- Hong Kong

- /

- Hospitality

- /

- SEHK:2555

Asian Growth Companies With Strong Insider Ownership In May 2025

Reviewed by Simply Wall St

In May 2025, the Asian markets are experiencing a wave of optimism following the U.S.-China agreement to pause tariffs, which has provided a much-needed boost to investor sentiment across the region. Amidst this backdrop, companies with strong insider ownership often stand out as promising opportunities, as they suggest a high level of confidence from those closest to the business in navigating such evolving economic landscapes.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Schooinc (TSE:264A) | 26.6% | 68.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.1% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 85.9% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| giftee (TSE:4449) | 34.5% | 63.7% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Let's take a closer look at a couple of our picks from the screened companies.

Sichuan Baicha Baidao Industrial (SEHK:2555)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Baicha Baidao Industrial Co., Ltd. is an investment holding company that offers tea drink products in the People’s Republic of China, with a market cap of HK$17.08 billion.

Operations: The company generates revenue from its food processing segment, amounting to CN¥4.92 billion.

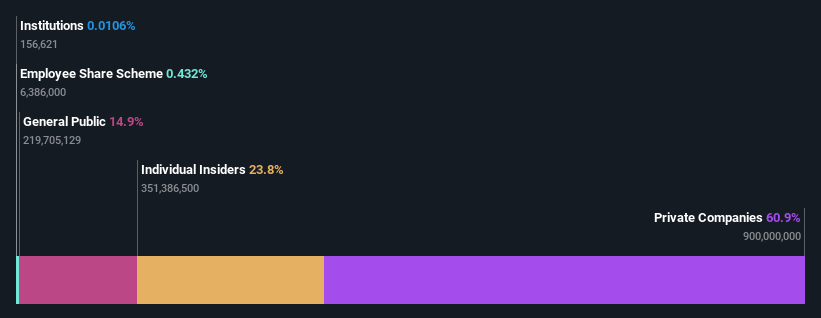

Insider Ownership: 23.8%

Earnings Growth Forecast: 22.6% p.a.

Sichuan Baicha Baidao Industrial's earnings are forecast to grow significantly at 22.6% annually, outpacing the Hong Kong market's average. Despite recent declines in sales and net income, with sales dropping to CNY 4.92 billion from CNY 5.70 billion and net income falling to CNY 472.18 million from CNY 1.14 billion year-over-year, the company maintains a high future return on equity forecast of 24.2%. No substantial insider trading activity was reported recently.

- Delve into the full analysis future growth report here for a deeper understanding of Sichuan Baicha Baidao Industrial.

- According our valuation report, there's an indication that Sichuan Baicha Baidao Industrial's share price might be on the expensive side.

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions in the United States, Mainland China, and internationally, with a market cap of HK$8.80 billion.

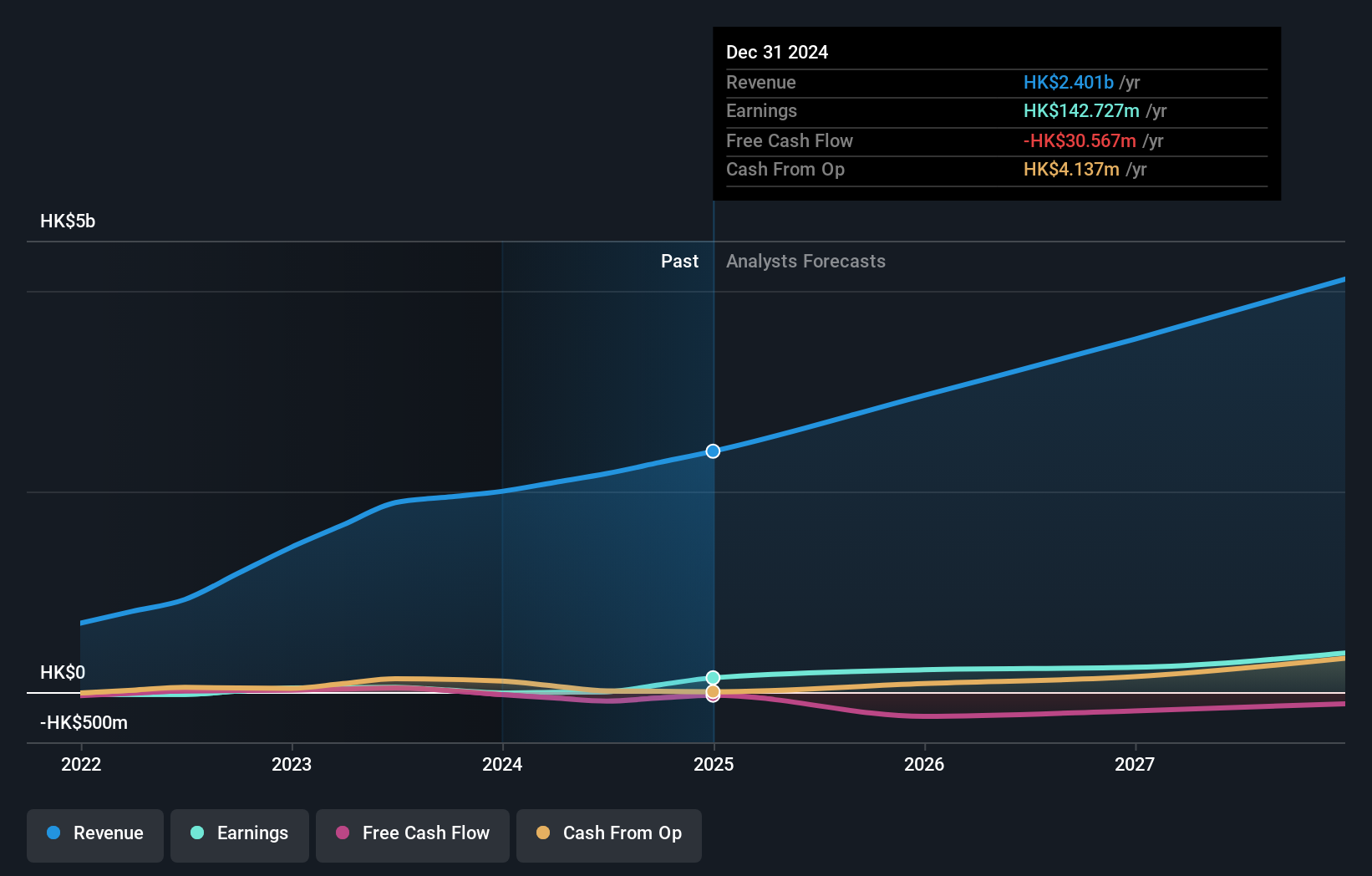

Operations: The company's revenue segment primarily comprises HK$2.40 billion from its software as a service offerings focused on digital content asset protection and transactions across various regions including the United States and Mainland China.

Insider Ownership: 23.1%

Earnings Growth Forecast: 28.5% p.a.

Vobile Group's earnings are expected to grow significantly at 28.55% annually, surpassing the Hong Kong market average. The company recently achieved profitability with net income of HK$142.73 million, a turnaround from the previous year's loss. Despite high share price volatility, Vobile's revenue growth forecast of 17.4% per year exceeds market expectations. Recent private placements raised HK$152 million through convertible bonds, supporting future expansion and innovation initiatives like the AI-powered DreamMaker platform for content creators.

- Get an in-depth perspective on Vobile Group's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Vobile Group's share price might be too optimistic.

SICC (SHSE:688234)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SICC Co., Ltd. focuses on the research, development, production, and sale of silicon carbide semiconductor materials both in China and internationally, with a market cap of CN¥25.61 billion.

Operations: The company generates revenue of CN¥1.75 billion from its semiconductor material segment.

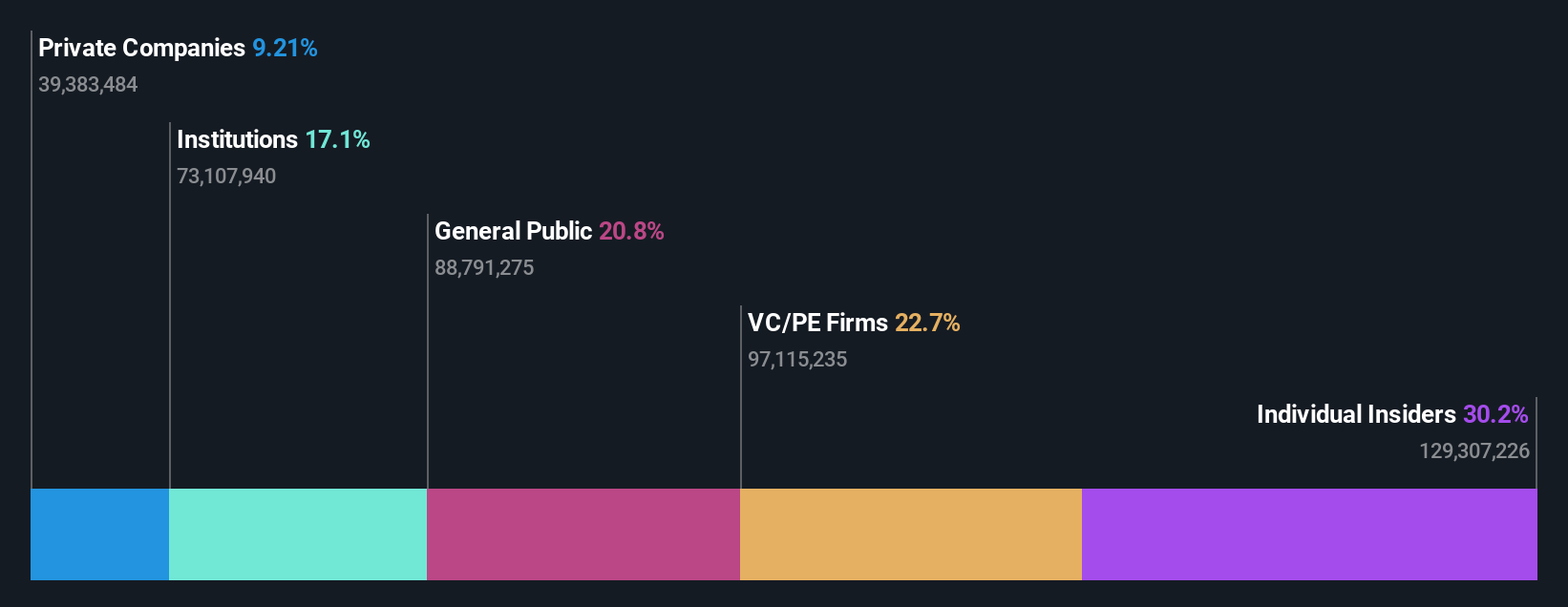

Insider Ownership: 30.2%

Earnings Growth Forecast: 36% p.a.

SICC's earnings are projected to grow significantly at 36% annually, outpacing the Chinese market average. Despite a recent dip in Q1 net income to CNY 8.52 million from CNY 46.1 million, SICC's revenue growth forecast of 22.4% per year remains strong compared to market expectations. The company reported substantial annual sales growth last year and achieved profitability with CNY 180.46 million in net income, highlighting its potential for sustained expansion despite recent volatility.

- Click here to discover the nuances of SICC with our detailed analytical future growth report.

- Our valuation report unveils the possibility SICC's shares may be trading at a premium.

Key Takeaways

- Click this link to deep-dive into the 625 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Searching for a Fresh Perspective? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 23 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2555

Sichuan Baicha Baidao Industrial

An investment holding company, provides tea drink products in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives