- China

- /

- Construction

- /

- SHSE:603183

Asian Market Insights: Fenbi And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and geopolitical uncertainties, investors are increasingly looking for opportunities in diverse regions such as Asia. Penny stocks, a term that may seem outdated but remains relevant, often represent smaller or newer companies that can offer unique growth prospects. By focusing on those with robust financials and clear growth trajectories, investors can uncover potential value in these under-the-radar opportunities.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.92 | HK$2.38B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.61 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.29 | SGD522.82M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.70 | THB2.82B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.093 | SGD48.69M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.26 | SGD12.83B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.10 | HK$3.17B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.98 | NZ$139.5M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.50 | THB9.09B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 958 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Fenbi (SEHK:2469)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fenbi Ltd. is an investment holding company offering non-formal vocational education and training services in the People's Republic of China, with a market cap of HK$6.42 billion.

Operations: The company generates revenue primarily from Tutoring Services amounting to CN¥2.26 billion and Sales of books and others totaling CN¥525.85 million.

Market Cap: HK$6.42B

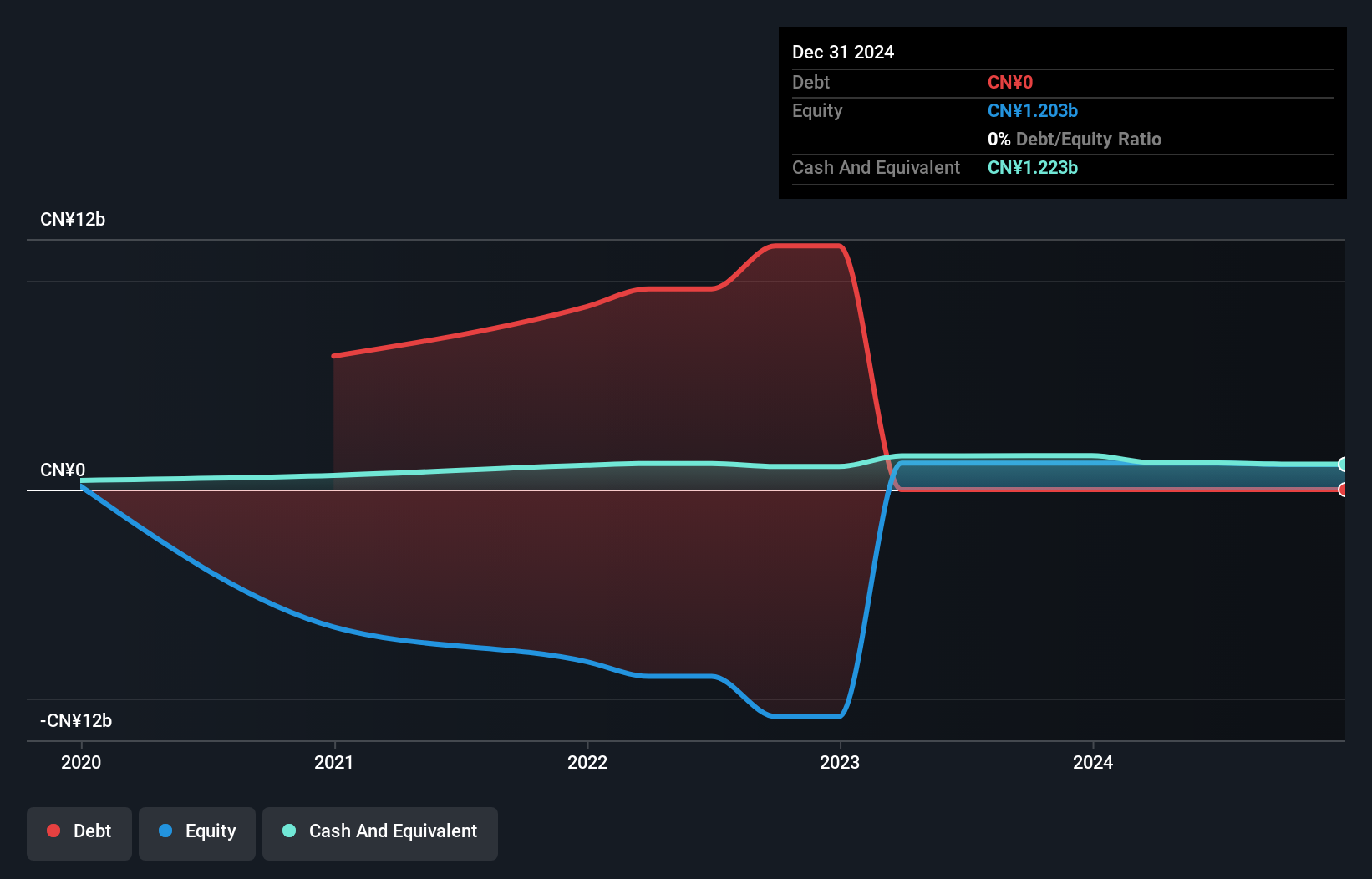

Fenbi Ltd., an investment holding company in China, faces challenges typical of penny stocks, such as fluctuating earnings and competitive pressures. The company reported a decline in revenue to CN¥1.49 billion and net income to CN¥226.65 million for the first half of 2025 compared to the previous year, highlighting intense competition in its tutoring services sector. Despite these challenges, Fenbi remains debt-free with strong short-term asset coverage over liabilities and forecasts a 26.42% annual earnings growth rate. Recent executive changes may influence corporate strategy moving forward, with no significant shareholder dilution observed recently.

- Click here and access our complete financial health analysis report to understand the dynamics of Fenbi.

- Assess Fenbi's future earnings estimates with our detailed growth reports.

China Travel International Investment Hong Kong (SEHK:308)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Travel International Investment Hong Kong Limited operates in the travel and tourism sector with a market capitalization of approximately HK$9.25 billion.

Operations: The company's revenue is primarily derived from Tourist Attraction and Related Operations at HK$2.18 billion, Passenger Transportation Operations at HK$1.07 billion, Hotel Operations at HK$882.15 million, and Travel Document and Related Operations at HK$310.78 million.

Market Cap: HK$9.25B

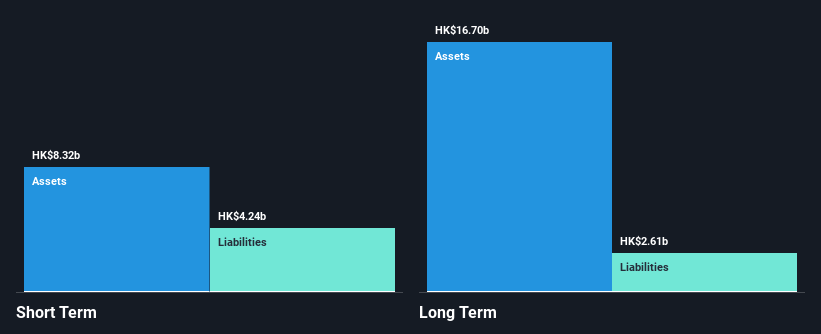

China Travel International Investment Hong Kong Limited, operating in the travel and tourism sector, recently reported a net loss of HK$86.85 million for H1 2025, contrasting with a profit in the previous year. The company's revenue streams include Tourist Attraction Operations (HK$2.18 billion) and Passenger Transportation (HK$1.07 billion). Despite being unprofitable, it maintains more cash than its total debt and has strong short-term asset coverage over liabilities. Recent board changes may impact governance as new leadership takes charge amid decreased earnings due to market volatility affecting investment property values. Earnings are forecast to grow significantly annually despite current challenges.

- Get an in-depth perspective on China Travel International Investment Hong Kong's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into China Travel International Investment Hong Kong's future.

Suzhou Institute of Building Science GroupLtd (SHSE:603183)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Suzhou Institute of Building Science Group Co., Ltd operates in the construction industry in China with a market cap of CN¥2.28 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥863.04 million.

Market Cap: CN¥2.28B

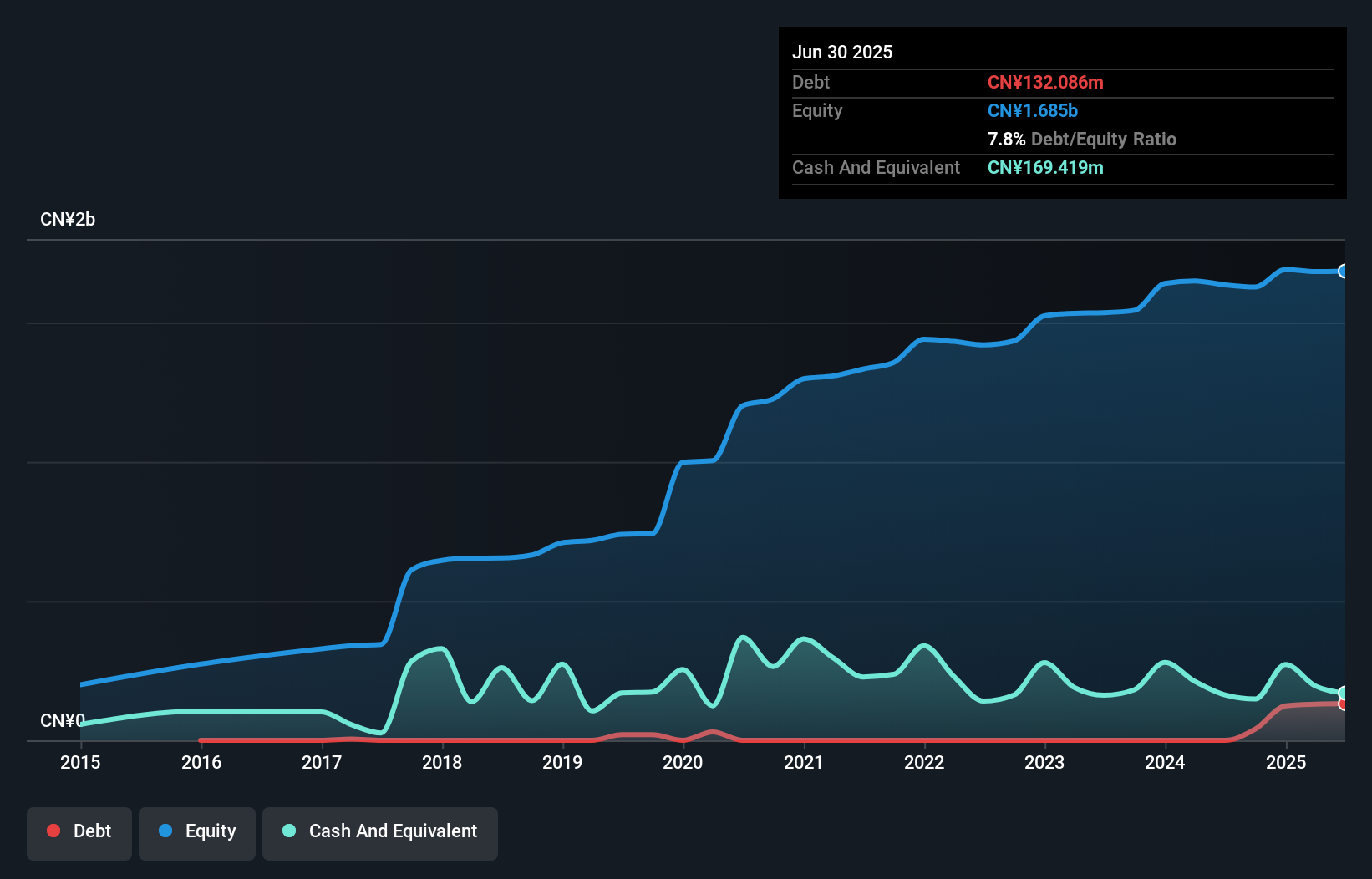

Suzhou Institute of Building Science Group Co., Ltd, operating in China's construction industry, reported a decrease in revenue to CN¥324.11 million for H1 2025 compared to the previous year. Despite this, the company maintains strong financial health with short-term assets exceeding liabilities and cash surpassing total debt. However, earnings have declined by 9.2% annually over five years and profit margins dropped from 11.5% to 5.2%. The company's board lacks experience with an average tenure of 1.7 years, potentially impacting strategic direction amid challenges like negative earnings growth and low return on equity at 3%.

- Dive into the specifics of Suzhou Institute of Building Science GroupLtd here with our thorough balance sheet health report.

- Gain insights into Suzhou Institute of Building Science GroupLtd's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Investigate our full lineup of 958 Asian Penny Stocks right here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603183

Suzhou Institute of Building Science GroupLtd

Operates in the construction industry in China.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives