- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2517

Kinetic Development Group And 2 Other Undiscovered Gems In Hong Kong

Reviewed by Simply Wall St

Amidst escalating geopolitical tensions and fluctuating oil prices, the Hong Kong market has shown resilience with the Hang Seng Index climbing 10.2% in a holiday-shortened week. This backdrop presents an intriguing landscape for small-cap investors seeking opportunities in lesser-known stocks like Kinetic Development Group, where identifying potential growth hinges on understanding market dynamics and sector-specific strengths.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| E-Commodities Holdings | 21.33% | 9.04% | 28.46% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| China Leon Inspection Holding | 8.55% | 21.36% | 22.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company focused on the extraction and sale of coal products in the People’s Republic of China, with a market capitalization of HK$13.24 billion.

Operations: Kinetic Development Group generates revenue primarily through the extraction and sale of coal products in China. The company's financial performance is influenced by its ability to manage production costs effectively, impacting its net profit margin.

Kinetic Development Group, a promising player in Hong Kong's market, showcases impressive financials with earnings growth of 39.2% in the past year, outpacing the Oil and Gas industry average of 4.6%. The company trades at 57.5% below its estimated fair value and has reduced its debt to equity ratio from 28.4% to a satisfactory 12.5% over five years. Recently, it reported a net income of CNY 1.09 billion for H1 2024, up from CNY 570 million previously, alongside declaring dividends reflecting shareholder confidence.

Time Interconnect Technology (SEHK:1729)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Time Interconnect Technology Limited is an investment holding company that manufactures and sells cable assembly and networking cable products across various international markets, with a market cap of HK$9.93 billion.

Operations: The company generates revenue primarily from its Server and Cable Assembly segments, with contributions of HK$2.57 billion each. Digital Cable also adds to the revenue stream at HK$1.36 billion.

Time Interconnect Technology, a nimble player in the cable assembly sector, reported a notable earnings growth of HKD 202.6 million for the half-year ending June 2024, up from HKD 151.11 million previously. The company has announced an interim dividend of HKD 0.01 per share, totaling HKD 19.47 million. With sales reaching HKD 2.67 billion and basic earnings per share rising to HKD 0.1041 from last year's HKD 0.0777, it showcases potential amidst its industry peers.

- Click here to discover the nuances of Time Interconnect Technology with our detailed analytical health report.

Gain insights into Time Interconnect Technology's past trends and performance with our Past report.

Guoquan Food (Shanghai) (SEHK:2517)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guoquan Food (Shanghai) Co., Ltd. is a Chinese company specializing in home meal products, with a market capitalization of approximately HK$10.19 billion.

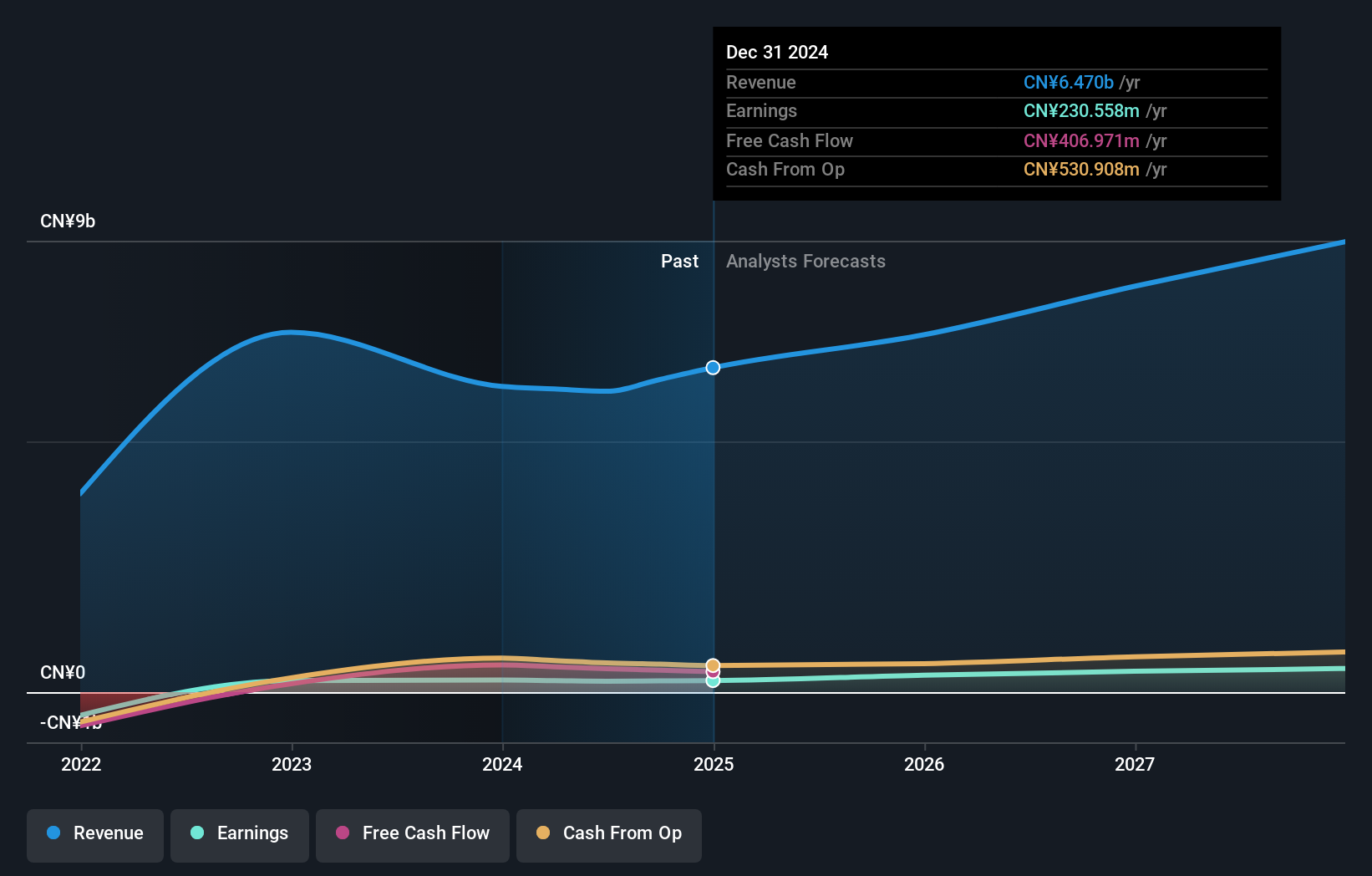

Operations: Guoquan Food generates revenue primarily through its retail segment focused on grocery stores, with reported earnings of CN¥5.998 billion.

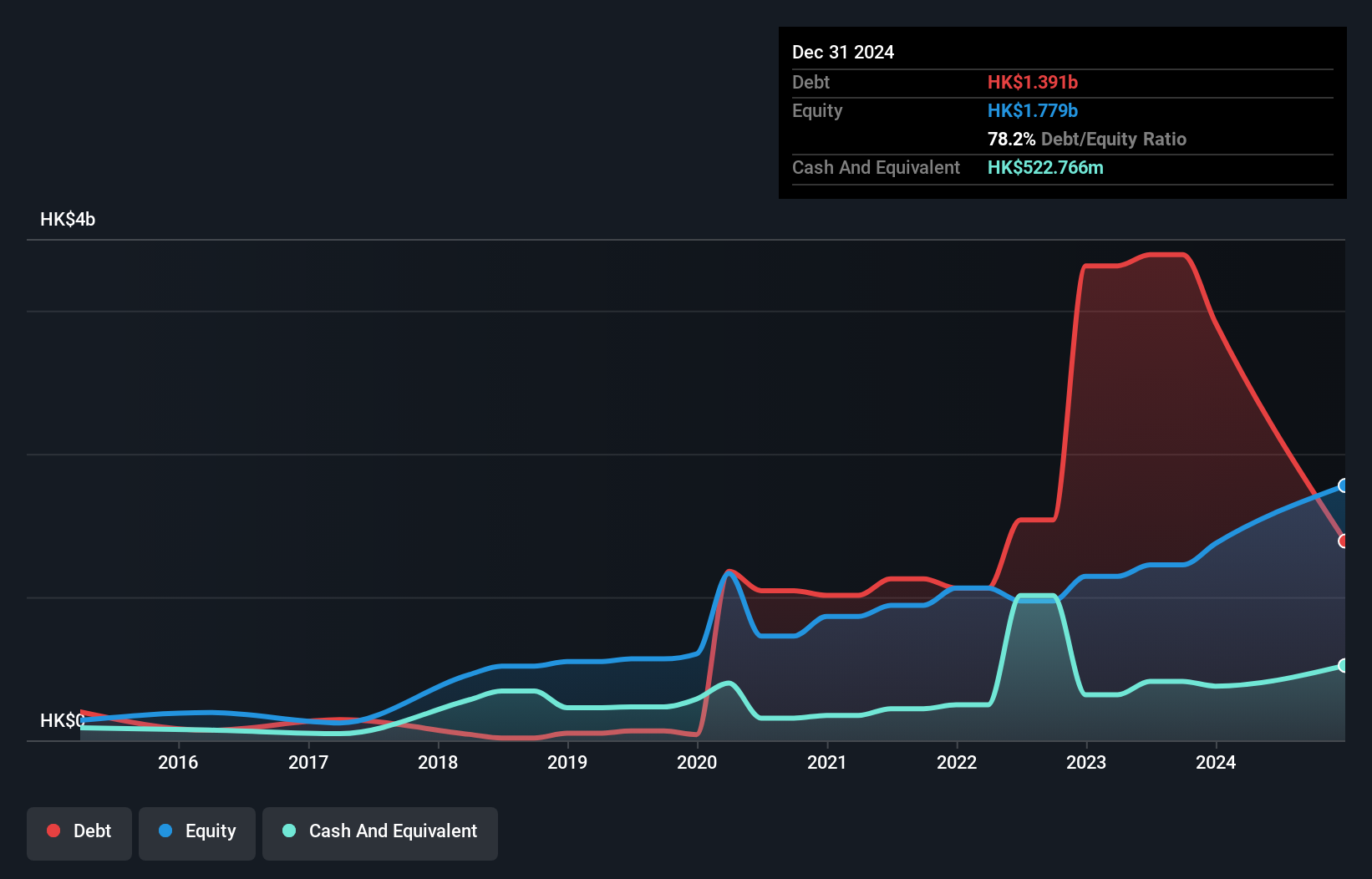

Guoquan Food (Shanghai) seems to be navigating a challenging market environment, with its recent half-year sales at CNY 2.67 billion, down from CNY 2.76 billion the previous year. Net income also took a hit, recording CNY 85.98 million compared to last year's CNY 107.7 million, while basic earnings per share dropped to CNY 0.0313 from CNY 0.0403. Despite these setbacks, the company trades at about half its estimated fair value and maintains high-quality earnings, indicating potential undervaluation in the market context.

- Dive into the specifics of Guoquan Food (Shanghai) here with our thorough health report.

Learn about Guoquan Food (Shanghai)'s historical performance.

Where To Now?

- Gain an insight into the universe of 168 SEHK Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2517

Guoquan Food (Shanghai)

Operates as a home meal products company in China.

Excellent balance sheet and fair value.