Global markets have experienced a significant rally, with major U.S. indices reaching record highs following recent political developments and economic policy shifts. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant investment area that can offer surprising value when backed by solid financial foundations. This article explores three penny stocks that demonstrate financial strength and potential for long-term growth, providing an opportunity to uncover hidden value in quality companies.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.24 | MYR349.03M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.755 | A$138.53M | ★★★★☆☆ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £477.59M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Shoe Zone (AIM:SHOE) | £1.525 | £70.5M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.80 | £377.93M | ★★★★☆☆ |

Click here to see the full list of 5,745 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Sino Hotels (Holdings) (SEHK:1221)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Sino Hotels (Holdings) Limited is an investment holding company that operates and manages hotels in Hong Kong, with a market capitalization of HK$1.59 billion.

Operations: The company's revenue is primarily derived from hotel operations at City Garden Hotel, generating HK$97.39 million, alongside investment holding activities contributing HK$20.48 million, and additional income from club operation and hotel management amounting to HK$15.82 million.

Market Cap: HK$1.59B

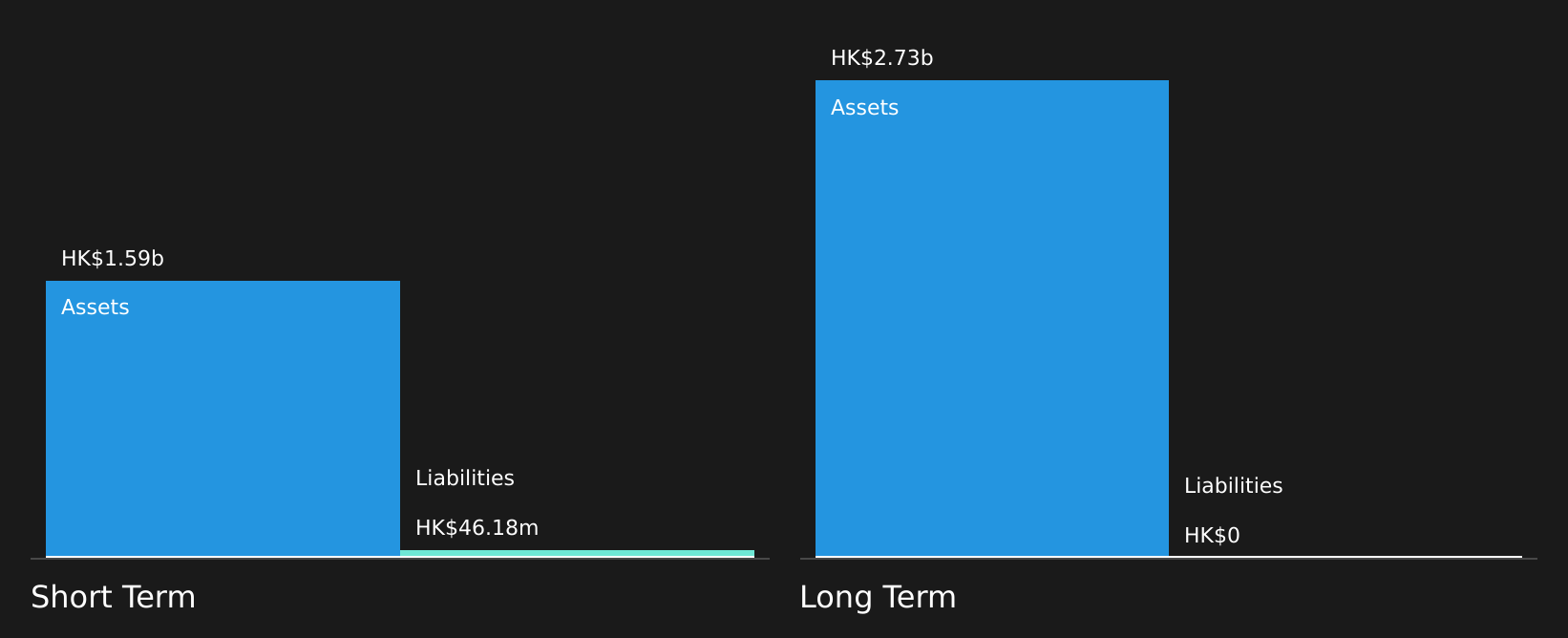

Sino Hotels (Holdings) Limited, with a market cap of HK$1.59 billion, has recently turned profitable, reporting a net income of HK$64.31 million for the year ended June 30, 2024. Despite a one-off loss of HK$40.9 million impacting its financial results, the company maintains more cash than its total debt and has no long-term liabilities. Its short-term assets significantly exceed short-term liabilities by approximately HK$1.38 billion, indicating strong liquidity management. The board is seasoned with an average tenure of 19.5 years, though Return on Equity remains low at 1.6%. A final dividend was approved at their recent AGM.

- Click to explore a detailed breakdown of our findings in Sino Hotels (Holdings)'s financial health report.

- Gain insights into Sino Hotels (Holdings)'s historical outcomes by reviewing our past performance report.

Infraset (SET:INSET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Infraset Public Company Limited is involved in constructing data centers, IT systems, infrastructure, and telecommunication transportation infrastructure in Thailand with a market cap of ฿2.78 billion.

Operations: There are no reported revenue segments available for Infraset Public Company Limited.

Market Cap: THB2.78B

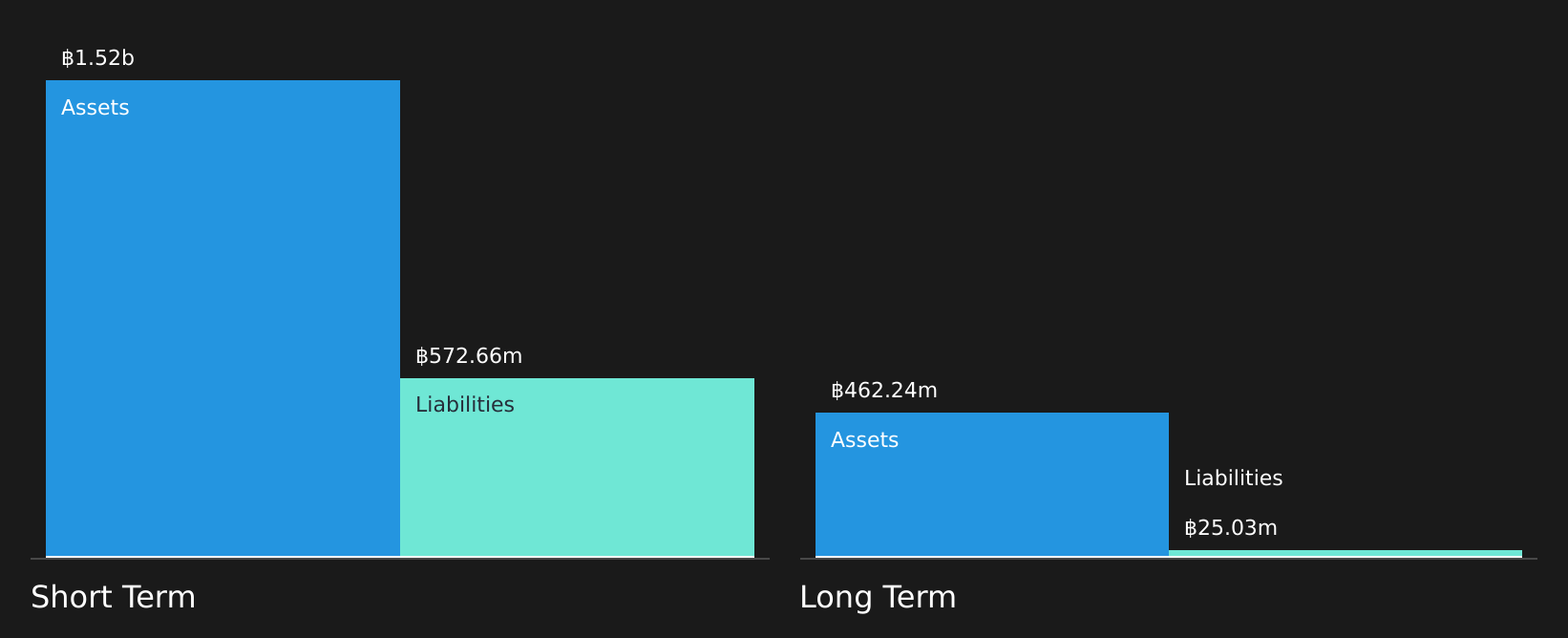

Infraset Public Company Limited, with a market cap of ฿2.78 billion, has experienced declining earnings over the past five years, yet maintains high-quality earnings and solid debt coverage. Despite recent volatility in its share price, the company reported third-quarter revenue growth to ฿766.76 million from ฿294.92 million year-on-year, while net income slightly increased to ฿39.42 million from last year's ฿36 million. Infraset's short-term assets significantly exceed both short and long-term liabilities, suggesting robust financial health despite negative earnings growth last year. Notably, it secured a significant contract worth THB 299.7 million for mobile signal infrastructure improvement with NBTC.

- Jump into the full analysis health report here for a deeper understanding of Infraset.

- Understand Infraset's earnings outlook by examining our growth report.

Nanning Baling Technology (SZSE:002592)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanning Baling Technology Co., Ltd. operates in the automotive industry in Mainland China with a market cap of CN¥1.30 billion.

Operations: Nanning Baling Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥1.3B

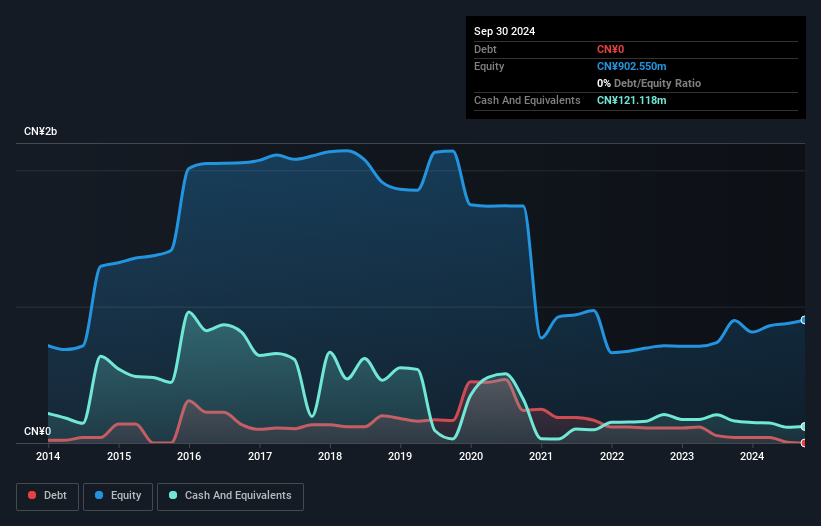

Nanning Baling Technology Co., Ltd., with a market cap of CN¥1.30 billion, operates debt-free and has seen its short-term assets exceed liabilities, indicating solid financial positioning. Despite a large one-off loss impacting recent results, the company reported sales of CN¥430.12 million for the nine months ended September 2024, up from CN¥333.12 million year-on-year. However, net income declined to CN¥51.13 million from last year's CN¥132.43 million due to lower profit margins and negative earnings growth over the past year compared to industry averages, reflecting challenges in maintaining profitability amidst operational hurdles in the automotive sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Nanning Baling Technology.

- Review our historical performance report to gain insights into Nanning Baling Technology's track record.

Make It Happen

- Unlock more gems! Our Penny Stocks screener has unearthed 5,742 more companies for you to explore.Click here to unveil our expertly curated list of 5,745 Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:INSET

Infraset

Infraset Public Company Limited constructs data centers, information technology system, infrastructure, and telecommunication transportation infrastructure in Thailand.

Reasonable growth potential with adequate balance sheet.