- Hong Kong

- /

- Consumer Services

- /

- SEHK:1082

Bradaverse Education (Int'l) Investments Group Limited's (HKG:1082) Earnings Haven't Escaped The Attention Of Investors

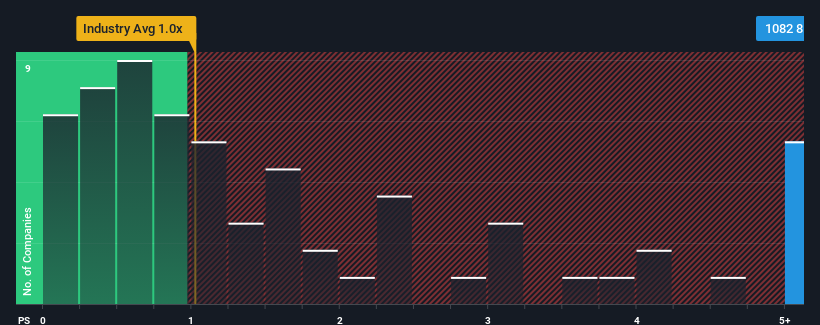

When you see that almost half of the companies in the Consumer Services industry in Hong Kong have price-to-sales ratios (or "P/S") below 1x, Bradaverse Education (Int'l) Investments Group Limited (HKG:1082) looks to be giving off strong sell signals with its 8.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Bradaverse Education (Int'l) Investments Group

How Has Bradaverse Education (Int'l) Investments Group Performed Recently?

Bradaverse Education (Int'l) Investments Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Bradaverse Education (Int'l) Investments Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Bradaverse Education (Int'l) Investments Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 36%. The latest three year period has also seen an excellent 293% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 19% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why Bradaverse Education (Int'l) Investments Group is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does Bradaverse Education (Int'l) Investments Group's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Bradaverse Education (Int'l) Investments Group maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Bradaverse Education (Int'l) Investments Group with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bradaverse Education (Int'l) Investments Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1082

Bradaverse Education (Int'l) Investments Group

An investment holding company, provides private educational services in Hong Kong.

Excellent balance sheet with weak fundamentals.

Market Insights

Community Narratives