- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2517

Will Guoquan Food's Large Share Buyback Program Reshape Its Investment Story (SEHK:2517)?

Reviewed by Sasha Jovanovic

- Guoquan Food (Shanghai) Co., Ltd. began repurchasing its shares in late September 2025 under a shareholder-approved program, with authorization to buy back up to 274,736,040 shares and a commitment of HK$100 million to the effort.

- This initiative allows the company to either cancel the repurchased shares or hold them as treasury shares, potentially boosting earnings per share by reducing the outstanding share count.

- We'll assess how this substantial buyback, highlighting management's confidence in Guoquan Food's outlook, shapes the company's investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Guoquan Food (Shanghai)'s Investment Narrative?

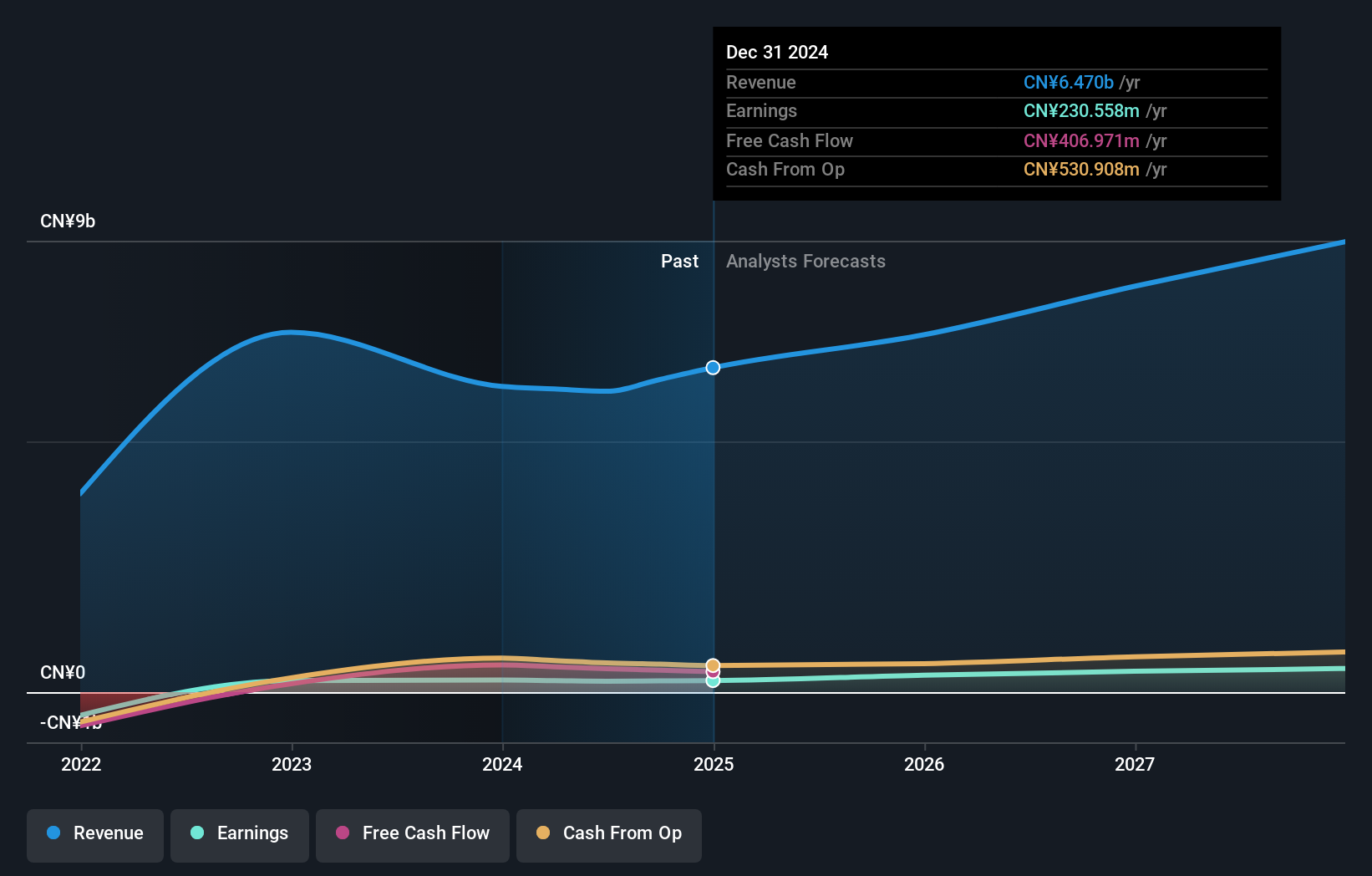

Owning shares of Guoquan Food means buying into the story of a food company that has delivered robust sales and profit growth, recently boosted by index inclusion and business expansion plans like the new Danzhou facility. The recent share buyback, which authorizes up to 10% of issued capital with HK$100 million allocated, reflects management’s confidence and may help lift near-term sentiment by signaling support for the current share price and potentially increasing EPS. This move might strengthen one of Guoquan’s short-term catalysts, valuation improvement versus analyst price targets, by reducing the share count and reinforcing the view that shares are undervalued. However, it is unlikely to address bigger, structural challenges such as high board turnover, weaker board experience, or the sustainability of dividend payouts relative to profits, which continue to shape the main risks. Yet, the less seasoned board remains a key concern investors should keep in mind.

Guoquan Food (Shanghai)'s shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Guoquan Food (Shanghai) - why the stock might be worth over 2x more than the current price!

Build Your Own Guoquan Food (Shanghai) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Guoquan Food (Shanghai) research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Guoquan Food (Shanghai) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Guoquan Food (Shanghai)'s overall financial health at a glance.

No Opportunity In Guoquan Food (Shanghai)?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2517

Guoquan Food (Shanghai)

Operates as a home meal products company in Mainland China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives