- Hong Kong

- /

- Consumer Services

- /

- SEHK:2779

Earnings Working Against China Xinhua Education Group Limited's (HKG:2779) Share Price Following 26% Dive

China Xinhua Education Group Limited (HKG:2779) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 27% in that time.

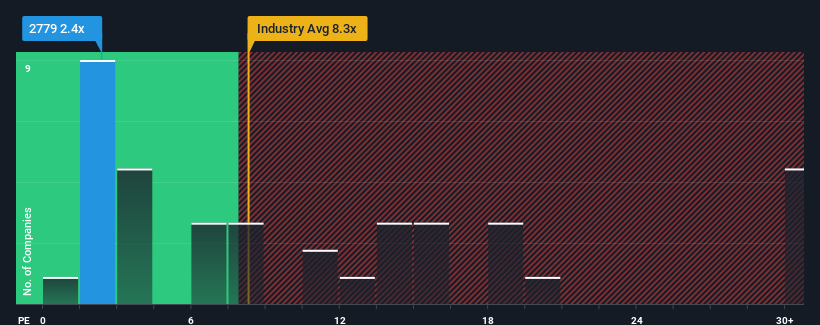

Even after such a large drop in price, China Xinhua Education Group's price-to-earnings (or "P/E") ratio of 2.4x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 11x and even P/E's above 21x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for China Xinhua Education Group recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for China Xinhua Education Group

Is There Any Growth For China Xinhua Education Group?

There's an inherent assumption that a company should far underperform the market for P/E ratios like China Xinhua Education Group's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 7.5%. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 6.8% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 18% shows it's an unpleasant look.

With this information, we are not surprised that China Xinhua Education Group is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Shares in China Xinhua Education Group have plummeted and its P/E is now low enough to touch the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that China Xinhua Education Group maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for China Xinhua Education Group with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade China Xinhua Education Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2779

China Xinhua Education Group

Provides higher and secondary vocational education services in the People's Republic of China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives