- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:1322

3 Growth Companies With High Insider Ownership And 41% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic data, investors are increasingly focusing on growth stocks that demonstrate resilience and potential. In this environment, companies with high insider ownership can be particularly appealing, as they often signal strong alignment between management and shareholder interests—an important consideration when seeking robust earnings growth despite broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

Let's review some notable picks from our screened stocks.

Grupo Rotoplas. de (BMV:AGUA *)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grupo Rotoplas S.A.B. de C.V. operates in Mexico, Argentina, the United States and internationally, focusing on manufacturing, purchasing, selling and installing plastic containers and accessories for water storage and solutions with a market cap of MX$7.67 billion.

Operations: The company generates revenue from two main segments: Individual Solutions, contributing MX$11.05 billion, and Comprehensive Solutions, contributing MX$803.32 million.

Insider Ownership: 37.9%

Earnings Growth Forecast: 16.7% p.a.

Grupo Rotoplas demonstrates potential as a growth company with high insider ownership, despite recent financial challenges. The company reported a net loss for Q3 2024, but nine-month earnings improved to MXN 291 million from MXN 241 million the previous year. Revenue is forecasted to grow at 9.9% annually, outpacing the Mexican market's average. However, its dividend coverage is weak and interest payments are not well covered by earnings, indicating some financial constraints.

- Unlock comprehensive insights into our analysis of Grupo Rotoplas. de stock in this growth report.

- In light of our recent valuation report, it seems possible that Grupo Rotoplas. de is trading behind its estimated value.

Al Masane Al Kobra Mining (SASE:1322)

Simply Wall St Growth Rating: ★★★★★☆

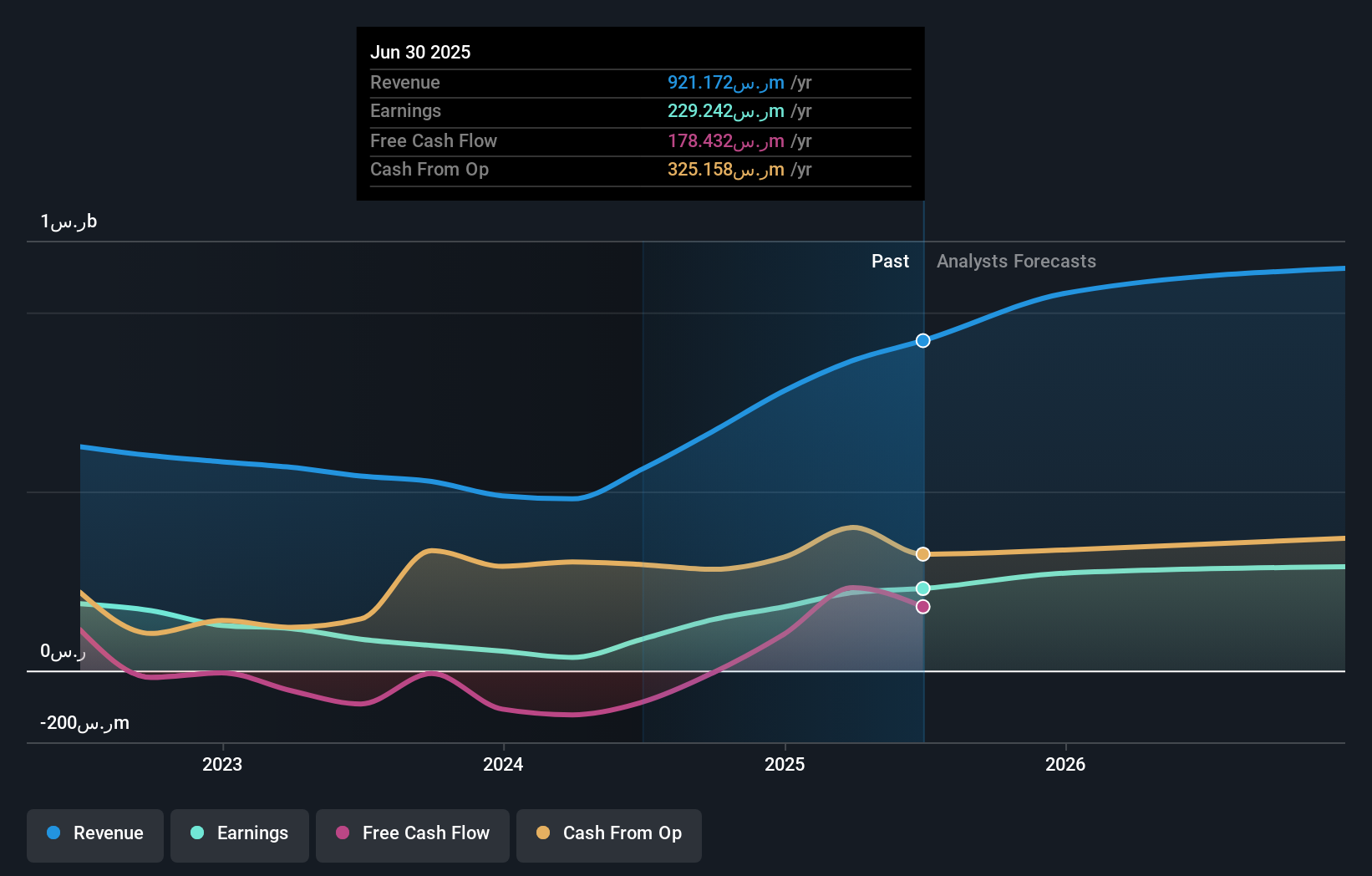

Overview: Al Masane Al Kobra Mining Company operates in the Kingdom of Saudi Arabia, focusing on the production of non-ferrous metal ores and precious metals, with a market capitalization of SAR6.03 billion.

Operations: The company's revenue is primarily derived from the Al Masane Mine, contributing SAR353.54 million, and the Mount Guyan Mine, contributing SAR190.02 million.

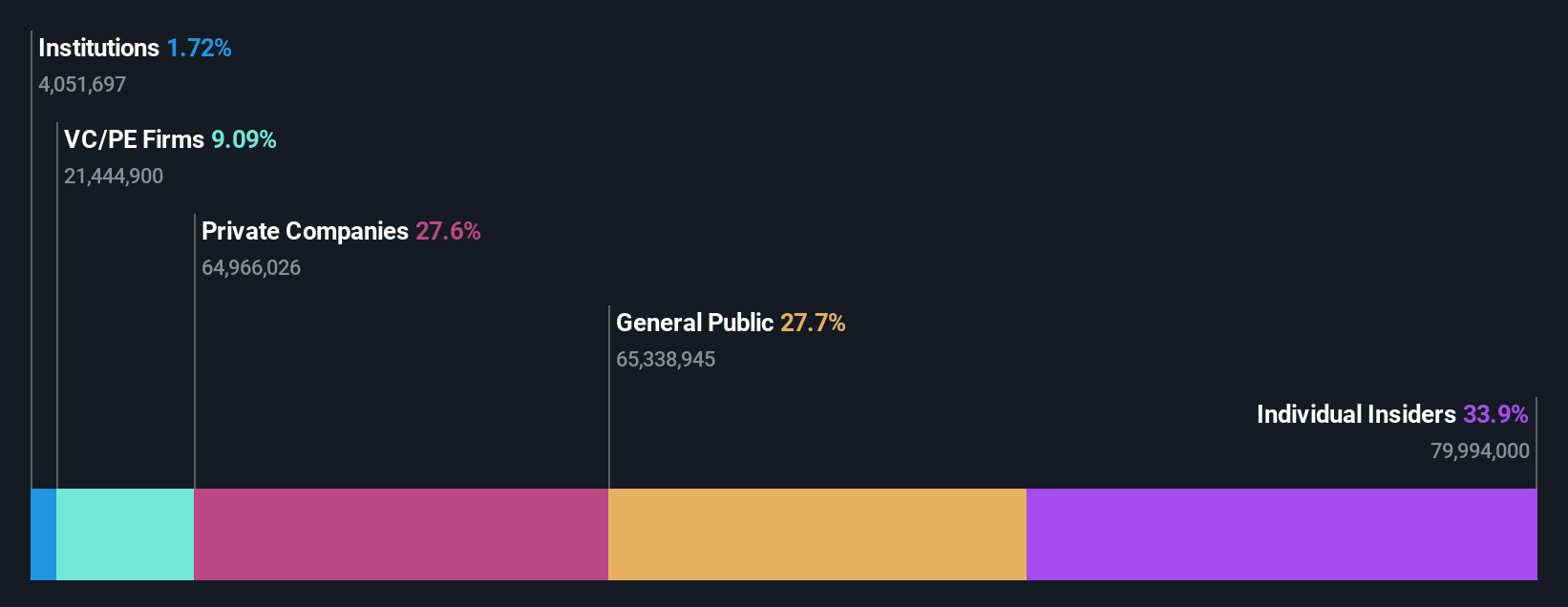

Insider Ownership: 12.8%

Earnings Growth Forecast: 41.4% p.a.

Al Masane Al Kobra Mining is experiencing substantial growth, with earnings forecasted to rise significantly at 41.4% annually, outpacing the South African market. Recent Q3 results showed a remarkable increase in sales to SAR 215.96 million and net income of SAR 59.75 million, indicating strong performance momentum. However, its dividend yield of 2.31% is not well supported by free cash flows, suggesting potential limitations in financial flexibility despite impressive revenue growth projections of over 23% annually.

- Click here and access our complete growth analysis report to understand the dynamics of Al Masane Al Kobra Mining.

- Upon reviewing our latest valuation report, Al Masane Al Kobra Mining's share price might be too optimistic.

Beauty Farm Medical and Health Industry (SEHK:2373)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beauty Farm Medical and Health Industry Inc. operates in the beauty and health sector, focusing on medical cosmetology services, with a market cap of HK$4.04 billion.

Operations: The company's revenue segments include CN¥851.81 million from Aesthetic Medical Services, CN¥125.69 million from Subhealth Medical Services, CN¥1.14 billion from Beauty and Wellness Services - Direct Stores, and CN¥131.48 million from Beauty and Wellness Services - Franchisee and Others.

Insider Ownership: 33.9%

Earnings Growth Forecast: 20.2% p.a.

Beauty Farm Medical and Health Industry is poised for growth, with earnings projected to increase by 20.18% annually, surpassing the Hong Kong market's average. Revenue growth is also expected to outpace the market at 18.7% per year. The company trades at a significant discount, estimated at 61% below its fair value, and boasts a high forecasted return on equity of 28.6%. There has been no substantial insider trading activity recently.

- Delve into the full analysis future growth report here for a deeper understanding of Beauty Farm Medical and Health Industry.

- The analysis detailed in our Beauty Farm Medical and Health Industry valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1507 Fast Growing Companies With High Insider Ownership here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1322

Al Masane Al Kobra Mining

Engages in the production of non-ferrous metal ores and precious metals in Kingdom of Saudi Arabia.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives