- Hong Kong

- /

- Capital Markets

- /

- SEHK:6608

SEHK Stocks That Could Be Trading Below Estimated Value In October 2024

Reviewed by Simply Wall St

As global markets experience varied economic conditions, the Hong Kong market has seen its benchmark Hang Seng Index decline by 6.53% amid waning optimism about Beijing's stimulus measures. In this environment, investors may find opportunities in stocks that are potentially trading below their estimated value, as these could offer a chance to capitalize on mispricings when broader market sentiments shift. Identifying such stocks often involves assessing fundamentals and potential growth prospects relative to current valuations, especially during periods of economic uncertainty or market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| BYD Electronic (International) (SEHK:285) | HK$31.65 | HK$63.09 | 49.8% |

| Giant Biogene Holding (SEHK:2367) | HK$49.95 | HK$97.75 | 48.9% |

| Laopu Gold (SEHK:6181) | HK$156.10 | HK$309.95 | 49.6% |

| Kuaishou Technology (SEHK:1024) | HK$45.30 | HK$88.36 | 48.7% |

| Yadea Group Holdings (SEHK:1585) | HK$11.88 | HK$23.13 | 48.6% |

| CSC Financial (SEHK:6066) | HK$8.68 | HK$17.09 | 49.2% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$10.12 | HK$19.47 | 48% |

| DPC Dash (SEHK:1405) | HK$69.00 | HK$131.26 | 47.4% |

| AK Medical Holdings (SEHK:1789) | HK$4.40 | HK$8.33 | 47.2% |

| Akeso (SEHK:9926) | HK$67.95 | HK$127.64 | 46.8% |

Let's explore several standout options from the results in the screener.

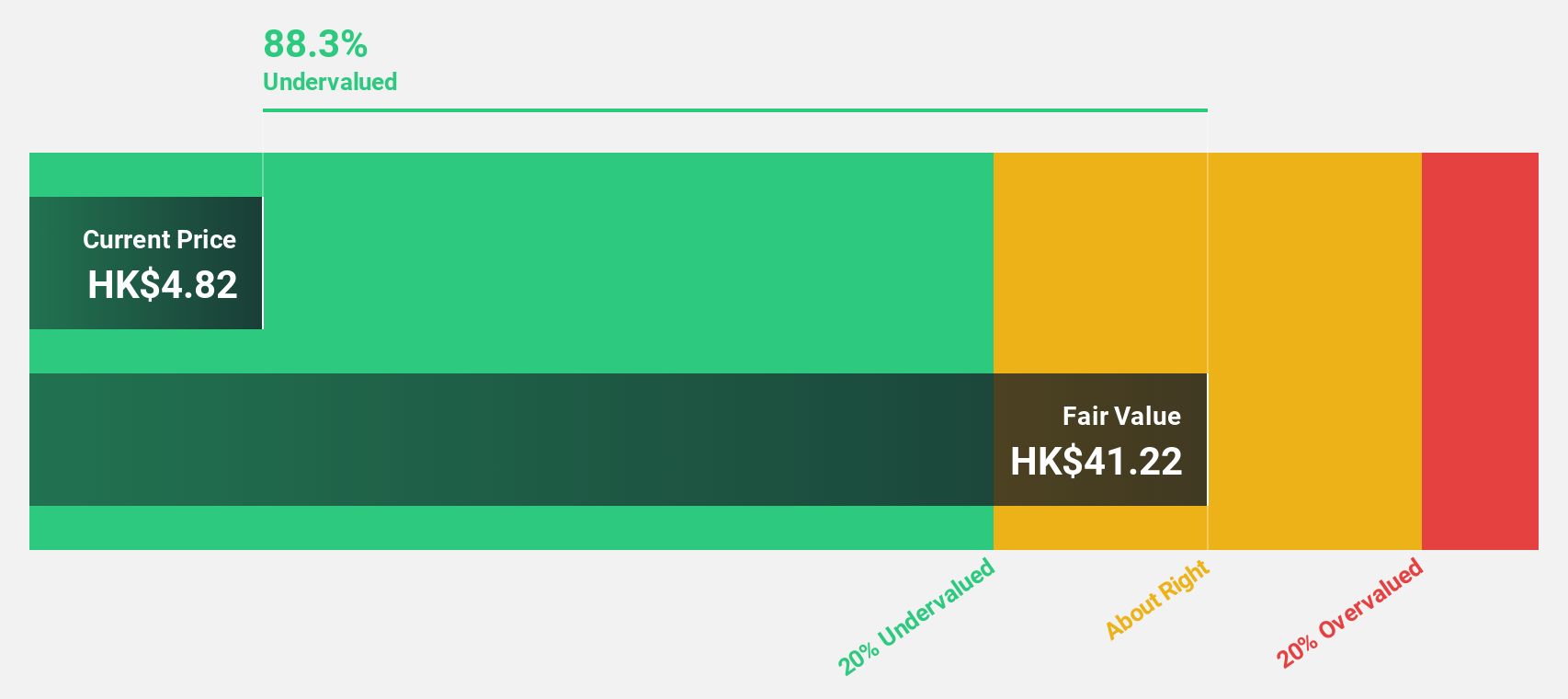

Melco International Development (SEHK:200)

Overview: Melco International Development Limited is an investment holding company operating in the leisure and entertainment sector across Macau, the Philippines, and Cyprus, with a market cap of HK$7.51 billion.

Operations: The company's revenue segments include Casino and Hospitality, generating HK$34.27 billion.

Estimated Discount To Fair Value: 37.4%

Melco International Development's recent earnings report shows a significant reduction in net loss, from HK$733.25 million to HK$253.22 million, indicating improving financial health. The stock trades at 37.4% below its estimated fair value of HK$7.91, suggesting potential undervaluation based on cash flows. Despite revenue growth forecasts lagging behind the market average, the company is expected to achieve profitability within three years and boasts a high future return on equity estimate of 41.3%.

- Insights from our recent growth report point to a promising forecast for Melco International Development's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Melco International Development.

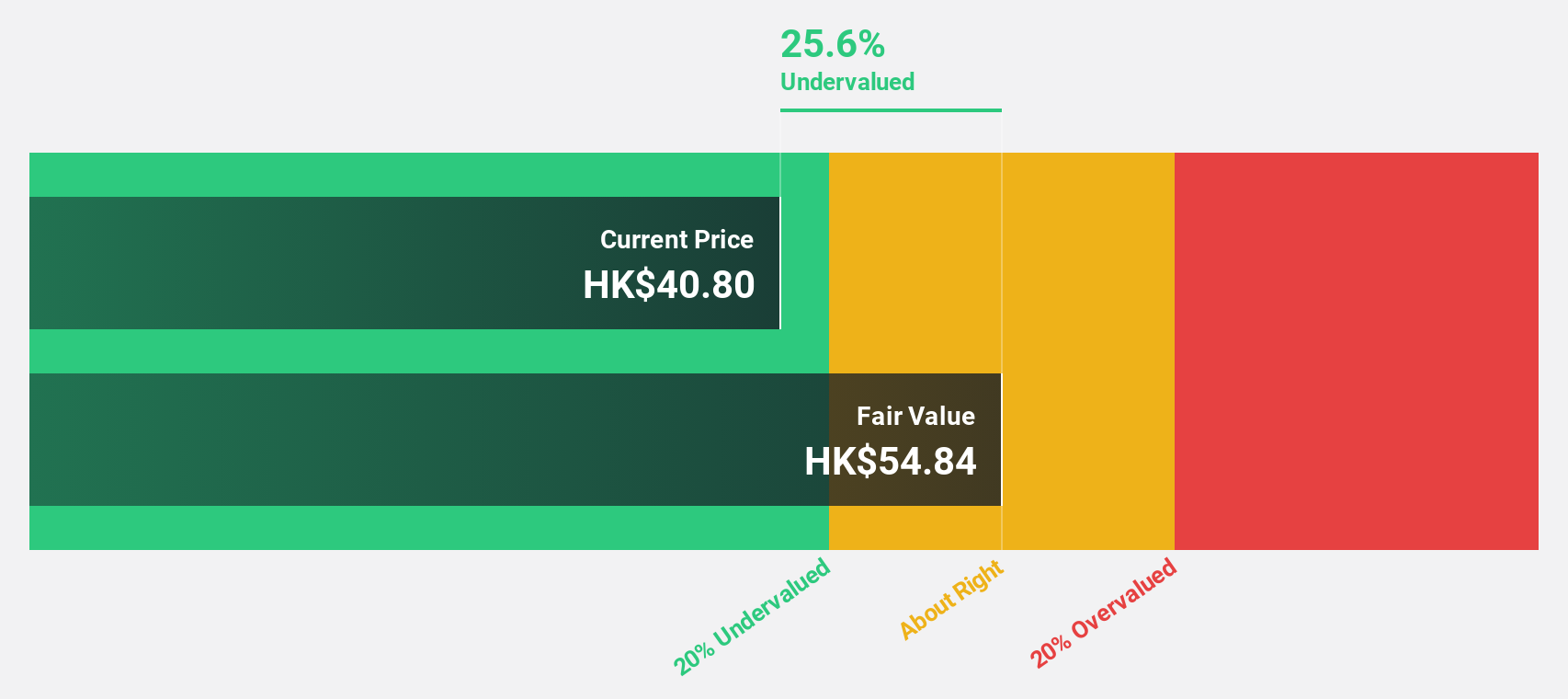

AAC Technologies Holdings (SEHK:2018)

Overview: AAC Technologies Holdings Inc. is an investment holding company that offers solutions for smart devices across various regions including Mainland China, Hong Kong, Taiwan, other Asian countries, the United States, and Europe, with a market cap of HK$37.15 billion.

Operations: The company's revenue segments include CN¥4.07 billion from Optics Products, CN¥7.64 billion from Acoustics Products, CN¥0.92 billion from Sensor and Semiconductor Products, and CN¥8.28 billion from Electromagnetic Drives and Precision Mechanics.

Estimated Discount To Fair Value: 11.9%

AAC Technologies Holdings is trading at HK$31, below the estimated fair value of HK$35.2, indicating potential undervaluation based on cash flows. The company's earnings surged by 81.3% over the past year and are forecast to grow significantly at 20.98% annually, outpacing the Hong Kong market's growth rate. However, its future return on equity is projected to be modest at 9.6%. Recent earnings show strong performance with net income rising from CNY 150.3 million to CNY 537.03 million year-over-year for H1 2024.

- The analysis detailed in our AAC Technologies Holdings growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in AAC Technologies Holdings' balance sheet health report.

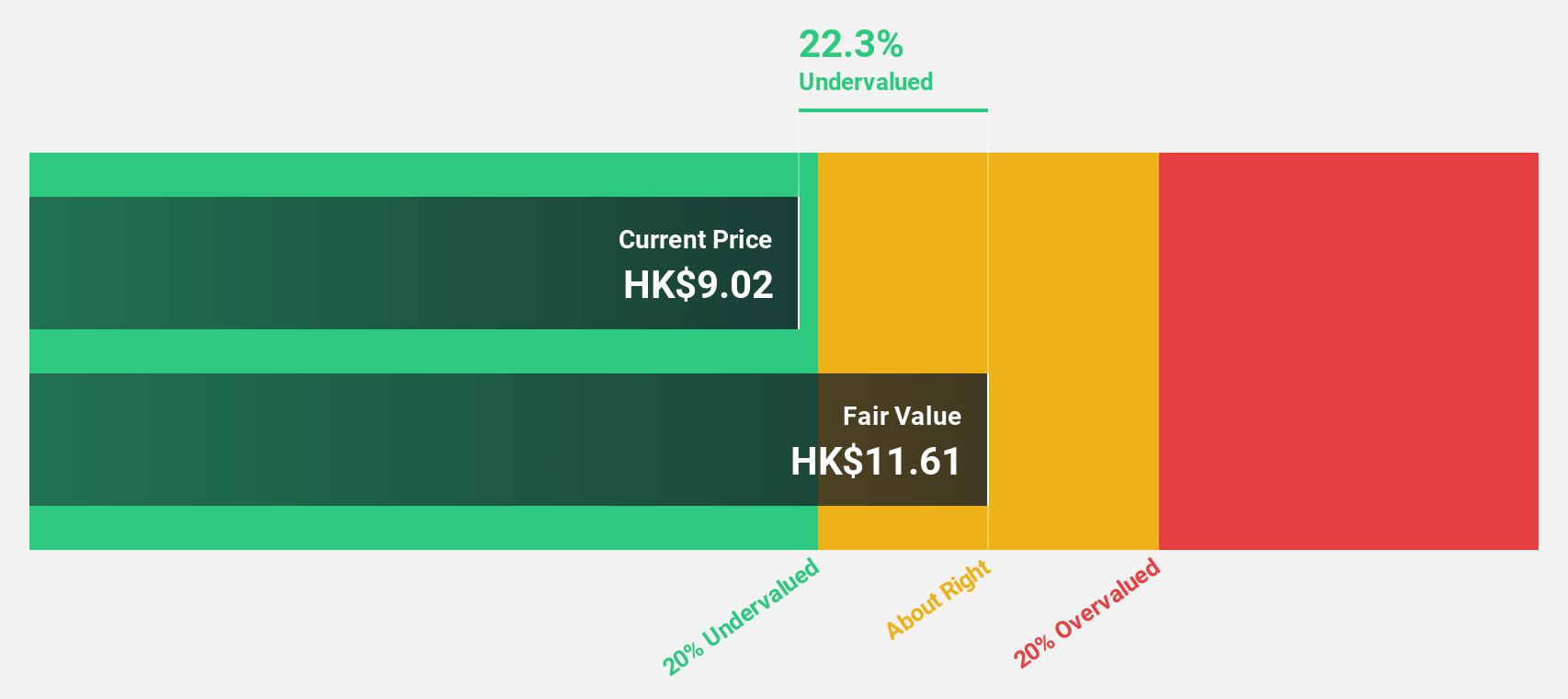

Bairong (SEHK:6608)

Overview: Bairong Inc. is a cloud-based AI turnkey services provider in China with a market cap of approximately HK$4.38 billion.

Operations: The company generates revenue from its data processing segment, which amounts to CN¥2.76 billion.

Estimated Discount To Fair Value: 42.1%

Bairong is trading at HK$9.45, significantly below its estimated fair value of HK$16.31, highlighting potential undervaluation based on cash flows. Despite a decline in net income to CNY 139.96 million for H1 2024 from CNY 205.25 million a year ago, earnings are expected to grow substantially at 28.1% annually over the next three years, surpassing the Hong Kong market's growth rate and suggesting strong future prospects despite current margin pressures.

- Our comprehensive growth report raises the possibility that Bairong is poised for substantial financial growth.

- Take a closer look at Bairong's balance sheet health here in our report.

Key Takeaways

- Unlock more gems! Our Undervalued SEHK Stocks Based On Cash Flows screener has unearthed 34 more companies for you to explore.Click here to unveil our expertly curated list of 37 Undervalued SEHK Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bairong might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6608

Flawless balance sheet and undervalued.