- Hong Kong

- /

- Consumer Services

- /

- SEHK:1448

What Is The Ownership Structure Like For Fu Shou Yuan International Group Limited (HKG:1448)?

If you want to know who really controls Fu Shou Yuan International Group Limited (HKG:1448), then you'll have to look at the makeup of its share registry. Insiders often own a large chunk of younger, smaller, companies while huge companies tend to have institutions as shareholders. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

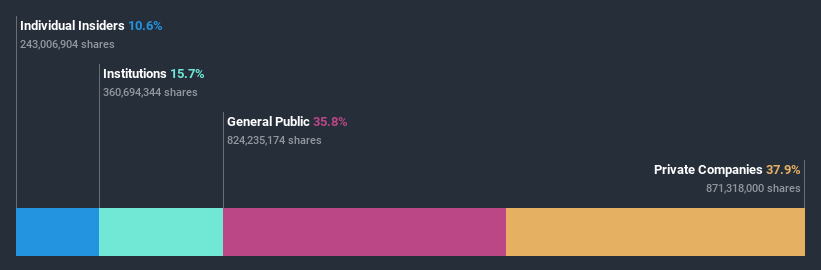

Fu Shou Yuan International Group isn't enormous, but it's not particularly small either. It has a market capitalization of HK$17b, which means it would generally expect to see some institutions on the share registry. Taking a look at our data on the ownership groups (below), it seems that institutional investors have bought into the company. Let's delve deeper into each type of owner, to discover more about Fu Shou Yuan International Group.

See our latest analysis for Fu Shou Yuan International Group

What Does The Institutional Ownership Tell Us About Fu Shou Yuan International Group?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

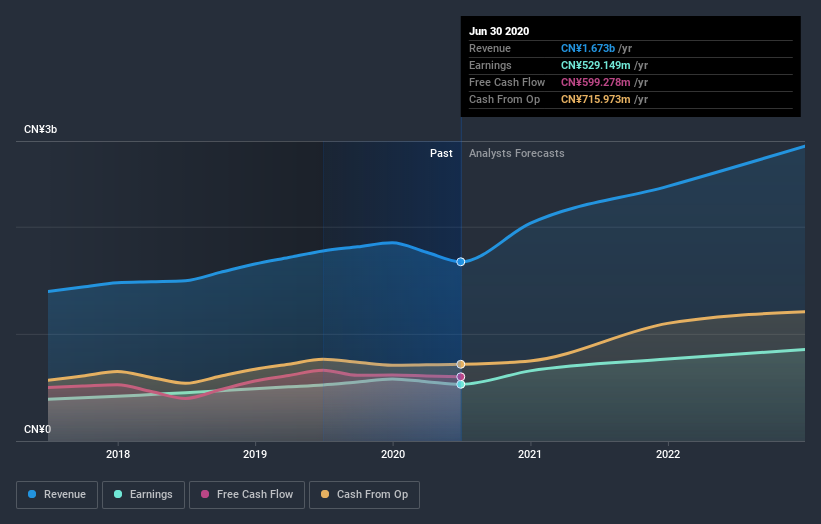

We can see that Fu Shou Yuan International Group does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Fu Shou Yuan International Group's historic earnings and revenue below, but keep in mind there's always more to the story.

Fu Shou Yuan International Group is not owned by hedge funds. The company's largest shareholder is China Zhongfu Industry Co., Ltd., with ownership of 21%. FSG Holding Corporation is the second largest shareholder owning 17% of common stock, and Sunshine Asset Management Co., Ltd. holds about 6.6% of the company stock. In addition, we found that Jisheng Wang, the CEO has 4.7% of the shares allocated to his name

To make our study more interesting, we found that the top 5 shareholders control more than half of the company which implies that this group has considerable sway over the company's decision-making.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Fu Shou Yuan International Group

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders maintain a significant holding in Fu Shou Yuan International Group Limited. It is very interesting to see that insiders have a meaningful HK$1.8b stake in this HK$17b business. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public holds a 36% stake in Fu Shou Yuan International Group. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

Our data indicates that Private Companies hold 38%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Fu Shou Yuan International Group you should know about.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

When trading Fu Shou Yuan International Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:1448

Fu Shou Yuan International Group

Provides burial and funeral services in the People’s Republic of China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives