- Hong Kong

- /

- Hospitality

- /

- SEHK:2097

Asian Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As global markets react to recent interest rate cuts and ongoing trade negotiations, Asia's economic landscape is experiencing a period of adjustment, with China's slowdown and Japan's cautious monetary policy moves drawing attention. In this context, growth companies in Asia with high insider ownership are particularly intriguing, as they often indicate strong confidence from those closest to the business—an appealing trait for investors navigating uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 57.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| M31 Technology (TPEX:6643) | 30.7% | 96.8% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Here's a peek at a few of the choices from the screener.

MIXUE Group (SEHK:2097)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MIXUE Group, with a market cap of HK$61.86 billion, produces and sells fruit drinks, tea drinks, ice cream, and coffee products in Mainland China and internationally.

Operations: The company's revenue segments include Franchise and Related Services at CN¥707.31 million, Sales of Goods at CN¥27.37 billion, and Sales of Equipment at CN¥949.98 million.

Insider Ownership: 28.8%

Earnings Growth Forecast: 14.2% p.a.

MIXUE Group's revenue is forecast to grow at 13.6% annually, outpacing the Hong Kong market's 8.6% growth rate, with earnings expected to rise by 14.2%. It trades at a significant discount to its estimated fair value and offers good relative value compared to peers. Despite no substantial insider trading in recent months, MIXUE was recently added to the S&P Global BMI Index, reflecting its growing market presence and potential appeal for investors seeking growth opportunities in Asia.

- Dive into the specifics of MIXUE Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that MIXUE Group's current price could be quite moderate.

West China Cement (SEHK:2233)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: West China Cement Limited is an investment holding company that manufactures and sells cement and related products in the People’s Republic of China, Mozambique, Ethiopia, the Democratic Republic of Congo, other African countries, and internationally with a market cap of HK$16.93 billion.

Operations: The company generates revenue primarily from two segments: CN¥5.98 billion from the People's Republic of China and CN¥4.19 billion from its overseas operations.

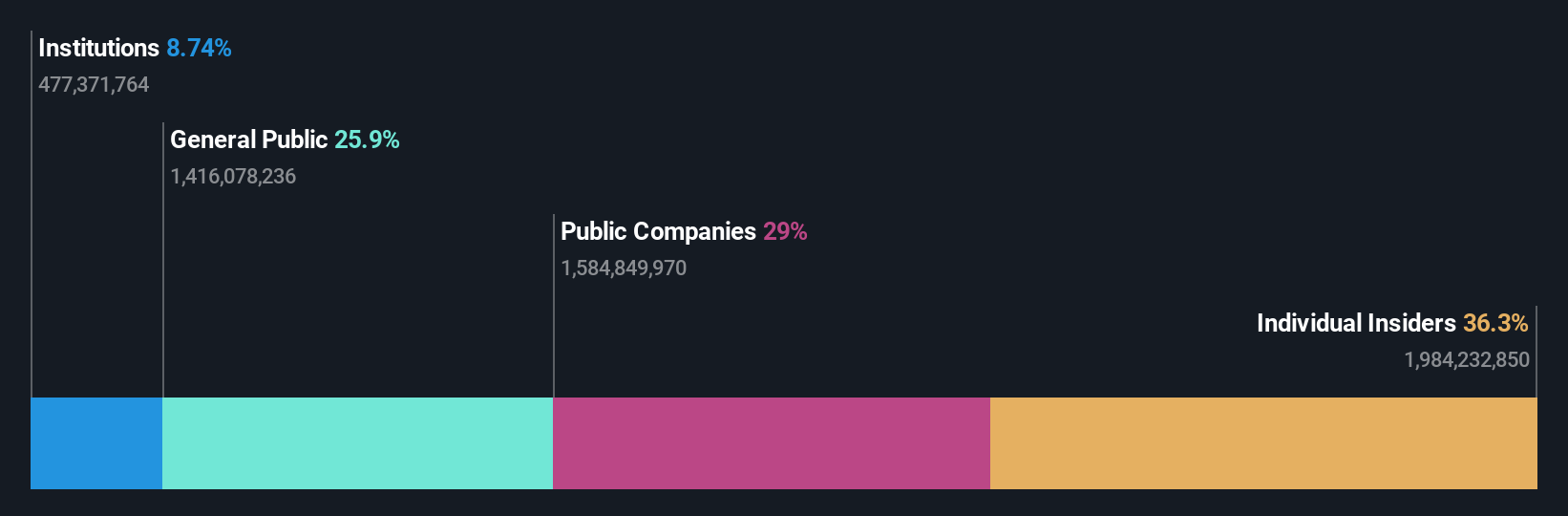

Insider Ownership: 36.3%

Earnings Growth Forecast: 28.2% p.a.

West China Cement's earnings are projected to grow significantly at 28.2% annually, surpassing the Hong Kong market average. Recent financial results show substantial growth, with net income rising to CNY 748.26 million for H1 2025 from CNY 386.88 million a year earlier, driven by increased overseas cement sales and improved margins in China. Despite no recent insider trading activity, the stock trades below its fair value estimate, suggesting potential investment appeal amidst robust profit forecasts.

- Delve into the full analysis future growth report here for a deeper understanding of West China Cement.

- In light of our recent valuation report, it seems possible that West China Cement is trading behind its estimated value.

Tongguan Gold Group (SEHK:340)

Simply Wall St Growth Rating: ★★★★★★

Overview: Tongguan Gold Group Limited is an investment holding company involved in the exploration, mining, processing, smelting, and sale of gold and related products in China with a market cap of approximately HK$10.99 billion.

Operations: The company's revenue is primarily derived from its gold mining operations, which generated HK$1.69 billion.

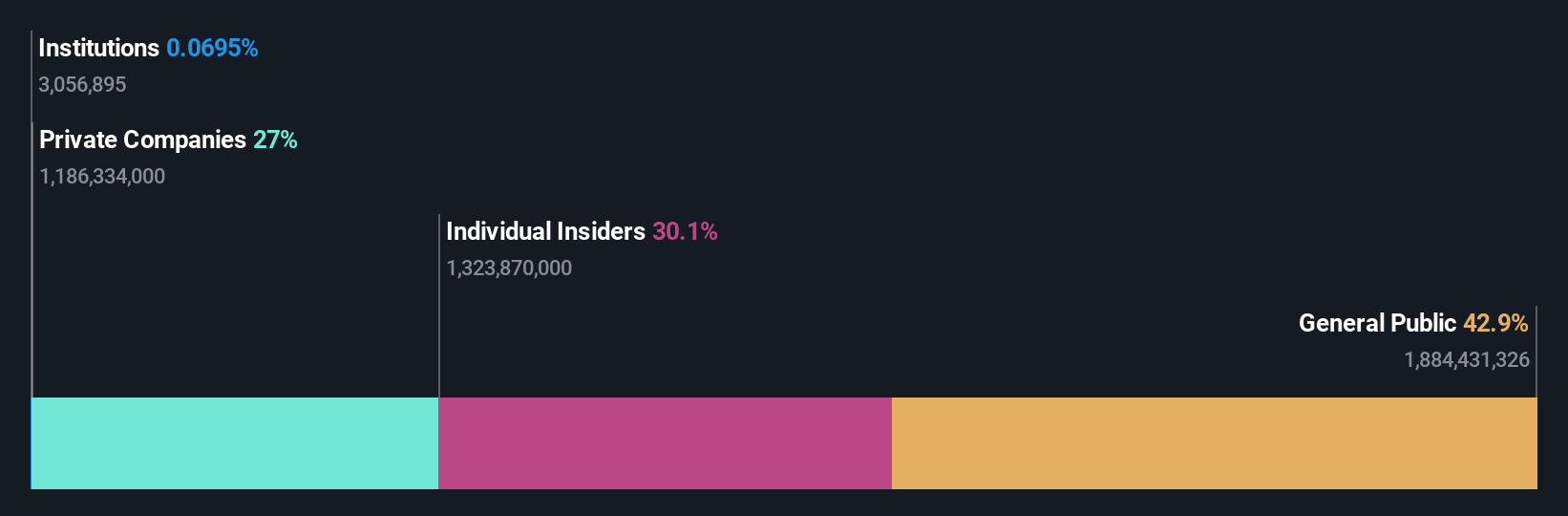

Insider Ownership: 30.1%

Earnings Growth Forecast: 32.1% p.a.

Tongguan Gold Group's earnings are forecast to grow significantly at 32.1% annually, outpacing the Hong Kong market. The company reported a substantial increase in net income for H1 2025, reaching HK$342.64 million from HK$91.96 million a year earlier, driven by higher production and sales of gold. Trading well below its estimated fair value and recently added to the S&P Global BMI Index, it presents potential growth opportunities despite no recent insider trading activity.

- Click to explore a detailed breakdown of our findings in Tongguan Gold Group's earnings growth report.

- Our valuation report here indicates Tongguan Gold Group may be undervalued.

Where To Now?

- Unlock more gems! Our Fast Growing Asian Companies With High Insider Ownership screener has unearthed 612 more companies for you to explore.Click here to unveil our expertly curated list of 615 Fast Growing Asian Companies With High Insider Ownership.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2097

MIXUE Group

Produces and sells fruit drinks, tea drinks, and ice cream and coffee products in Mainland China and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives