- Hong Kong

- /

- Communications

- /

- SEHK:2342

September 2024's Top Undervalued Small Caps In Hong Kong With Insider Buying

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, Hong Kong's small-cap stocks have garnered attention for their potential resilience and growth opportunities. With recent market volatility and shifts in key indices, identifying undervalued small caps with insider buying can offer a unique investment angle amidst broader market sentiment. In this context, a good stock is often characterized by strong fundamentals, attractive valuations, and positive insider activity that may signal confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Shenzhen International Holdings | 5.7x | 0.7x | 24.89% | ★★★★★★ |

| Shanghai Chicmax Cosmetic | 15.5x | 1.9x | -128.67% | ★★★★☆☆ |

| Ferretti | 10.3x | 0.7x | 49.51% | ★★★★☆☆ |

| EVA Precision Industrial Holdings | 4.5x | 0.2x | 16.21% | ★★★★☆☆ |

| Meilleure Health International Industry Group | 26.0x | 9.6x | 21.77% | ★★★☆☆☆ |

| Analogue Holdings | 12.8x | 0.2x | 43.37% | ★★★☆☆☆ |

| Skyworth Group | 4.9x | 0.1x | -150.49% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 5.8x | 0.3x | -19.39% | ★★★☆☆☆ |

| CN Logistics International Holdings | 19.3x | 0.4x | 25.23% | ★★★☆☆☆ |

| Comba Telecom Systems Holdings | NA | 0.6x | 36.35% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

Comba Telecom Systems Holdings (SEHK:2342)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Comba Telecom Systems Holdings specializes in providing wireless telecommunications network system equipment and services, as well as operator telecommunication services, with a market cap of HK$1.94 billion.

Operations: The company generates revenue primarily from Wireless Telecommunications Network System Equipment and Services, contributing significantly more than Operator Telecommunication Services. For the period ending September 30, 2023, the gross profit margin was 28.23%, with a net income of HK$109.36 million and operating expenses amounting to HK$1.72 billion.

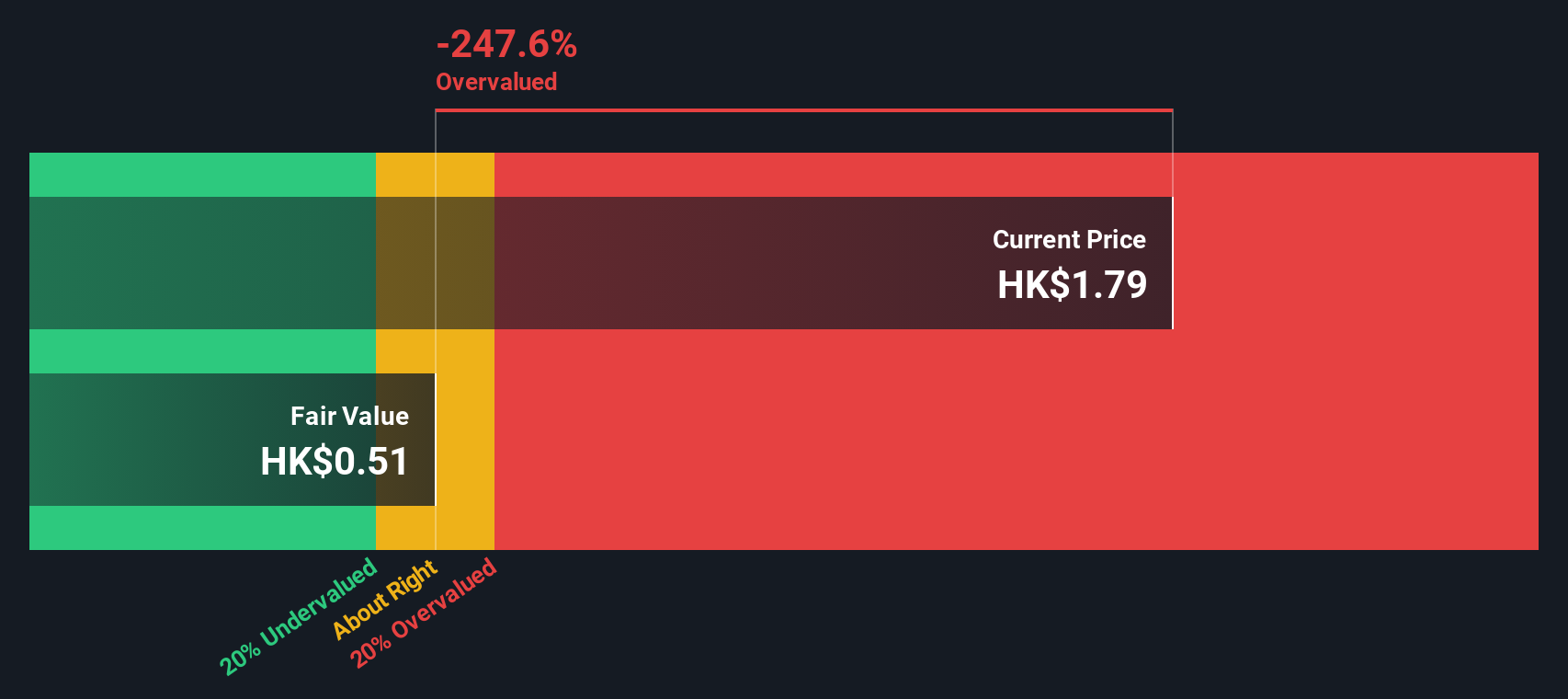

PE: -11.9x

Comba Telecom Systems Holdings, a smaller player in Hong Kong's telecom sector, recently faced challenges with a reported loss of HK$160 million for the first half of 2024, attributed to delayed network projects and decreased income. Despite this, insider confidence is evident with significant share purchases over the past year. The company opted not to declare an interim dividend for the period ending June 30, 2024. Their presence at MWC Shanghai highlights ongoing industry engagement and potential future growth opportunities.

- Delve into the full analysis valuation report here for a deeper understanding of Comba Telecom Systems Holdings.

Learn about Comba Telecom Systems Holdings' historical performance.

Skyworth Group (SEHK:751)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Skyworth Group is a diversified technology company engaged in smart household appliances, smart systems technology, modern services, and new energy businesses with a market cap of CN¥7.72 billion.

Operations: Skyworth Group generates revenue from four main segments: New Energy Business (CN¥20.21 billion), Modern Services and Others (CN¥5.80 billion), Smart Systems Technology Business (CN¥9.84 billion), and Smart Household Appliances Business (CN¥32.51 billion). The company's gross profit margin has seen fluctuations, with a recent figure of 14.36% as of June 30, 2024, down from earlier periods such as 21.93% in March 2016 and peaking at around 20%.

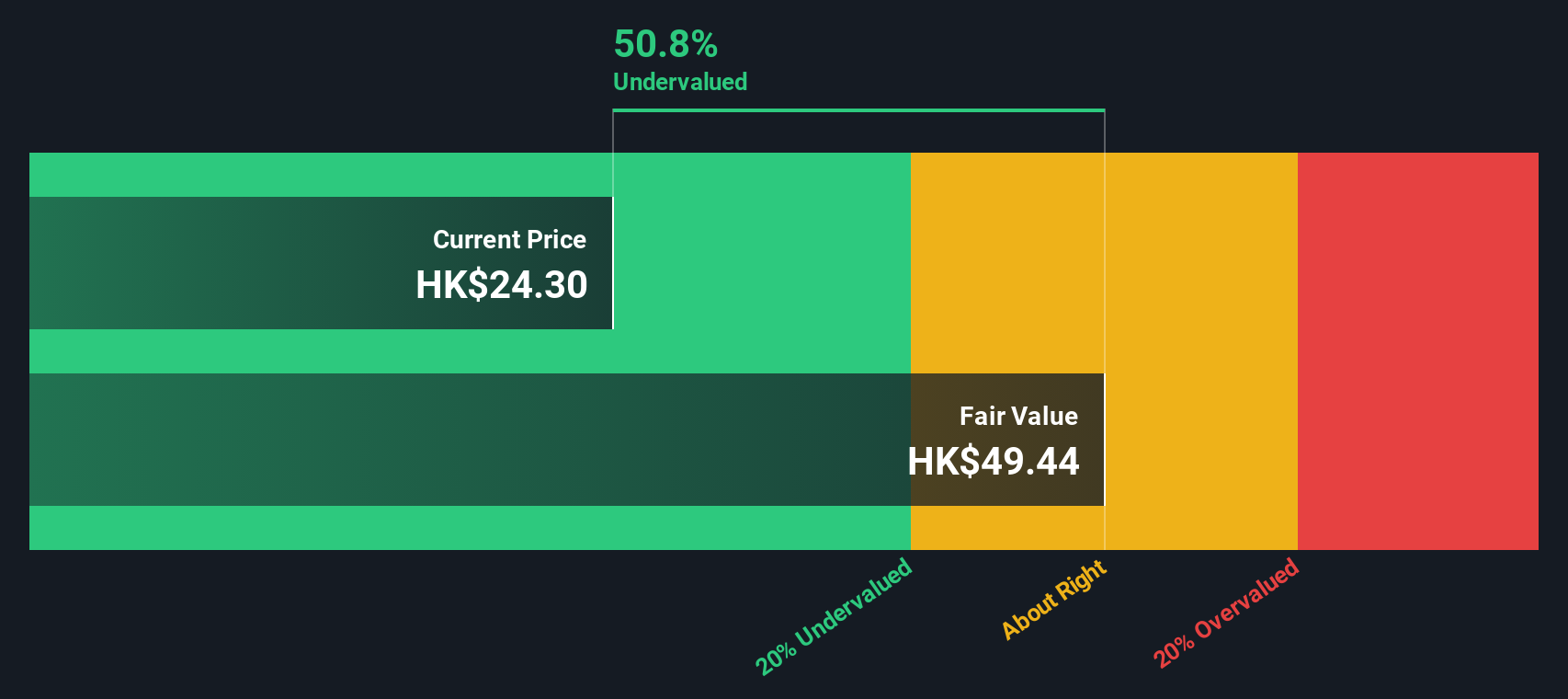

PE: 4.9x

Skyworth Group has shown promising signs as an undervalued small cap in Hong Kong. For the half year ended June 30, 2024, Skyworth reported net income of CNY 384 million, up from CNY 302 million a year ago. Earnings per share rose to CNY 0.1631 from CNY 0.1195. Notably, insider confidence is evident with Chi Shi purchasing over two million shares worth approximately US$6.3 million in recent months, reflecting strong belief in the company's potential growth and strategic moves into new markets like Russia.

- Click to explore a detailed breakdown of our findings in Skyworth Group's valuation report.

Evaluate Skyworth Group's historical performance by accessing our past performance report.

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ferretti is engaged in the design, construction, and marketing of yachts and recreational boats with a market cap of approximately €1.30 billion.

Operations: The company generates revenue primarily from the design, construction, and marketing of yachts and recreational boats. As of the latest period, it reported €1.30 billion in revenue with a gross profit margin of 36.04%. Operating expenses include significant allocations to general and administrative costs along with depreciation and amortization expenses. Net income margin stands at 6.67%, reflecting profitability after accounting for various operational costs.

PE: 10.3x

Ferretti, a Hong Kong small cap, has shown promising financial growth with sales reaching €695.1 million for the half year ending June 30, 2024, up from €628.18 million the previous year. Net income also increased to €43.86 million from €40.45 million. Recent insider confidence is evident as key executives purchased shares between January and August 2024, indicating strong belief in the company's future prospects despite recent leadership changes and reliance on external borrowing for funding.

- Navigate through the intricacies of Ferretti with our comprehensive valuation report here.

Examine Ferretti's past performance report to understand how it has performed in the past.

Key Takeaways

- Delve into our full catalog of 10 Undervalued SEHK Small Caps With Insider Buying here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2342

Comba Telecom Systems Holdings

An investment holding company, engages in the research and development, manufacture, and sale of wireless telecommunications network system equipment and related engineering services.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives