- Hong Kong

- /

- Diversified Financial

- /

- SEHK:2598

3 Growth Companies On SEHK With Insider Ownership And Up To 95 Percent Earnings Growth

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic shifts and policy changes, Hong Kong's stock market has faced its own challenges, with the Hang Seng Index recently experiencing a significant decline. In this environment, identifying growth companies with substantial insider ownership can offer insights into potential resilience and confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Akeso (SEHK:9926) | 20.5% | 53% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| DPC Dash (SEHK:1405) | 38.1% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.4% | 93.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 69.7% |

| MicroTech Medical (Hangzhou) (SEHK:2235) | 25.8% | 105% |

Let's take a closer look at a couple of our picks from the screened companies.

Beauty Farm Medical and Health Industry (SEHK:2373)

Simply Wall St Growth Rating: ★★★★★☆

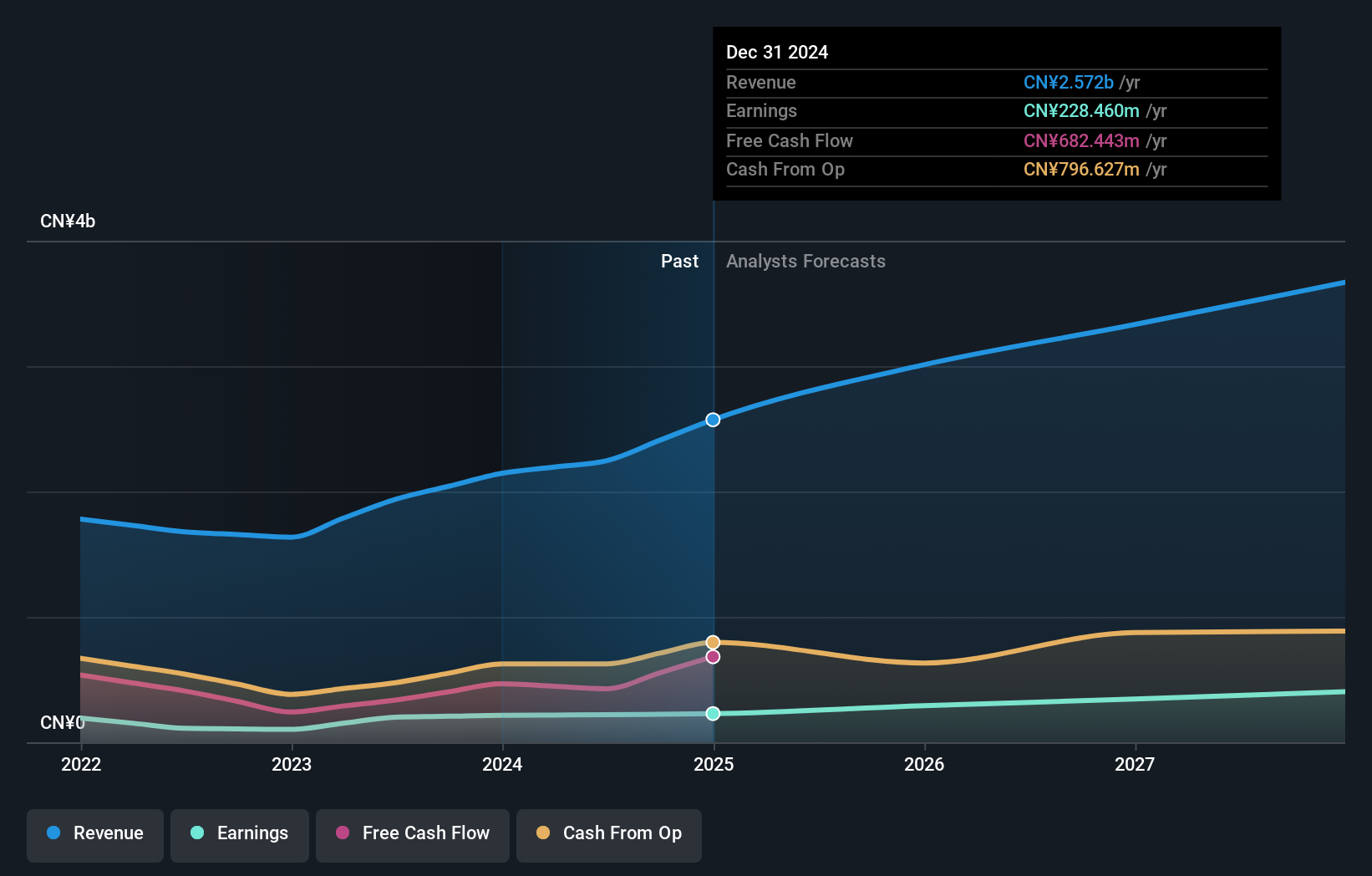

Overview: Beauty Farm Medical and Health Industry Inc. operates in the beauty and health sector, focusing on providing medical aesthetic services, with a market cap of approximately HK$4.05 billion.

Operations: The company's revenue segments include CN¥851.81 million from Aesthetic Medical Services, CN¥125.69 million from Subhealth Medical Services, CN¥1.14 billion from Beauty and Wellness Services - Direct Stores, and CN¥131.48 million from Beauty and Wellness Services - Franchisee and Others.

Insider Ownership: 33.9%

Earnings Growth Forecast: 20.2% p.a.

Beauty Farm Medical and Health Industry is experiencing robust growth, with earnings forecasted to grow significantly at 20.2% annually, outpacing the Hong Kong market. Recent half-year results show sales of CNY 1.14 billion and net income of CNY 115.42 million, reflecting steady year-on-year growth. Despite no recent insider trading activity, the company benefits from strong insider ownership and strategic board changes, including the appointment of Mr. Hu Tenghe as a non-executive director with extensive capital markets experience.

- Click to explore a detailed breakdown of our findings in Beauty Farm Medical and Health Industry's earnings growth report.

- Our valuation report unveils the possibility Beauty Farm Medical and Health Industry's shares may be trading at a premium.

Lianlian DigiTech (SEHK:2598)

Simply Wall St Growth Rating: ★★★★★☆

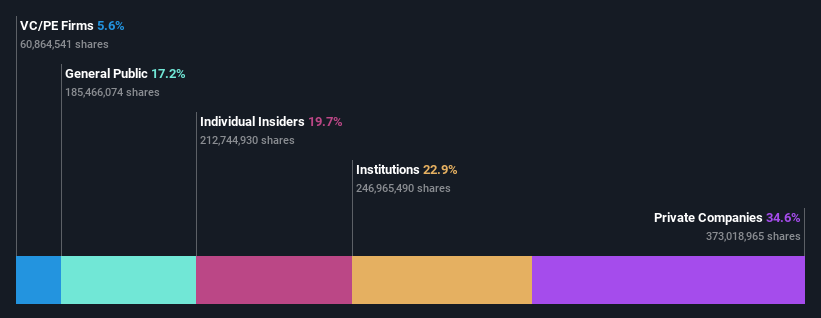

Overview: Lianlian DigiTech Co., Ltd. offers digital payment and value-added services to small and midsized merchants and enterprises in China, with a market cap of HK$10.59 billion.

Operations: The company's revenue is derived from Global Payment (CN¥722.95 million), Domestic Payment (CN¥309.92 million), and Value-Added Services (CN¥153.01 million).

Insider Ownership: 19.7%

Earnings Growth Forecast: 95.7% p.a.

Lianlian DigiTech is poised for substantial growth, with revenue expected to rise 22.3% annually, surpassing the Hong Kong market average. Despite reporting a net loss of CNY 351.29 million for H1 2024, this marks an improvement from the previous year. The company anticipates becoming profitable within three years, indicating above-average market growth potential. No significant insider trading activity has been recorded recently, but high insider ownership suggests alignment with shareholder interests.

- Click here to discover the nuances of Lianlian DigiTech with our detailed analytical future growth report.

- Our expertly prepared valuation report Lianlian DigiTech implies its share price may be too high.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★☆

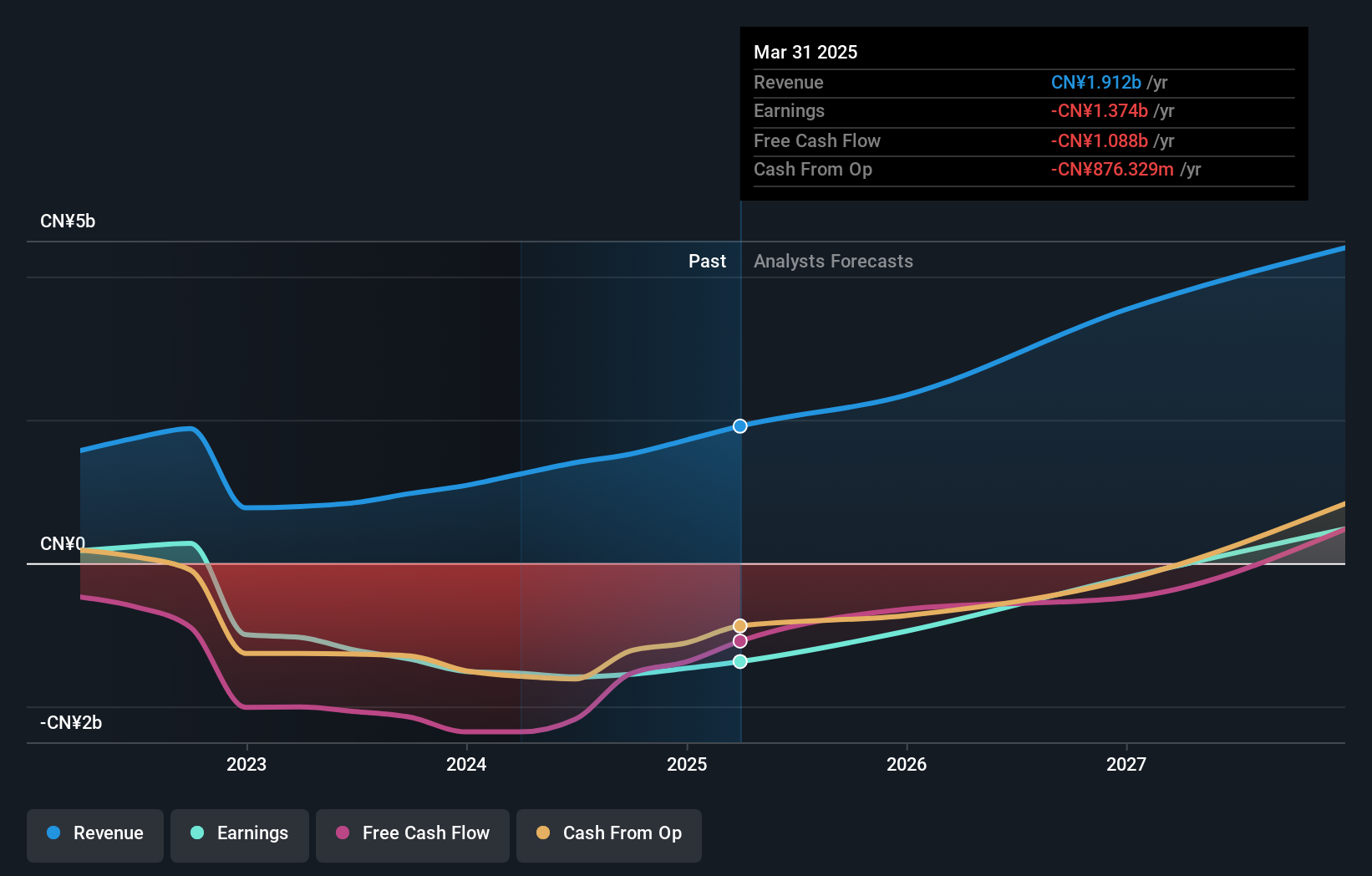

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on discovering, developing, and commercializing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of approximately HK$14.76 billion.

Operations: The company's revenue from its biopharmaceutical research, service, production, and sales segment totals CN¥1.40 billion.

Insider Ownership: 15.9%

Earnings Growth Forecast: 52.2% p.a.

RemeGen's revenue is forecasted to grow at 26.3% annually, outpacing the Hong Kong market. Despite a net loss of CNY 780.46 million for H1 2024, its innovative drug telitacicept shows promise in treating autoimmune diseases globally, with recent approvals in China and ongoing trials in the U.S. High insider ownership aligns management with shareholder interests, though financial stability remains a concern due to limited cash runway and volatile share prices.

- Dive into the specifics of RemeGen here with our thorough growth forecast report.

- The analysis detailed in our RemeGen valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Access the full spectrum of 47 Fast Growing SEHK Companies With High Insider Ownership by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2598

Lianlian DigiTech

Provides digital payment services and value-added services to small and midsized merchants and enterprises in China.

Reasonable growth potential with adequate balance sheet.