- Hong Kong

- /

- Hospitality

- /

- SEHK:1405

February 2025's Select Stocks Estimated Below Their True Value

Reviewed by Simply Wall St

As global markets experience a surge with U.S. stock indexes nearing record highs and European indices reaching fresh peaks, investors are closely monitoring inflation data and its implications for monetary policy. In this environment of cautious optimism, identifying stocks that may be undervalued presents an opportunity for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.65 | US$36.99 | 49.6% |

| Samwha ElectricLtd (KOSE:A009470) | ₩43150.00 | ₩86111.21 | 49.9% |

| Thomas Cook (India) (BSE:500413) | ₹125.25 | ₹249.45 | 49.8% |

| Wienerberger (WBAG:WIE) | €33.08 | €65.84 | 49.8% |

| Elin Electronics (NSEI:ELIN) | ₹127.89 | ₹255.10 | 49.9% |

| Saigon Thuong Tin Commercial Bank (HOSE:STB) | ₫38300.00 | ₫76325.14 | 49.8% |

| Solum (KOSE:A248070) | ₩17580.00 | ₩34915.02 | 49.6% |

| Hensoldt (XTRA:HAG) | €40.78 | €81.50 | 50% |

| Array Technologies (NasdaqGM:ARRY) | US$6.79 | US$13.53 | 49.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

Let's dive into some prime choices out of the screener.

HANMI Semiconductor (KOSE:A042700)

Overview: HANMI Semiconductor Co., Ltd. manufactures and sells semiconductor equipment both in South Korea and internationally, with a market cap of approximately ₩9.53 trillion.

Operations: The company generates revenue primarily from its semiconductor segment, amounting to approximately ₩461.54 billion.

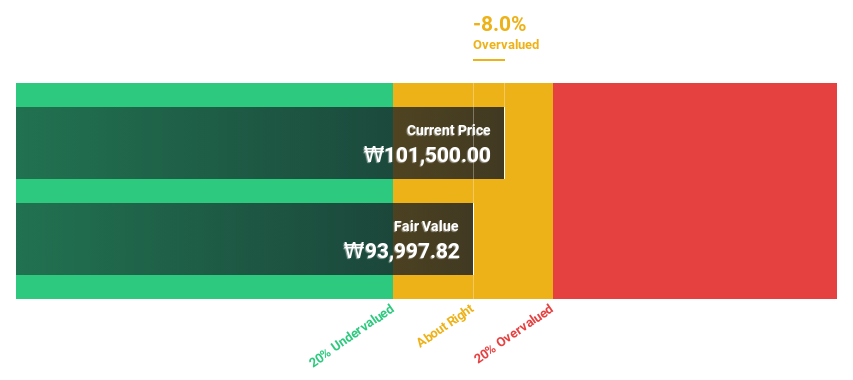

Estimated Discount To Fair Value: 16.7%

HANMI Semiconductor is trading at ₩100,700, below its estimated fair value of ₩120,857.09. Despite a lower profit margin than last year and high share price volatility recently, the company shows strong potential with forecasted earnings growth of 57.91% annually over the next three years and revenue growth outpacing the KR market at 26.7%. Recent buybacks totaling KRW 32 billion may support shareholder value as analysts predict a 62.4% stock price increase.

- Our expertly prepared growth report on HANMI Semiconductor implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of HANMI Semiconductor.

DPC Dash (SEHK:1405)

Overview: DPC Dash Ltd, along with its subsidiaries, operates a chain of fast-food restaurants in the People's Republic of China and has a market cap of HK$10.94 billion.

Operations: The company generates revenue primarily from its fast-food restaurant operations in the People's Republic of China, totaling CN¥3.72 billion.

Estimated Discount To Fair Value: 26%

DPC Dash is trading at HK$86.2, significantly below its estimated fair value of HK$116.44, indicating potential undervaluation based on cash flows. Despite a low forecasted return on equity (8.4%) in three years, the company shows promise with expected annual profit growth exceeding market averages and revenue projected to grow 24.9% per year, surpassing the Hong Kong market rate of 7.8%. Recent board changes may enhance financial oversight and strategic direction.

- Our comprehensive growth report raises the possibility that DPC Dash is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in DPC Dash's balance sheet health report.

Wienerberger (WBAG:WIE)

Overview: Wienerberger AG is a company that produces and sells clay blocks, facing bricks, roof tiles, and pavers in Europe with a market cap of €3.69 billion.

Operations: The company's revenue segments include clay blocks at €1.50 billion, facing bricks at €1.20 billion, roof tiles at €800 million, and pavers at €600 million.

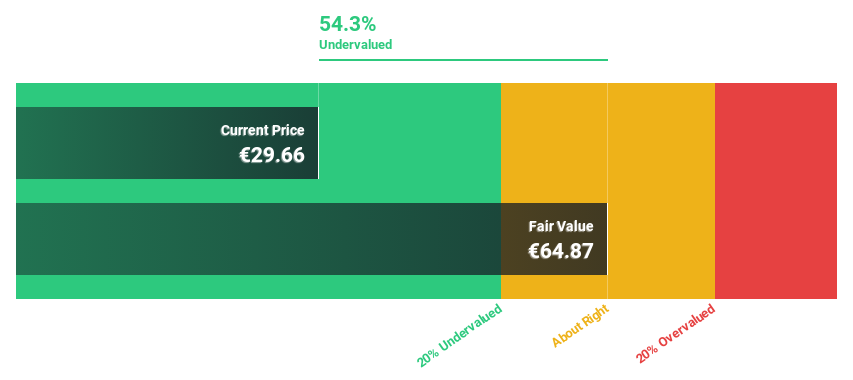

Estimated Discount To Fair Value: 49.8%

Wienerberger, trading at €33.08, is valued significantly below its estimated fair value of €65.84, suggesting potential undervaluation based on cash flows. Despite a low forecasted return on equity of 11.5% in three years and high debt levels, the company's earnings are expected to grow substantially at 56.32% annually over the next three years, outpacing the Austrian market's growth rate of 10%. Recent executive changes could further strengthen financial strategies and operations in Central & East regions.

- Our earnings growth report unveils the potential for significant increases in Wienerberger's future results.

- Take a closer look at Wienerberger's balance sheet health here in our report.

Make It Happen

- Unlock our comprehensive list of 921 Undervalued Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1405

DPC Dash

Operates a chain of fast-food restaurants in the People’s Republic of China.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives