- Hong Kong

- /

- Consumer Services

- /

- SEHK:1851

We Think Shareholders May Consider Being More Generous With China Gingko Education Group Company Limited's (HKG:1851) CEO Compensation Package

Key Insights

- China Gingko Education Group's Annual General Meeting to take place on 20th of June

- Salary of CN¥391.0k is part of CEO Gongyu Fang's total remuneration

- The total compensation is 77% less than the average for the industry

- China Gingko Education Group's total shareholder return over the past three years was 25% while its EPS grew by 58% over the past three years

The decent performance at China Gingko Education Group Company Limited (HKG:1851) recently will please most shareholders as they go into the AGM coming up on 20th of June. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

Check out our latest analysis for China Gingko Education Group

How Does Total Compensation For Gongyu Fang Compare With Other Companies In The Industry?

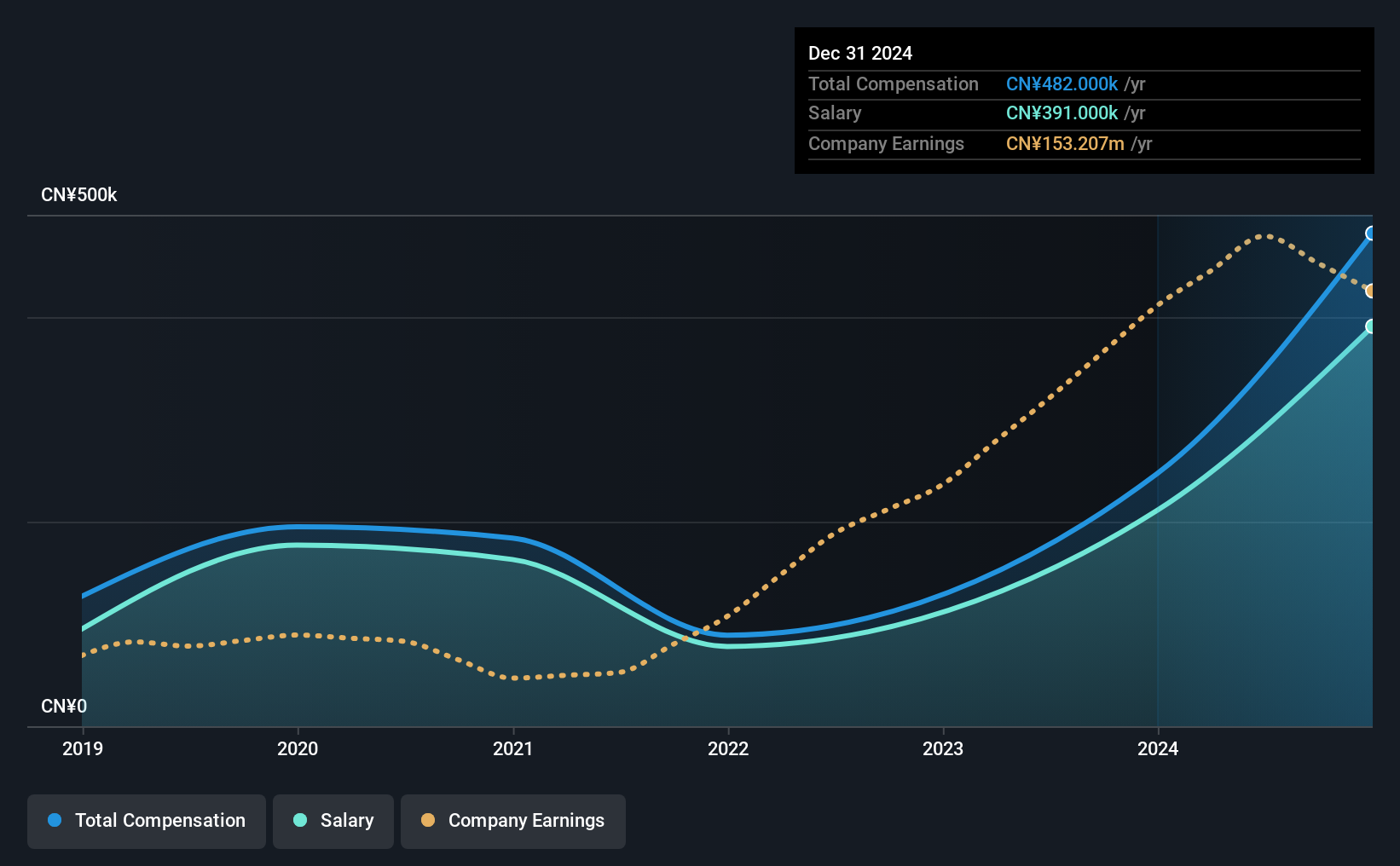

Our data indicates that China Gingko Education Group Company Limited has a market capitalization of HK$735m, and total annual CEO compensation was reported as CN¥482k for the year to December 2024. We note that's an increase of 95% above last year. In particular, the salary of CN¥391.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Hong Kong Consumer Services industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of CN¥2.1m. That is to say, Gongyu Fang is paid under the industry median. What's more, Gongyu Fang holds HK$539m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥391k | CN¥211k | 81% |

| Other | CN¥91k | CN¥36k | 19% |

| Total Compensation | CN¥482k | CN¥247k | 100% |

On an industry level, roughly 81% of total compensation represents salary and 19% is other remuneration. China Gingko Education Group is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

China Gingko Education Group Company Limited's Growth

Over the past three years, China Gingko Education Group Company Limited has seen its earnings per share (EPS) grow by 58% per year. In the last year, its revenue is up 5.0%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has China Gingko Education Group Company Limited Been A Good Investment?

China Gingko Education Group Company Limited has generated a total shareholder return of 25% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. Assuming the business continues to grow at a good clip, few shareholders would raise any objections to the CEO's remuneration. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 2 warning signs (and 1 which is a bit concerning) in China Gingko Education Group we think you should know about.

Important note: China Gingko Education Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1851

China Gingko Education Group

An investment holding company, provides private higher education services in the People's Republic of China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives