- Hong Kong

- /

- Hospitality

- /

- SEHK:1405

Rapid Store Openings and Rising Digital Engagement Might Change The Case For Investing In DPC Dash (SEHK:1405)

Reviewed by Sasha Jovanovic

- DPC Dash, the exclusive master franchisee of Domino's Pizza in China, opened 275 net new stores in the Chinese Mainland during the third quarter of 2025, bringing its total to 1,283 stores across 51 cities as of September 30, 2025.

- A significant rise in loyalty program membership and positive same-store sales growth underscore the company's digital engagement and resilience in major urban markets.

- We'll examine how rapid expansion into new cities and rising digital engagement are shifting DPC Dash's investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

DPC Dash Investment Narrative Recap

To be a shareholder in DPC Dash is to believe that rapid geographic expansion and strong digital adoption can offset growing industry competition and operational risks in China's evolving fast-food market. The latest news of 275 net new store openings and another quarter of positive same-store sales growth supports optimism around short-term revenue momentum, but it does not materially diminish the main risk: whether new stores will maintain productivity and avoid dragging on margins as the network grows.

Among the company’s recent announcements, the goal to open 300–350 new stores per year remains the most relevant next to the latest expansion update. With DPC Dash having already achieved nearly all of its 2025 store opening target, investors will continue to focus on whether scaling at this pace can sustain both group and per-store profitability, making the quality of new store performance crucial for the near-term outlook.

Yet, even with robust expansion, investors should watch closely for signs that growth in less-tested new city markets may...

Read the full narrative on DPC Dash (it's free!)

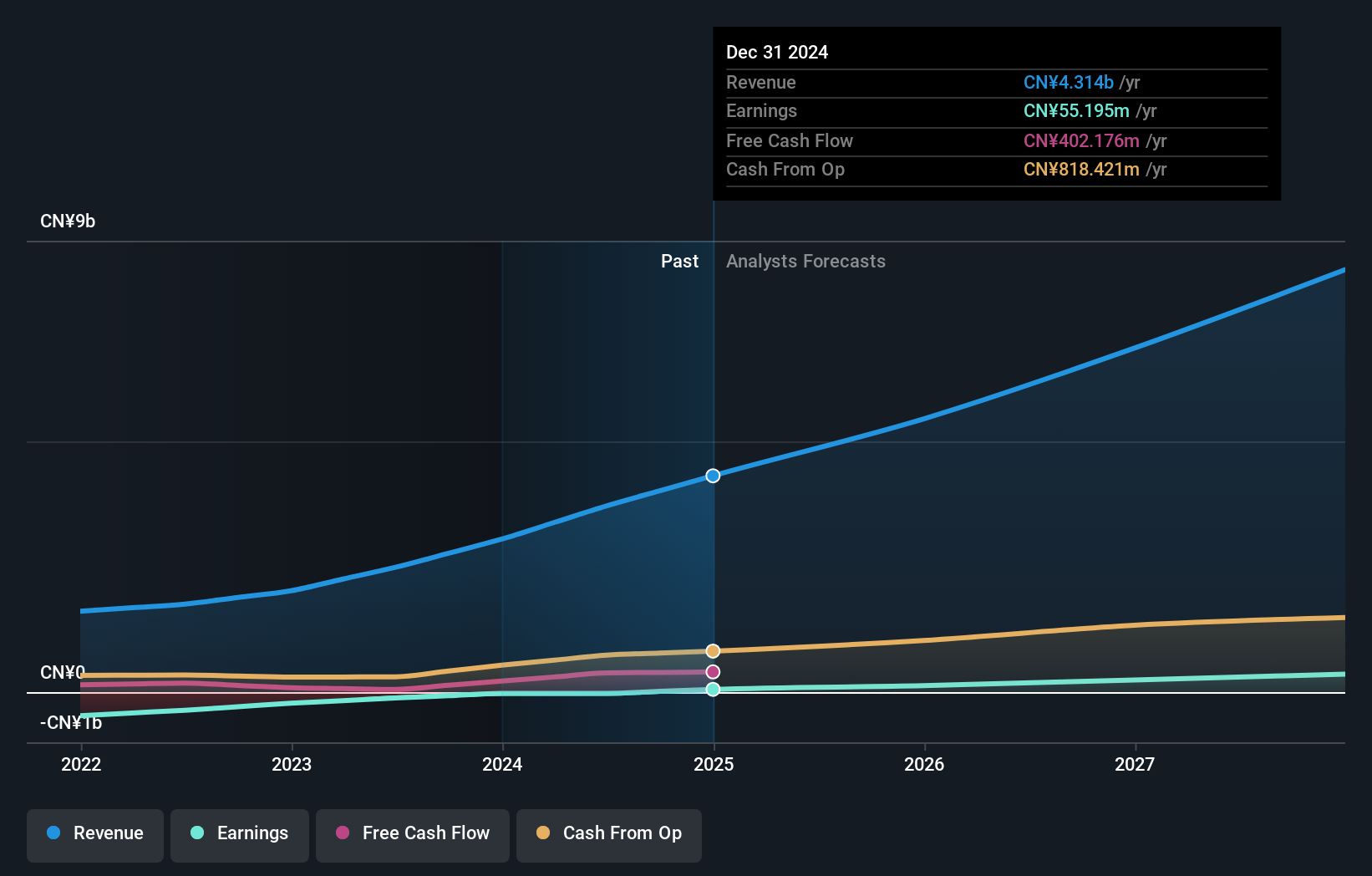

DPC Dash's narrative projects CN¥9.2 billion revenue and CN¥438.8 million earnings by 2028. This requires 23.6% yearly revenue growth and a CN¥328.6 million earnings increase from the current earnings of CN¥110.2 million.

Uncover how DPC Dash's forecasts yield a HK$114.67 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published three fair value targets for DPC Dash, stretching from HK$32.69 up to HK$207.33. With such a spread in opinions, but against a backdrop of continued aggressive store rollouts, you may want to review how different growth assumptions can impact future profitability.

Explore 3 other fair value estimates on DPC Dash - why the stock might be worth over 2x more than the current price!

Build Your Own DPC Dash Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DPC Dash research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free DPC Dash research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DPC Dash's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1405

DPC Dash

Operates a chain of fast-food restaurants in the People’s Republic of China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.