- Hong Kong

- /

- Consumer Services

- /

- SEHK:1890

Here's Why China Kepei Education Group (HKG:1890) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in China Kepei Education Group (HKG:1890). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for China Kepei Education Group

How Quickly Is China Kepei Education Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years China Kepei Education Group grew its EPS by 14% per year. That's a pretty good rate, if the company can sustain it.

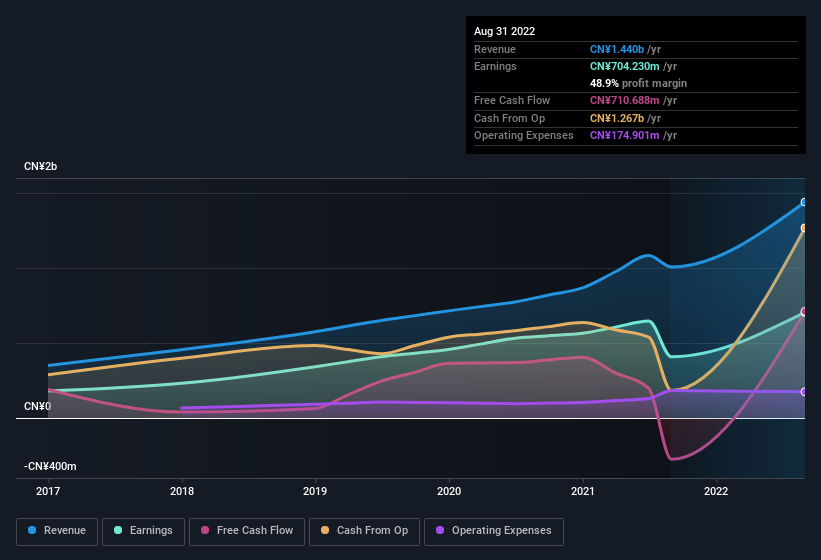

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that China Kepei Education Group is growing revenues, and EBIT margins improved by 5.6 percentage points to 51%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of China Kepei Education Group's forecast profits?

Are China Kepei Education Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for China Kepei Education Group shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Lixia Sun, the Senior VP & Executive Director of the company, paid CN¥65k for shares at around CN¥3.26 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in China Kepei Education Group.

On top of the insider buying, we can also see that China Kepei Education Group insiders own a large chunk of the company. To be exact, company insiders hold 67% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. And their holding is extremely valuable at the current share price, totalling CN¥4.0b. That means they have plenty of their own capital riding on the performance of the business!

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Nianqiao Ye, is paid less than the median for similar sized companies. For companies with market capitalisations between CN¥2.8b and CN¥11b, like China Kepei Education Group, the median CEO pay is around CN¥3.7m.

The China Kepei Education Group CEO received total compensation of just CN¥1.3m in the year to August 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add China Kepei Education Group To Your Watchlist?

As previously touched on, China Kepei Education Group is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. You still need to take note of risks, for example - China Kepei Education Group has 1 warning sign we think you should be aware of.

Keen growth investors love to see insider buying. Thankfully, China Kepei Education Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1890

China Kepei Education Group

An investment holding company, provides private vocational education services focusing on profession-oriented and vocational education in the People’s Republic of China.

Undervalued with adequate balance sheet and pays a dividend.