- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2360

Here's Why We're Wary Of Buying Best Mart 360 Holdings' (HKG:2360) For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Best Mart 360 Holdings Limited (HKG:2360) is about to go ex-dividend in just 3 days. This means that investors who purchase shares on or after the 18th of December will not receive the dividend, which will be paid on the 4th of January.

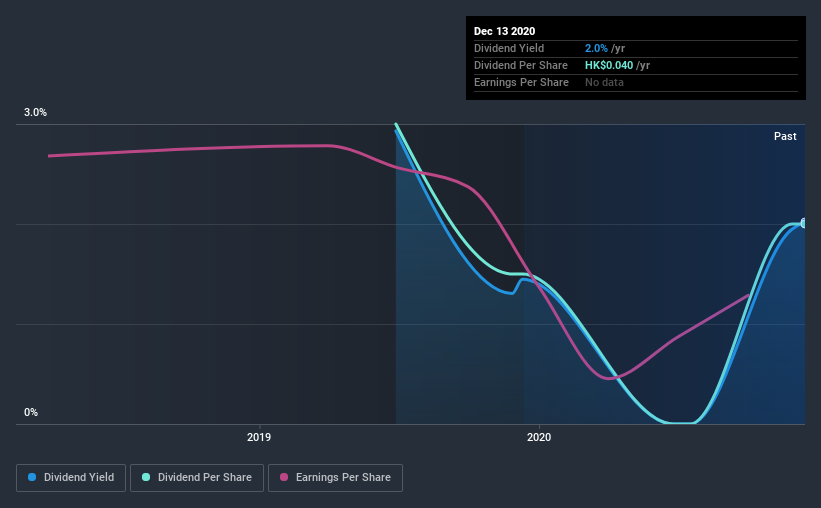

Best Mart 360 Holdings's upcoming dividend is HK$0.02 a share, following on from the last 12 months, when the company distributed a total of HK$0.04 per share to shareholders. Calculating the last year's worth of payments shows that Best Mart 360 Holdings has a trailing yield of 2.0% on the current share price of HK$1.98. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Best Mart 360 Holdings

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Best Mart 360 Holdings is paying out an acceptable 58% of its profit, a common payout level among most companies. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out 10% of its free cash flow as dividends last year, which is conservatively low.

It's positive to see that Best Mart 360 Holdings's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Best Mart 360 Holdings paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Best Mart 360 Holdings's earnings per share plummeted 46% over the past year,which is rarely good news for the dividend.

We'd also point out that Best Mart 360 Holdings issued a meaningful number of new shares in the past year. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Given that Best Mart 360 Holdings has only been paying a dividend for a year, there's not much of a past history to draw insight from.

The Bottom Line

From a dividend perspective, should investors buy or avoid Best Mart 360 Holdings? The payout ratios are within a reasonable range, implying the dividend may be sustainable. Declining earnings are a serious concern, however, and could pose a threat to the dividend in future. To summarise, Best Mart 360 Holdings looks okay on this analysis, although it doesn't appear a stand-out opportunity.

If you want to look further into Best Mart 360 Holdings, it's worth knowing the risks this business faces. Our analysis shows 3 warning signs for Best Mart 360 Holdings and you should be aware of these before buying any shares.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Best Mart 360 Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Best Mart 360 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:2360

Best Mart 360 Holdings

An investment holding company, engages in leisure food retailing by operating chain retail stores under Best Mart 360 and FoodVille brands in Hong Kong, Macau, and the People’s Republic of China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives