Ferretti (HKG:9638) Shareholders Will Want The ROCE Trajectory To Continue

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So when we looked at Ferretti (HKG:9638) and its trend of ROCE, we really liked what we saw.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Ferretti:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = €110m ÷ (€1.5b - €642m) (Based on the trailing twelve months to June 2023).

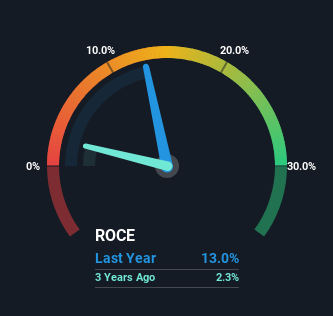

Thus, Ferretti has an ROCE of 13%. In absolute terms, that's a satisfactory return, but compared to the Leisure industry average of 8.1% it's much better.

Check out our latest analysis for Ferretti

In the above chart we have measured Ferretti's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Ferretti here for free.

What The Trend Of ROCE Can Tell Us

Investors would be pleased with what's happening at Ferretti. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 13%. Basically the business is earning more per dollar of capital invested and in addition to that, 90% more capital is being employed now too. So we're very much inspired by what we're seeing at Ferretti thanks to its ability to profitably reinvest capital.

On a separate but related note, it's important to know that Ferretti has a current liabilities to total assets ratio of 43%, which we'd consider pretty high. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Bottom Line

To sum it up, Ferretti has proven it can reinvest in the business and generate higher returns on that capital employed, which is terrific. And with a respectable 19% awarded to those who held the stock over the last year, you could argue that these developments are starting to get the attention they deserve. So given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist.

If you'd like to know about the risks facing Ferretti, we've discovered 1 warning sign that you should be aware of.

While Ferretti isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9638

Ferretti

Designs, constructs, markets, and sells yachts and vessels under the Riva, Wally, Ferretti Yachts, Pershing, Itama, Easy Boat, CRN, and Custom Line brand names.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026