casual dining chains in Hong Kong and Mainland China.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.