Here's Why Some Shareholders May Not Be Too Generous With Honma Golf Limited's (HKG:6858) CEO Compensation This Year

The disappointing performance at Honma Golf Limited (HKG:6858) will make some shareholders rather disheartened. At the upcoming AGM on 16 September 2021, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. We think most shareholders will probably pass the CEO compensation, based on what we gathered.

Check out our latest analysis for Honma Golf

How Does Total Compensation For Jianguo Liu Compare With Other Companies In The Industry?

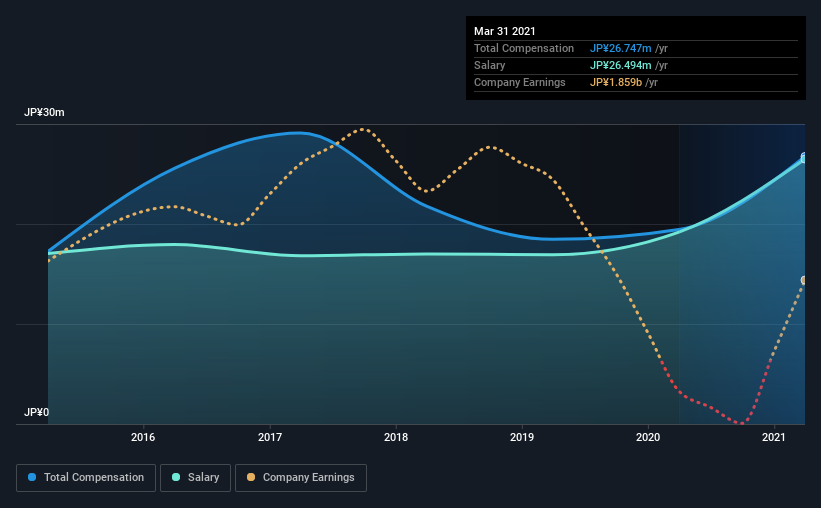

According to our data, Honma Golf Limited has a market capitalization of HK$2.1b, and paid its CEO total annual compensation worth JP¥27m over the year to March 2021. That's a notable increase of 38% on last year. Notably, the salary which is JP¥26.5m, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from HK$779m to HK$3.1b, we found that the median CEO total compensation was JP¥55m. That is to say, Jianguo Liu is paid under the industry median. Moreover, Jianguo Liu also holds HK$801m worth of Honma Golf stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | JP¥26m | JP¥19m | 99% |

| Other | JP¥253k | JP¥252k | 1% |

| Total Compensation | JP¥27m | JP¥19m | 100% |

Speaking on an industry level, nearly 77% of total compensation represents salary, while the remainder of 23% is other remuneration. Honma Golf pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Honma Golf Limited's Growth

Over the last three years, Honma Golf Limited has shrunk its earnings per share by 22% per year. Its revenue is down 4.4% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Honma Golf Limited Been A Good Investment?

Few Honma Golf Limited shareholders would feel satisfied with the return of -41% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Honma Golf pays its CEO a majority of compensation through a salary. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Honma Golf that you should be aware of before investing.

Important note: Honma Golf is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Honma Golf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6858

Honma Golf

An investment holding company, designs, develops, manufactures, and sells a range of golf club equipment in Japan, Korea, Hong Kong, Macau, rest of China, North America, Europe, and internationally.

Excellent balance sheet with minimal risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026