- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:6808

Sun Art Retail Group Limited's (HKG:6808) Shares May Have Run Too Fast Too Soon

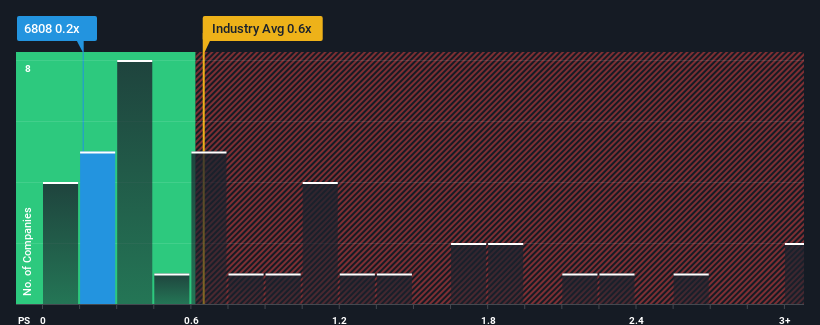

There wouldn't be many who think Sun Art Retail Group Limited's (HKG:6808) price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S for the Consumer Retailing industry in Hong Kong is similar at about 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Sun Art Retail Group

What Does Sun Art Retail Group's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Sun Art Retail Group's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sun Art Retail Group.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Sun Art Retail Group would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. As a result, revenue from three years ago have also fallen 27% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 2.8% each year over the next three years. With the industry predicted to deliver 13% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Sun Art Retail Group is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Sun Art Retail Group's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Sun Art Retail Group with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6808

Sun Art Retail Group

An investment holding company, operates brick-and-mortar stores and online sales channels in the People’s Republic of China.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives