- Thailand

- /

- Consumer Finance

- /

- SET:THANI

Fu Shou Yuan International Group Among 3 Promising Penny Stocks To Consider

Reviewed by Simply Wall St

Global markets have shown resilience, with U.S. stock indexes climbing toward record highs and growth stocks outperforming value shares, despite inflationary pressures and shifting economic policies. In this context, penny stocks—once a buzzword but now more of a niche—still present intriguing opportunities for investors seeking potential growth in smaller or newer companies. When these stocks are supported by strong financial health, they can offer unique value propositions that larger firms may not provide.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.52 | MYR2.59B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.90 | HK$44.77B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.95 | £319.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.96 | £152.99M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR932.02M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.855 | £468.01M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.09 | £307.32M | ★★★★☆☆ |

Click here to see the full list of 5,692 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fu Shou Yuan International Group Limited, with a market cap of HK$9.77 billion, operates in the People’s Republic of China offering burial and funeral services through its subsidiaries.

Operations: The company's revenue primarily comes from Burial Services at CN¥1.78 billion and Funeral Services at CN¥357.97 million, supplemented by Other Services totaling CN¥73.22 million.

Market Cap: HK$9.77B

Fu Shou Yuan International Group Limited has a solid financial position with cash exceeding total debt and operating cash flow well covering its liabilities. Despite a slight decline in net profit margins from 30.9% to 28.4%, the company maintains high-quality earnings and stable weekly volatility at 3%. The board is experienced, though management's tenure averages only 1.4 years, suggesting new leadership dynamics. Recent events include the announcement of a special dividend totaling HKD 900 million, reflecting strong cash management practices. While earnings growth slowed last year, forecasts indicate potential recovery with expected annual growth of over 10%.

- Click here to discover the nuances of Fu Shou Yuan International Group with our detailed analytical financial health report.

- Explore Fu Shou Yuan International Group's analyst forecasts in our growth report.

Ratchthani Leasing (SET:THANI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ratchthani Leasing Public Company Limited, along with its subsidiary, offers hire-purchase and leasing services in Thailand and has a market cap of THB9.66 billion.

Operations: Ratchthani Leasing generates its revenue primarily through hire-purchase and leasing services within Thailand.

Market Cap: THB9.66B

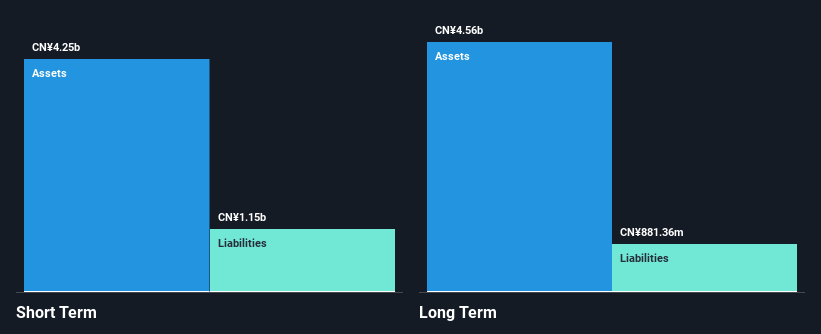

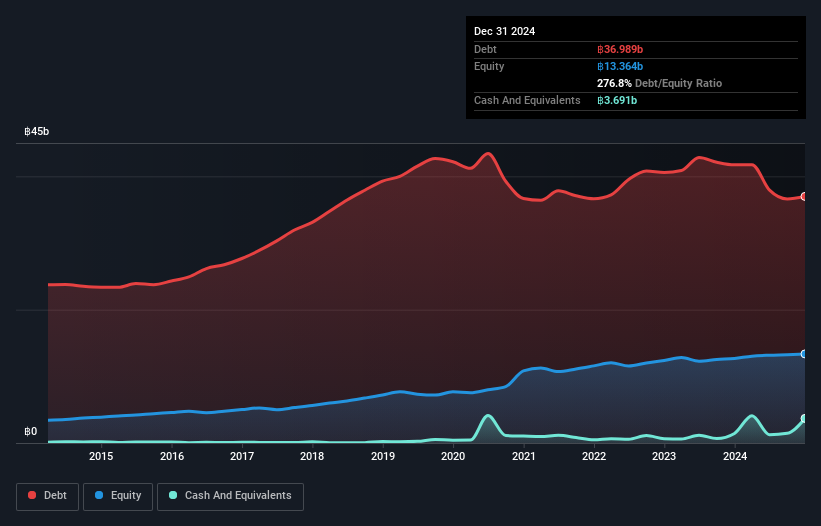

Ratchthani Leasing's financial position shows strengths and challenges. The company trades at a significant discount to its estimated fair value, suggesting potential upside for investors. Despite high net debt to equity ratio of 249.2%, short-term assets significantly exceed liabilities, indicating solid liquidity. However, earnings have declined by 12.5% annually over five years with recent negative growth of 37.8%. While the dividend track record is unstable, a cash dividend of THB 0.07 has been proposed for April 2025 following decreased annual revenue and net income compared to the previous year. Management and board members are experienced with stable tenures.

- Click here and access our complete financial health analysis report to understand the dynamics of Ratchthani Leasing.

- Learn about Ratchthani Leasing's future growth trajectory here.

Guizhou Xinbang Pharmaceutical (SZSE:002390)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guizhou Xinbang Pharmaceutical Co., Ltd. is engaged in the research, development, manufacturing, and sale of Chinese herbal medicines and other pharmaceutical products both domestically and internationally, with a market cap of CN¥8.17 billion.

Operations: No specific revenue segments have been reported for Guizhou Xinbang Pharmaceutical.

Market Cap: CN¥8.17B

Guizhou Xinbang Pharmaceutical presents a mixed investment case. Despite a stable net profit margin of 3.5%, recent negative earnings growth (-5.5%) contrasts with its five-year profitability trend, where earnings grew by 32.8% annually. The company has reduced its debt significantly over the past five years, now maintaining more cash than total debt and covering interest payments well with EBIT (58.7x coverage). However, volatility remains high compared to most Chinese stocks, and the return on equity is low at 4%. While short-term assets comfortably cover both short- and long-term liabilities, the board's inexperience may be a concern for potential investors.

- Get an in-depth perspective on Guizhou Xinbang Pharmaceutical's performance by reading our balance sheet health report here.

- Learn about Guizhou Xinbang Pharmaceutical's historical performance here.

Key Takeaways

- Take a closer look at our Penny Stocks list of 5,692 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:THANI

Ratchthani Leasing

Together with its subsidiary, provides hire-purchase and leasing services in Thailand.

Undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives