- Hong Kong

- /

- Hospitality

- /

- SEHK:219

Here's Why Shareholders Should Examine Shun Ho Property Investments Limited's (HKG:219) CEO Compensation Package More Closely

Key Insights

- Shun Ho Property Investments' Annual General Meeting to take place on 23rd of May

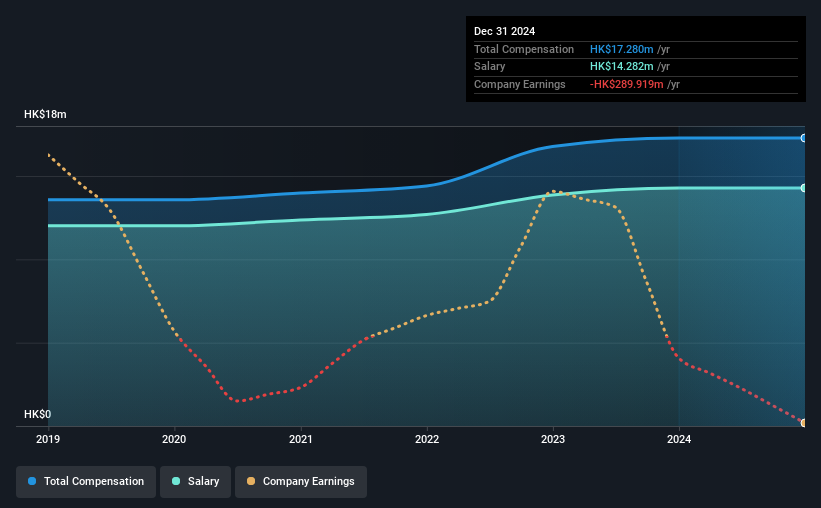

- CEO William Cheng's total compensation includes salary of HK$14.3m

- Total compensation is 620% above industry average

- Shun Ho Property Investments' three-year loss to shareholders was 47% while its EPS was down 72% over the past three years

Shun Ho Property Investments Limited (HKG:219) has not performed well recently and CEO William Cheng will probably need to up their game. At the upcoming AGM on 23rd of May, shareholders can hear from the board including their plans for turning around performance. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Shun Ho Property Investments

How Does Total Compensation For William Cheng Compare With Other Companies In The Industry?

At the time of writing, our data shows that Shun Ho Property Investments Limited has a market capitalization of HK$287m, and reported total annual CEO compensation of HK$17m for the year to December 2024. There was no change in the compensation compared to last year. In particular, the salary of HK$14.3m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Hong Kong Hospitality industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.4m. This suggests that William Cheng is paid more than the median for the industry. Moreover, William Cheng also holds HK$958k worth of Shun Ho Property Investments stock directly under their own name.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$14m | HK$14m | 83% |

| Other | HK$3.0m | HK$3.0m | 17% |

| Total Compensation | HK$17m | HK$17m | 100% |

Speaking on an industry level, nearly 83% of total compensation represents salary, while the remainder of 17% is other remuneration. Although there is a difference in how total compensation is set, Shun Ho Property Investments more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Shun Ho Property Investments Limited's Growth Numbers

Over the last three years, Shun Ho Property Investments Limited has shrunk its earnings per share by 72% per year. In the last year, its revenue is up 13%.

Overall this is not a very positive result for shareholders. There's no doubt that the silver lining is that revenue is up. But it isn't sufficiently fast growth to overlook the fact that EPS has gone backwards over three years. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Shun Ho Property Investments Limited Been A Good Investment?

Few Shun Ho Property Investments Limited shareholders would feel satisfied with the return of -47% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for Shun Ho Property Investments that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:219

Shun Ho Property Investments

An investment holding company, invests in and operates hotels in Hong Kong, the People’s Republic of China, and the United Kingdom.

Good value with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.