3 SEHK Growth Stocks With High Insider Ownership Expecting Up To 55% Earnings Growth

Reviewed by Simply Wall St

The Hong Kong market has been experiencing mixed performance, with the Hang Seng Index declining by 0.45% amid weak manufacturing data and cautious investor sentiment. Despite these challenges, growth companies with high insider ownership can offer promising opportunities for investors looking to capitalize on robust earnings potential. In this article, we will explore three SEHK growth stocks that are not only demonstrating strong earnings growth expectations but also benefit from significant insider ownership, which often aligns management interests with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| iDreamSky Technology Holdings (SEHK:1119) | 18.8% | 104.1% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

| Fenbi (SEHK:2469) | 31.1% | 42.8% |

| Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 79.3% |

| DPC Dash (SEHK:1405) | 38.2% | 91.4% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

| Ocumension Therapeutics (SEHK:1477) | 23.3% | 93.7% |

| Beijing Airdoc Technology (SEHK:2251) | 28.6% | 83.9% |

Let's uncover some gems from our specialized screener.

SSY Group (SEHK:2005)

Simply Wall St Growth Rating: ★★★★☆☆

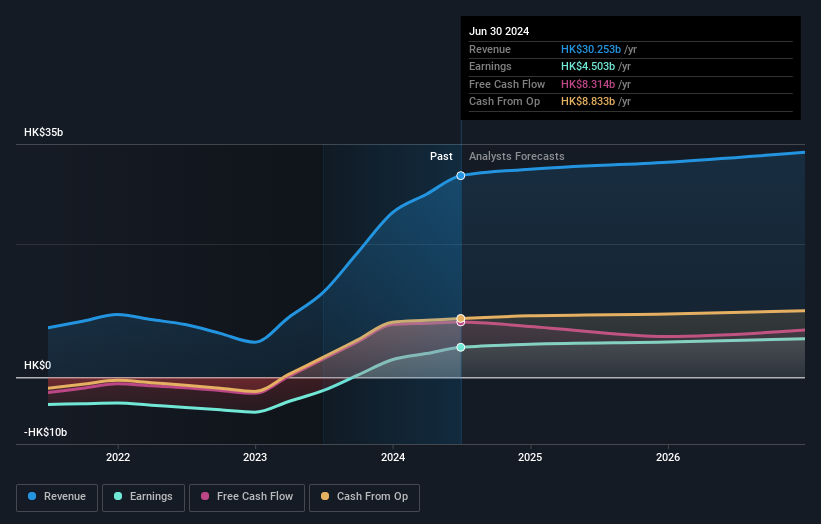

Overview: SSY Group Limited researches, develops, manufactures, trades in, and sells various pharmaceutical products to hospitals and distributors in China and internationally, with a market cap of HK$11.22 billion.

Operations: The company's revenue segments include HK$6.30 billion from Intravenous Infusion Solution and Others, and HK$387.45 million from Medical Materials.

Insider Ownership: 10.4%

Earnings Growth Forecast: 15% p.a.

SSY Group, a growth company with high insider ownership in Hong Kong, is forecast to grow earnings by 15.03% annually, outpacing the Hong Kong market's 11.3%. Trading at 76.2% below its estimated fair value and expected to rise by 64.7%, it has recently secured multiple drug production approvals from China's NMPA, enhancing its portfolio with treatments for Parkinson's disease and depression among others. However, its dividend of 4.5% isn't well covered by free cash flows.

- Take a closer look at SSY Group's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, SSY Group's share price might be too pessimistic.

MGM China Holdings (SEHK:2282)

Simply Wall St Growth Rating: ★★★★☆☆

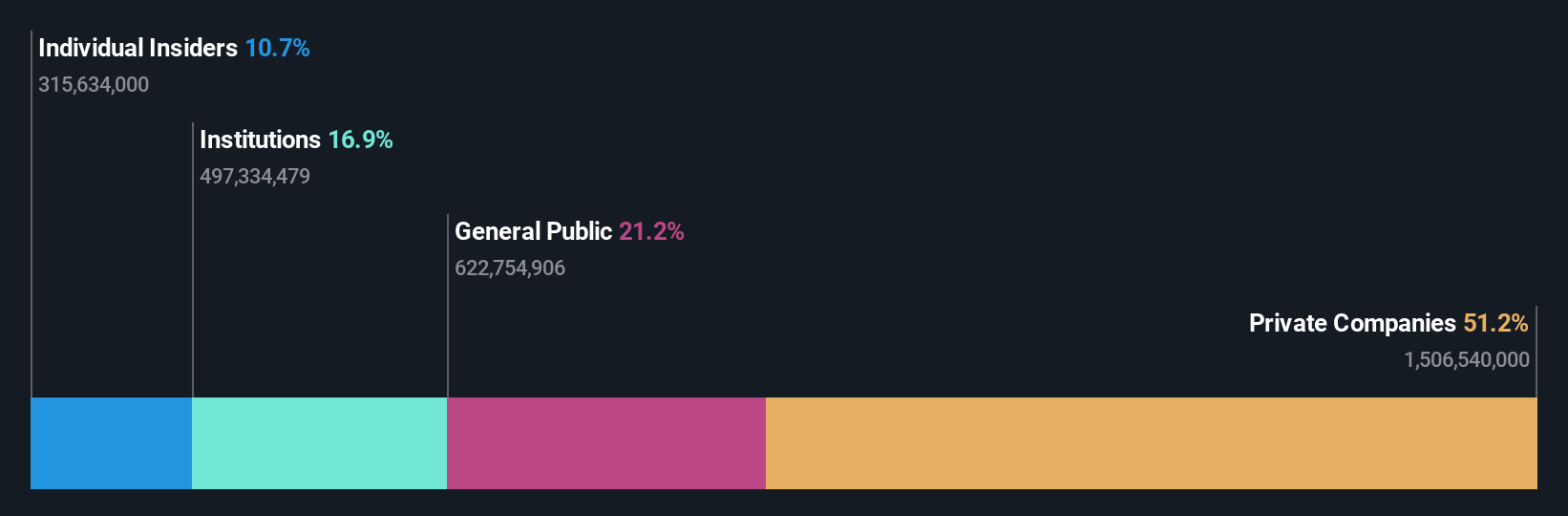

Overview: MGM China Holdings Limited is an investment holding company that develops, owns, and operates gaming and lodging resorts in the Greater China region with a market cap of HK$44.61 billion.

Operations: The company's revenue segments include HK$24.68 billion from Casinos & Resorts.

Insider Ownership: 10%

Earnings Growth Forecast: 18.1% p.a.

MGM China Holdings is forecast to grow earnings at 18.1% annually, faster than the Hong Kong market's 11.3%. Trading at 51.5% below its estimated fair value, analysts expect a price rise of 45.1%. Recent issuance of $500 million in senior notes aims to repay revolving credit debt, improving financial flexibility. The company also commenced share repurchases and declared a final dividend of HK$0.243 per share for FY2023, enhancing shareholder value amidst insider ownership stability.

- Navigate through the intricacies of MGM China Holdings with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that MGM China Holdings' current price could be quite moderate.

Value Partners Group (SEHK:806)

Simply Wall St Growth Rating: ★★★★☆☆

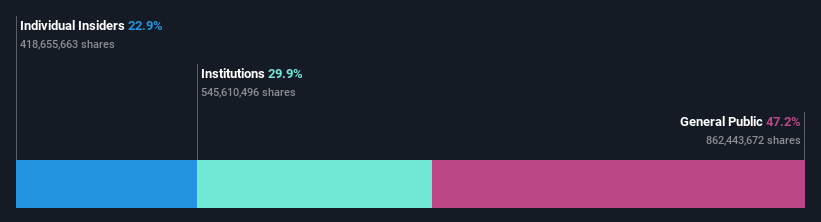

Overview: Value Partners Group Limited is a publicly owned investment manager with a market cap of approximately HK$2.69 billion.

Operations: The company's revenue segment primarily comprises its Asset Management Business, generating HK$575.73 million.

Insider Ownership: 23.4%

Earnings Growth Forecast: 55.9% p.a.

Value Partners Group, a growth company with high insider ownership in Hong Kong, has seen significant insider buying over the past three months. Earnings are forecast to grow 55.92% annually, outpacing the market's 11.3%. Despite recent one-off items affecting financial results and a forecasted low return on equity of 8.8% in three years, revenue is expected to grow at 10.7% per year, faster than the market's 7.4%.

- Delve into the full analysis future growth report here for a deeper understanding of Value Partners Group.

- Our expertly prepared valuation report Value Partners Group implies its share price may be too high.

Summing It All Up

- Delve into our full catalog of 54 Fast Growing SEHK Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2005

SSY Group

An investment holding company, researches, develops, manufactures, trades in, and sells various pharmaceutical products to hospitals and distributors in the People’s Republic of China and internationally.

Solid track record with excellent balance sheet.