- Hong Kong

- /

- Personal Products

- /

- SEHK:1259

Spotlight On 3 Penny Stocks With Market Caps Starting At US$10M

Reviewed by Simply Wall St

As global markets navigate a landscape marked by central banks cutting rates and fluctuating indices, investors are increasingly exploring alternatives beyond large-cap stocks. Penny stocks, though an older term, remain a vital area of interest for those seeking growth opportunities at lower price points. These smaller or newer companies can offer unique potential when backed by strong fundamentals and financial resilience. In this article, we explore three penny stocks that stand out for their robust balance sheets and potential to deliver impressive returns amidst current market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.43 | MYR1.2B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.12 | £804.39M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.00 | HK$44.05B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.775 | £186M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.89M | ★★★★☆☆ |

Click here to see the full list of 5,742 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Lokotech Group (OB:LOKO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lokotech Group AS is a management and holding company that provides software and hardware solutions for the crypto industry, with a market cap of NOK265.76 million.

Operations: Lokotech Group has not reported any specific revenue segments.

Market Cap: NOK265.76M

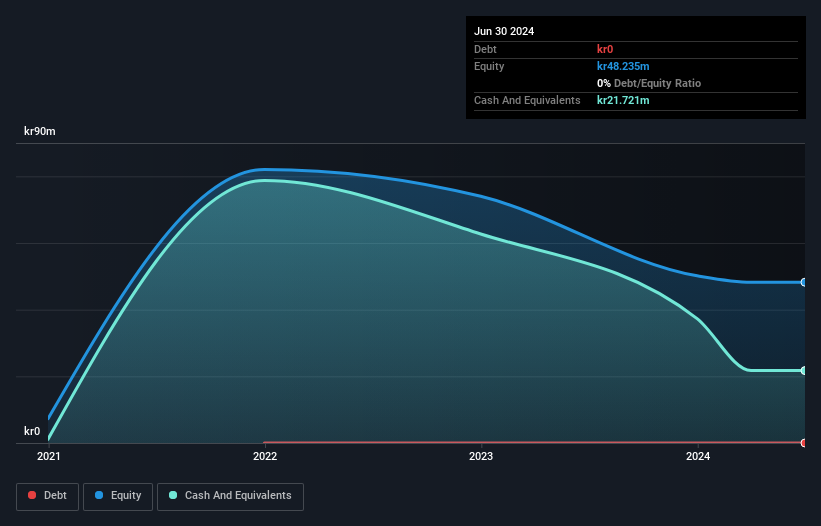

Lokotech Group, with a market cap of NOK265.76 million, is pre-revenue and currently unprofitable, but it remains debt-free and has not diluted shareholders in the past year. The company recently signed a framework agreement for its Scrypt miners with potential revenue of US$2-5 million, positioning it to achieve economies of scale. Despite trading significantly below estimated fair value and having sufficient cash runway for over a year based on current free cash flow, Lokotech's share price remains highly volatile. Earnings are forecasted to grow substantially at 72.44% annually despite ongoing losses over the past five years.

- Unlock comprehensive insights into our analysis of Lokotech Group stock in this financial health report.

- Understand Lokotech Group's earnings outlook by examining our growth report.

Sino Hotels (Holdings) (SEHK:1221)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sino Hotels (Holdings) Limited is an investment holding company that operates and manages hotels in Hong Kong, with a market cap of HK$1.57 billion.

Operations: The company's revenue is primarily derived from hotel operations at the City Garden Hotel, generating HK$97.39 million, supplemented by investment holding activities contributing HK$20.48 million, and club operation and hotel management services adding HK$15.82 million.

Market Cap: HK$1.57B

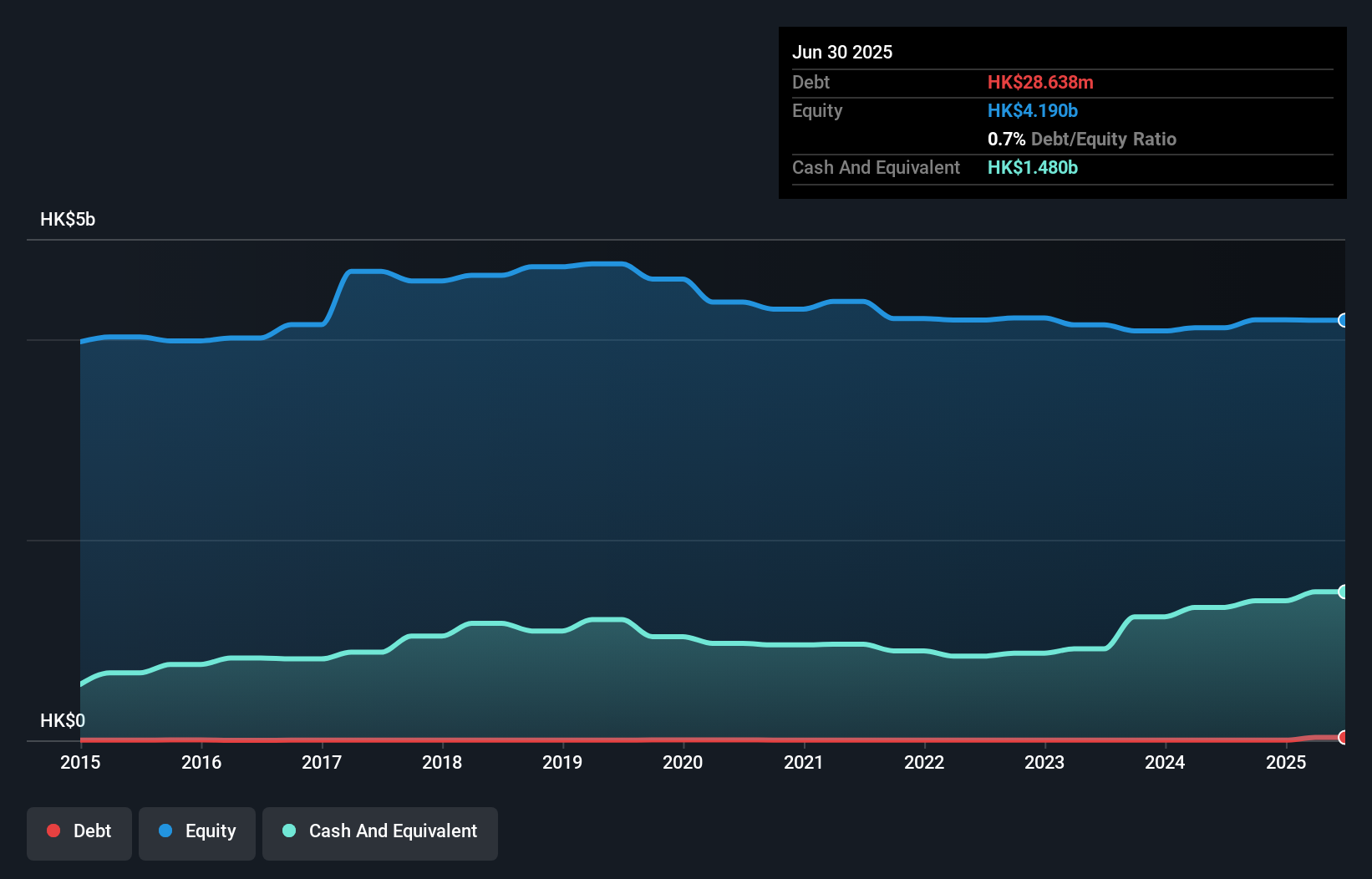

Sino Hotels (Holdings) Limited, with a market cap of HK$1.57 billion, has shown financial resilience by becoming profitable this year and maintaining strong liquidity, as its short-term assets significantly exceed liabilities. The company's debt is well-covered by operating cash flow, and it holds more cash than total debt. Despite a low return on equity at 1.6% and earnings declining by 9.6% annually over five years, the firm recently declared a final dividend of HK$0.015 per share with an option for scrip dividend, reflecting stable shareholder returns amid volatility in earnings due to large one-off losses impacting recent results.

- Click here and access our complete financial health analysis report to understand the dynamics of Sino Hotels (Holdings).

- Examine Sino Hotels (Holdings)'s past performance report to understand how it has performed in prior years.

Prosperous Future Holdings (SEHK:1259)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Prosperous Future Holdings Limited, with a market cap of HK$138.81 million, is an investment holding company that sells frozen food and beverage products in Hong Kong and internationally.

Operations: The company's revenue is derived from three main segments: Food and Beverage contributing HK$430.50 million, Financial Business generating HK$96.65 million, and Properties Holding accounting for HK$1.08 billion.

Market Cap: HK$138.81M

Prosperous Future Holdings Limited, with a market cap of HK$138.81 million, is navigating the complexities of its diverse revenue streams across food and beverage, financial business, and property holdings. Despite being unprofitable, it has reduced losses by 44.5% annually over five years and maintains a strong cash position with no debt. Recent strategic moves include a planned expansion into the insurance sector through its Cayman Islands subsidiary to diversify income sources further. The company also recently changed auditors to enhance audit quality and independence without impacting the current year's audit process significantly.

- Get an in-depth perspective on Prosperous Future Holdings' performance by reading our balance sheet health report here.

- Gain insights into Prosperous Future Holdings' past trends and performance with our report on the company's historical track record.

Taking Advantage

- Discover the full array of 5,742 Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1259

Prosperous Future Holdings

An investment holding company, engages in selling of frozen food and beverage products in Hong Kong and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives