- Singapore

- /

- Specialty Stores

- /

- SGX:AGS

February 2025's Top Penny Stocks With Promising Fundamentals

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes have climbed toward record highs, with growth stocks outpacing their value counterparts. For investors willing to explore beyond well-known names, penny stocks—often associated with smaller or newer companies—continue to hold relevance due to their potential for surprising opportunities. Despite being a somewhat outdated term, penny stocks can offer a blend of affordability and growth potential when supported by strong financial fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.86 | HK$44.31B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.32 | MYR890.29M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.22 | THB2.53B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.865 | £468.01M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.00 | £319.11M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.956 | £152.99M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$145.87M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.185 | £307.32M | ★★★★☆☆ |

Click here to see the full list of 5,694 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Lhyfe (ENXTPA:LHYFE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lhyfe SA is a renewable energy company that designs, installs, and operates green hydrogen production units in France with a market cap of €165.79 million.

Operations: Lhyfe generates revenue from its Oil & Gas - Exploration & Production segment, totaling €2.60 million.

Market Cap: €165.79M

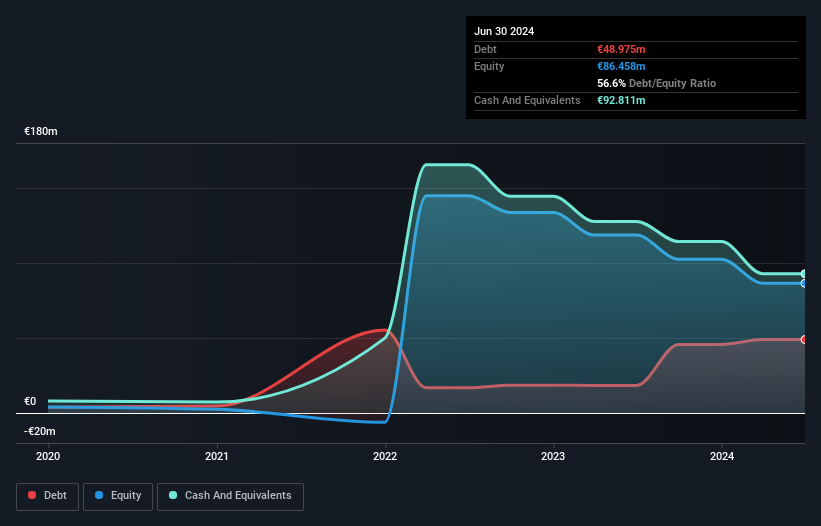

Lhyfe SA, with a market cap of €165.79 million, operates in the renewable energy sector focusing on green hydrogen production. Despite generating €2.60 million in revenue and having more cash than debt, Lhyfe remains unprofitable with increasing losses over the past five years. The company has a stable but high volatility share price and sufficient cash runway for over a year based on current free cash flow trends. While its board is experienced, management tenure data is insufficient to assess experience levels fully. Revenue growth is forecasted at 45.97% annually, but profitability isn't expected within three years.

- Click here to discover the nuances of Lhyfe with our detailed analytical financial health report.

- Explore Lhyfe's analyst forecasts in our growth report.

China Wantian Holdings (SEHK:1854)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Wantian Holdings Limited operates in the green food supply and catering chain, as well as environmental protection and technology sectors in Hong Kong and the People’s Republic of China, with a market cap of HK$2.44 billion.

Operations: The company generates revenue through its food supply segment (HK$241.44 million), catering services (HK$16.23 million), and environmental protection and technology services (HK$1.14 million).

Market Cap: HK$2.44B

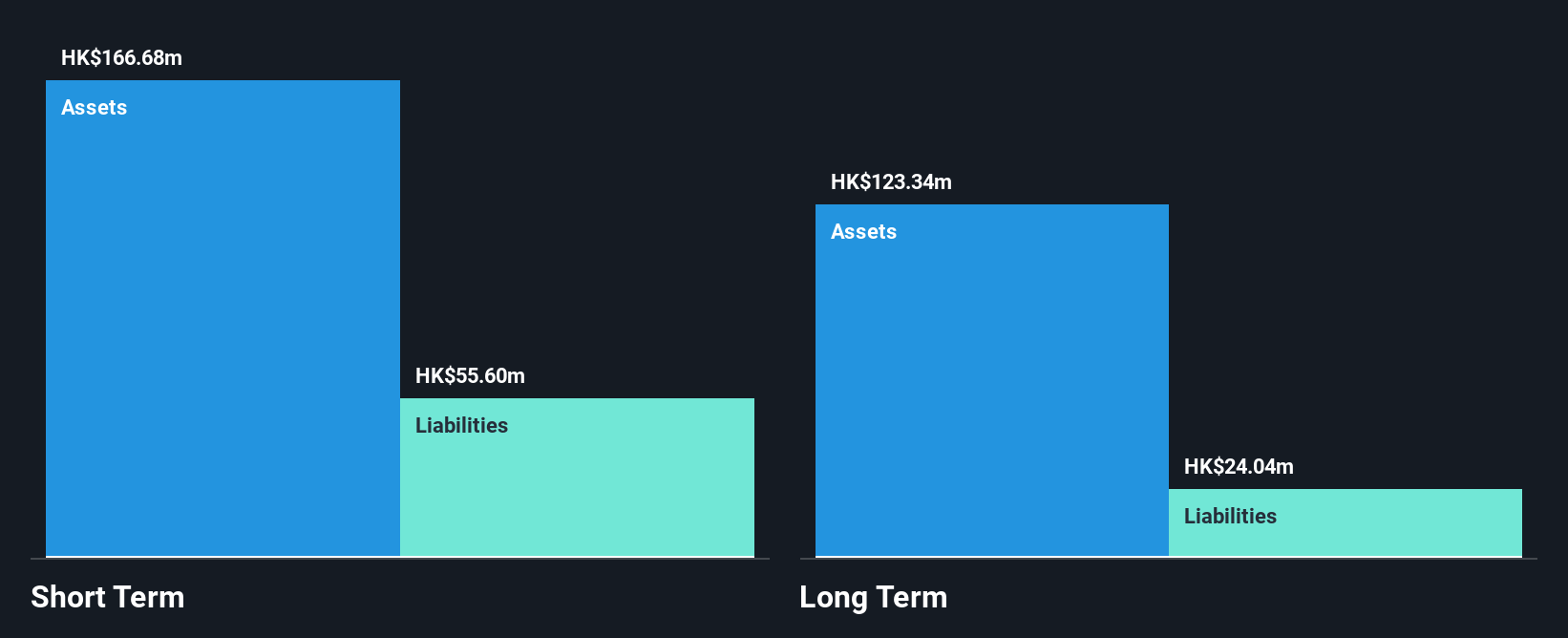

China Wantian Holdings, with a market cap of HK$2.44 billion, operates in green food supply and related sectors, generating significant revenue from its food supply segment (HK$241.44 million). The company has established ESG and Climate Change Committees to enhance sustainability efforts. Despite being unprofitable with a negative return on equity of -30.92%, it maintains more cash than debt, indicating financial prudence. Revenue grew by 56.7% over the past year while reducing its debt-to-equity ratio significantly over five years. Short-term assets exceed both short- and long-term liabilities, reflecting sound liquidity management amidst stable share price volatility.

- Dive into the specifics of China Wantian Holdings here with our thorough balance sheet health report.

- Examine China Wantian Holdings' past performance report to understand how it has performed in prior years.

Hour Glass (SGX:AGS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: The Hour Glass Limited is an investment holding company involved in the retailing and distribution of watches, jewelry, and other luxury products across several countries including Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market cap of SGD1.03 billion.

Operations: The company's revenue primarily stems from its retailing and distribution activities in watches, jewelry, and other luxury products, generating SGD1.11 billion.

Market Cap: SGD1.03B

Hour Glass Limited, with a market cap of SGD1.03 billion, primarily generates revenue from its watch and luxury product retailing and distribution business across several countries. Despite a high-quality earnings record, the company's net profit margin has decreased to 12.6% from 14.6% last year, and it experienced negative earnings growth of -14.5%, contrasting sharply with the Specialty Retail industry average growth of 45.2%. However, Hour Glass maintains financial stability with operating cash flow well covering debt (192.5%) and short-term assets exceeding liabilities significantly while offering good value at a price-to-earnings ratio of 7.3x against the SG market's 12.1x.

- Get an in-depth perspective on Hour Glass' performance by reading our balance sheet health report here.

- Evaluate Hour Glass' historical performance by accessing our past performance report.

Where To Now?

- Gain an insight into the universe of 5,694 Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hour Glass might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AGS

Hour Glass

An investment holding company, engages in the retailing and distribution of watches, jewellry, and other luxury products in Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives