- Hong Kong

- /

- Hospitality

- /

- SEHK:2150

Investors Appear Satisfied With Nayuki Holdings Limited's (HKG:2150) Prospects As Shares Rocket 46%

Nayuki Holdings Limited (HKG:2150) shares have had a really impressive month, gaining 46% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 49% over that time.

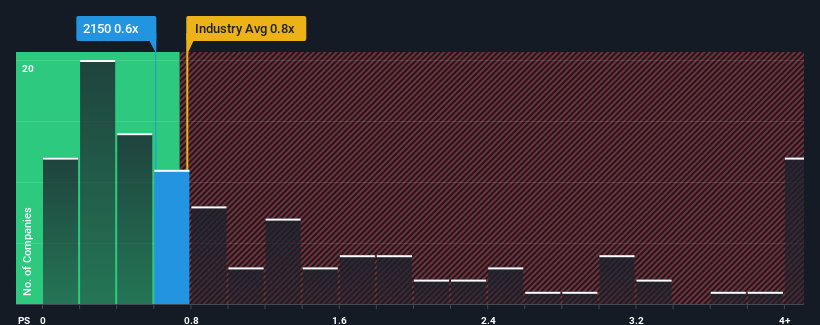

In spite of the firm bounce in price, there still wouldn't be many who think Nayuki Holdings' price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in Hong Kong's Hospitality industry is similar at about 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Nayuki Holdings

What Does Nayuki Holdings' P/S Mean For Shareholders?

Nayuki Holdings could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Nayuki Holdings will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Nayuki Holdings?

Nayuki Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.7%. Revenue has also lifted 28% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 16% as estimated by the analysts watching the company. That's shaping up to be similar to the 17% growth forecast for the broader industry.

With this in mind, it makes sense that Nayuki Holdings' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Nayuki Holdings' P/S Mean For Investors?

Its shares have lifted substantially and now Nayuki Holdings' P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Nayuki Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Hospitality industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Nayuki Holdings with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Nayuki Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Nayuki Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nayuki Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2150

Nayuki Holdings

An investment holding company, operates a chain of teahouses in the People’s Republic of China.

Adequate balance sheet and fair value.

Market Insights

Community Narratives